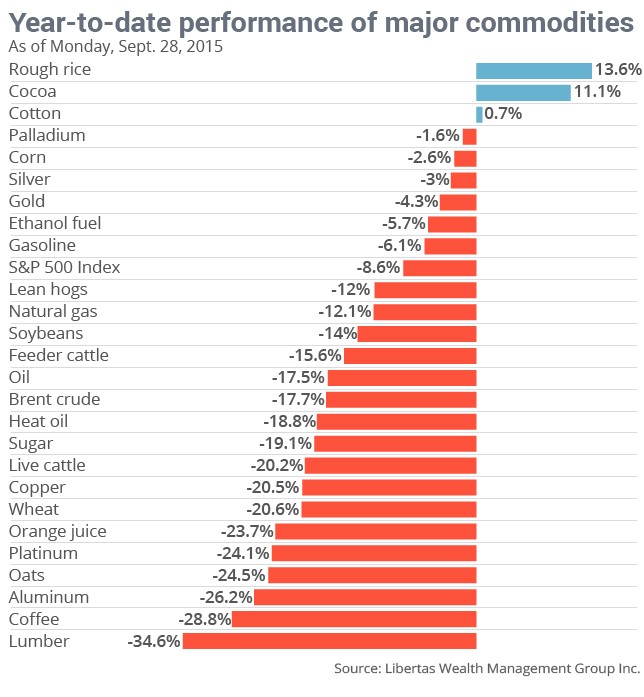

As the third quarter is about to end, most commodities have logged huge losses, with lumber, coffee and aluminum having experienced the most grinding declines year-to-date.

There are winners, though. Rough rice, cocoa and cotton are among the only major traded commodities to see prices climb since the beginning of the year.

Lumber futures have seen the largest drop so far this year, down by nearly 35% as of Monday. Adam Koos, president of Libertas Wealth Management Group Inc. said that lumber prices have been largely affected by China's currency devaluation and a drop in lumber imports. The Canadian tariff on this raw material expires on Oct. 12 and that may drive higher competition and supply from Canada - possibly "at lower prices and higher profits than U.S. mills can hold a candle to,” he added.

Coffee, has taken the second-largest hit, down 28.8% for the year to date as Brazil and Colombia boost exports to customers buying with U.S. dollars, in an effort to help offset losses from weakness in their local currencies.

Rice futures, on the contrary, have surged by 13.6% year to date against the backdrop of production and supply declines.

The U.S. Department of Agriculture in a monthly report trimmed its U.S. rice production forecast for the current crop year.

Cocoa is also one of the few commodities to have logged positive performance - has been up more than 11% for the year. The world’s biggest producers which are the Ivory Coast and Ghana have been hurt by a drought damaging production.

Cotton has climbed by 0.7% year to date, supported by the USDA’s lowered outlook for stocks in 2015, but also pressured by expectations for lower Chinese demand.

Oil and gold

Both WTI and Brent crude find their places in the middle of the list.

“But considering how much talk there has been surrounding black gold, you would think the numbers would look worse than they do,” Koos said adding that they definitely started to see a potential bottoming process in oil.

Meanwhile, he doesn’t believe there will be any “significant bid” for oil prices until after the start of the new year.

“The biggest issues surround supply, specifically having to do with the [Organization of the Petroleum Exporting Countries’] lack of interest in tightening production levels, combined with the additional supply being created in North America,” said Koos.

Losses for gold have deepened, with the yellow metal down 4.3% for the year to date with investors being obsessed with the timing of a Federal Reserve interest-rate increase and moves in the U.S. dollar. Many traders hit by softness in global equities have sold off gold to raise cash to cover losses.