Societe Generale is making some consideration about future possible forecasts. For now - it is just a question: 'When And At What Level To Sell EUR/USD'. Next two weeks will be very important related to fundamental news events as the factors to strong USD, and Societe Generale (as the other int'l financial institutions) are fully believe in bullish/strong dollar related to EUR/USD pair. There are two questions only:

- when to sell EUR/USD;

- at what level to sell EUR/USD.

There are some fundamental analysis provided by Societe Generale:

- "The key to EUR/USD is the Fed and therefore the data in the next two weeks - which really means the data next week, as this week’s fare is pretty limited."

- "If the data next week are strong enough to seriously revive talk of a September rate hike, the dollar will get a lift. Even if the Fed holds fire in September but remains on watch to tighten ‘soon’ and the waiting game is simply dragged out, it’s just a question when and at what level to sell EUR/USD. But this week, with too little data and too much momentum behind the position-squeeze, none of that matters."

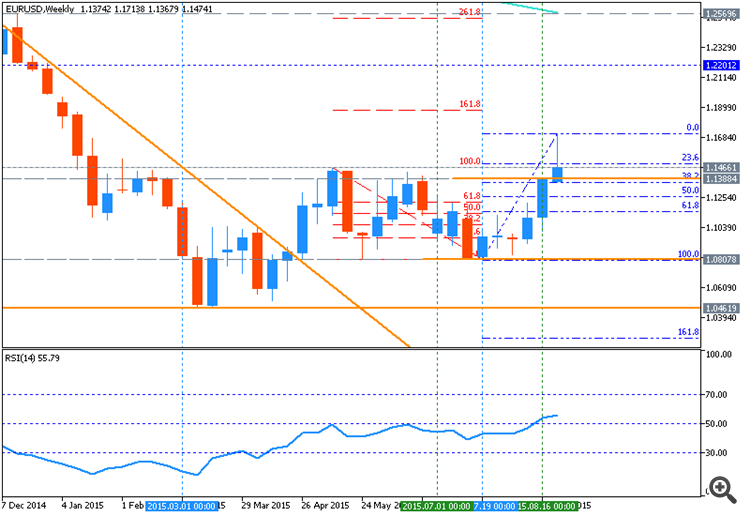

From the technical point of view the reversal resistance levels are the following:

- 1.2568 - if the price breaks this level from below to above so we can say about bullish reversal to be started;

- 1.2665 - this is YR1 Central Pivot dividing weekly chart onto bearish and bullish areas; if the price breaks this level so the price will be reversed to the primary bullish market condition.

There are intermediate resistance level at 1.2199. This is breakout level - means; if the price crosses this level so we may see the breakout with the good possibility to bullish reversal.

So, at what level to sell EUR/USD? I think we will know it in the end of this week. But anyway, those level to sell EUR/USD should be less than 1.21 for example.