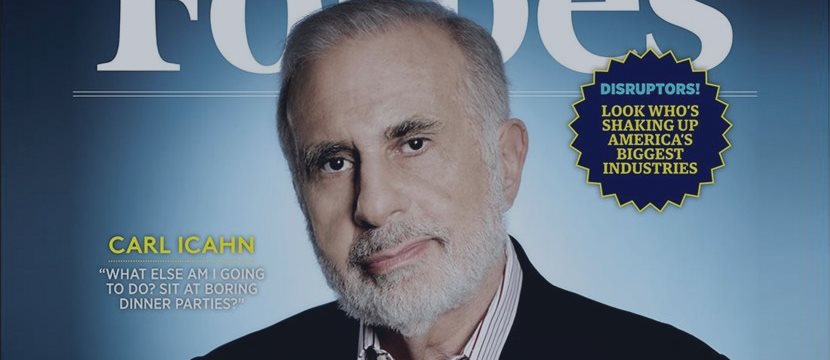

Carl Icahn's video message to investors: "Danger Ahead" over zero rates, junk bonds

Billionaire activist investor Carl Icahn gave a fresh warning about the Federal Reserve's zero-interest rate policy and high-yield bonds.

In the video message called "Danger Ahead", Icahn once again called upon the Fed to increase rates, referring to

bubbles across real estate and even in the art market.

At its highly anticipated September meeting the central bank stood pat on its current policy - a move that drove more indecision among market participants.

“If low interest rates were just that simple of a panacea, we would

never have recessions and we were never have these crisis, these

panics,” said Icahn in the video, released on his website at midnight

Eastern Time on Tuesday.

“The Fed saved us in 2008, but then again you could argue the Fed got us into it in ‘02 and ‘03.”

The final result of this steady stream of cheap money is dangerous unknown. “You don’t know how bad the end of this is going to be. You do know, though, that when you did it a few years ago, it caused a catastrophe. It caused ‘08,” he said.

Nowhere to go but the stock market, high-yield bonds

Icahn also cautioned about high-yield bonds again, as he did in the summer, when he squared off with BlackRock’s founder Larry Fink

over the dangers of that asset class and particularly from a lack of

liquidity among exchange-traded funds.

BlackRock is one of the biggest providers of ETFs.

The growing Fed balance sheet has left the middle-class investor with “nowhere to go but the stock market, or those high-yield bonds.” The balance sheet swelled from $1 trillion to over $4.5 trillion, Icahn said, describing this as an “almost unbelievable move.”

Those bonds are extremely risky and being sold “en masse” to the public, who he says don’t really understand what they are buying. Icahn argued that the figures on that market are very risky, adding that growth in that market has been outstanding, with the junk bonds and leveraged loan market now worth $2.2 trillion, up $1 trillion from five years ago.

“If and when there is a real problem in the economy, there’s going to be a rush for the exits … and people want to sell those bonds and think they can sell them,” Icahn said. Then those investors will find there is no market for them, he predicted.

History is doomed to repeat itself here, warned Icahn. “I’ve been

around a long time. I’ve seen it before, ‘69 ‘74, ‘79. I can tell you …

’87, 2000 wasn’t pretty, and I think a time is coming that might make

some of those times look pretty good,” he warned.