3

303

His Dovish The Fed cause the greenback debilitated against every single major currencie with the exception of against the Euro a week ago because of benefit taking after EUR/USD rally for 3 weeks. The FOMC has chosen not to raise interest rates this month and find in holding at level 0% to 0.25% that has been in actuality since August 2009. The reason defer the ascent in interest rates of reference is the worldwide monetary log jam would have the capacity to debilitate expansion. On a spot plot of projection there interest rates 13 of the 17 individuals from the FOMC that still need the first increment in a year, lower than the speck plot last June where there are 15 individuals who need an ascent this year. This year leaving just 2 times meeting is the month of October and December. Other than dab plot in September is likewise tinged with amazement where there is a part that needs The Fed to actualize negative interest rates until the year's end 2016.

His Dovish Nourished anticipated that would be infectious to other national banks. ECB President Mario Draghi has raised the cutoff to buy bond at meeting 3 last September, and expects to broaden quantitative facilitating (QE) to go from the first arrangement in September 2016. In the event that the ECB include stimulusnya October next, the stride's likelihood will be trailed by the Bank of Japan (of the BoJ) which at present Japan is encountering monetary lull and expansion target which is never come to. Thus, the Bank of Britain (BoE), despite the fact that information a week ago demonstrated the normal compensation list in the United Kingdom to rise and the unemployment rate went down, an expected BoE won't raise rates before The Fed see. While the nation's national bank evaluated the merchandise monetary standards will likewise consider cutting the blossom one month from now for the most part tribal Store Bank of New Zealand (RBNZ).

It is evaluated for the current week of vulnerability will proceed with the likelihood of recuperation USD post FOMC. Information and critical occasion was a discourse by Janet Yellen in Massachusetts, Caixin record (Markit) Blaze Producing PMI of China, Germany and the Eurozone in September, Mario Draghi's confirmation before the European Parliament, the US Gross domestic product information for quarter 2 finals, Germany IFO list, Jobless Cases u.s., Japan CPI and discourse Stephen Poloz.

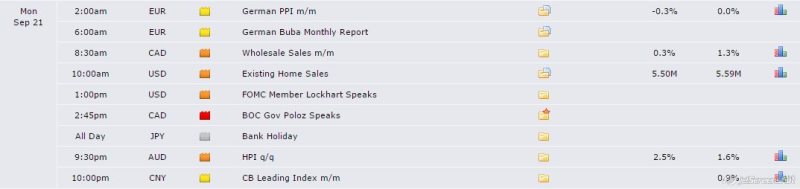

Monday, September 21, 2015:

Bank occasions bank in Japan (the Matured Day)

12:00 pm: the information Maker Value File (PPI) Germany August 2015

06:30 pm: information Wholesale Deals Canada July 2015

11:00 am EST: U.S. Existing Home Deals information for the month of August 2015

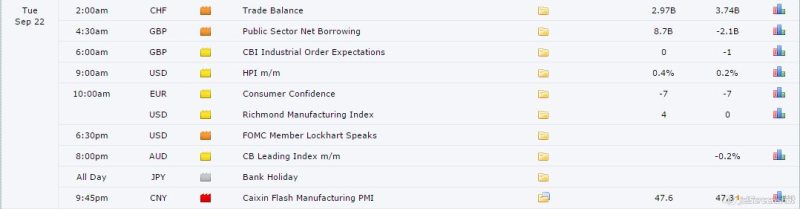

Tuesday, September 22, 2015:

01:00 pm: discourse by FOMC Part Dennis Lockhart in Atlanta

01:45 pm: the Senator's discourse of the Bank of Canada (BoC) Stephen Poloz in Calgary

Bank occasions bank in Japan

12:30 pm: file of lodging costs in Australia second quarter 2015

12:00 pm: Switzerland exchange equalization information for August 2015

06:30 pm: Open Area Net Obtaining information United Kingdom August 2015

11:00 am EST: shopper certainty list of the Euro zone's adaptation of Eurostat September 2015

Wednesday, September 23, 2015:

Bank occasions bank in Japan (Fall Equinox Day)

05:30 pm: discourse by FOMC Part Dennis Lockhart in Montgomery

08:45 pm: list of Caixin (Markit) Blaze Producing PMI China September 2015

12:00 pm: list of Blaze and Glimmer Administrations PMI Producing France September 2015

12:30 pm: list of Blaze and Glimmer Administrations PMI Producing Germany September 2015

12:00 pm: record of Glimmer and Blaze Administrations PMI Fabricating Euro range September 2015

06:30 pm: Retail Deals information Canada July 2015

07:00 pm: confirmation the President of the European National Bank (ECB) Mario Draghi at the European Parliament in Brussels

03:30 pm: discourse by FOMC Part Dennis Lockhart in Columbus Rotary Club

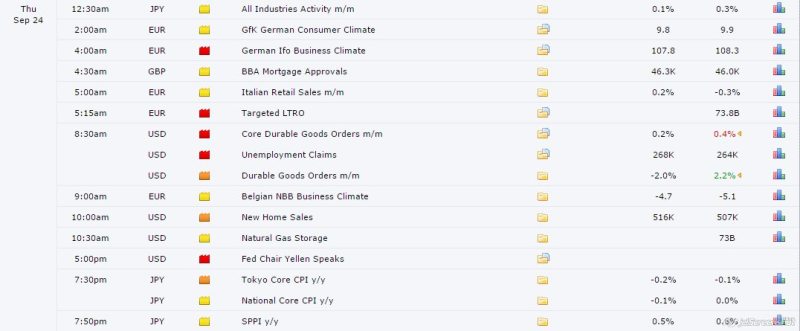

Thursday, September 24, 2015:

05:45 pm: New Zealand exchange equalization information for August 2015

12:00 pm EST: buyer certainty record GfK Germany variant September 2015

15:00 GMT: Germany's business certainty record IFO variant September 2015

05:15 pm: TLTRO closeout results ECB September 2015

06:30 pm: Sturdy Products Orders information for the US August 2015

06:30 pm: Jobless Cases information according to 19 September 2015

11:00 am EST: U.S. New Home Deals information for the month of August 2015

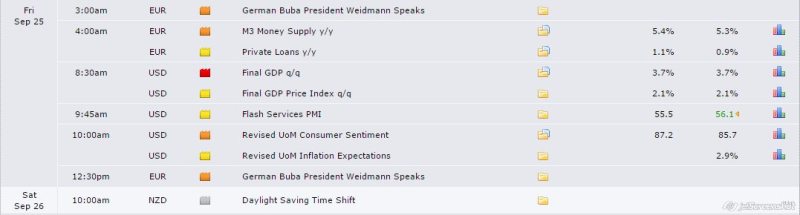

Friday, September 25, 2015:

04:00 pm: discourse by the Executive of The Central bank (The Fed) Janet Yellen at the College of Massachusetts

06:30 pm: the National's information Buyer Value Record (CPI) Japan August 2015

06:30 pm: the Tokyo CPI information September 2015

14:00 GMT: discourse President Bundesbank Germany Jens Weidmann in Florence

04:00 pm: M3 Cash Supply information for the Euro range in August 2015

06:30 pm: information on Total national output (Gross domestic product) US quarter to 2 year 2015 (Last)

11:00 am EST: shopper certainty record of the US adaptation of the College of Michigan (UoM) September 2015 (Last)

03:30 pm: Question and answer session of the President of Bundesbank Germany Jens Weidmann in Florence. https://www.mql5.com/en/signals/111434#!tab=history