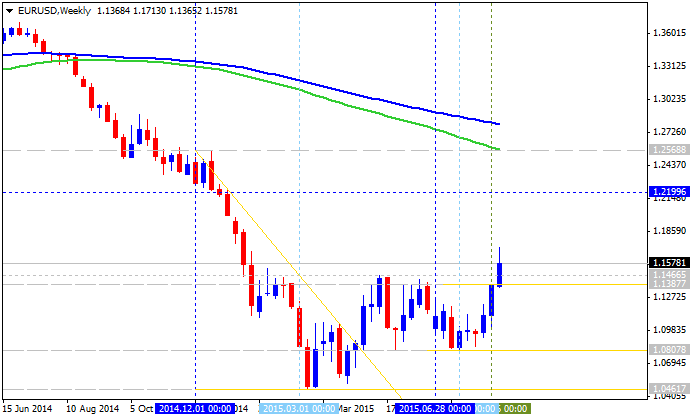

Danske Bank is forecasting the ranging market condition for EUR/USD up to August 2016: the price will be ranging between 100 day SMA and 200 day SMA within 1.10/1.13 support/resistance channel:

| Pair | Q3 September'15 | Q4 November'15 | Q1 February'16 | Q3 August'16 |

|---|---|---|---|---|

| EUR/USD | 1.130 | 1.100 | 1.100 | 1.150 |

Thus, according to the Danske Bank - we should expect the bullish for daily EUR/USD only in the middle of the next year by the price to be turned to 1.15 which is located on the bullish area of daily chart.

Concerning weekly price for this pair so the price will be in total ranging condition within the primary bearish: all support/resistance levels (incl 1.25 'reversal' resistance level which is on the border between bearish and bullish on the weekly chart) are located on the bearish zone. So, Danske Bank expects for the EUR/USD to be in bearish market condition in long term situation for example.

Anyway, if 'reversal' resistance level is somewhere around 1.25 so this may be really bearish market condition if we are talking about weekly price. Some int'l financial institutions are started to ask the question: when to sell EUR/USD. Because as we know - all of them are expecting for EUR/USD to be in bearish market condition up to the end of this year.