EUR - Fundamental Outlook for the Current Week by Morgan Stanley

Morgan Stanley is considering the this is a good time to be with EUR forecasting bullish for the next few weeks:

"We believe EUR is likely to outperform over the next few weeks. The risk-off environment is likely to drive repatriation flows, which should be EUR supportive. In addition, many risky holdings were funded in EUR, and the unwind of these positions should support EUR. With EUR not being used as funder in the near term, it should receive support from its current account surplus."

Let's evaluate this situation with technical points of vew:

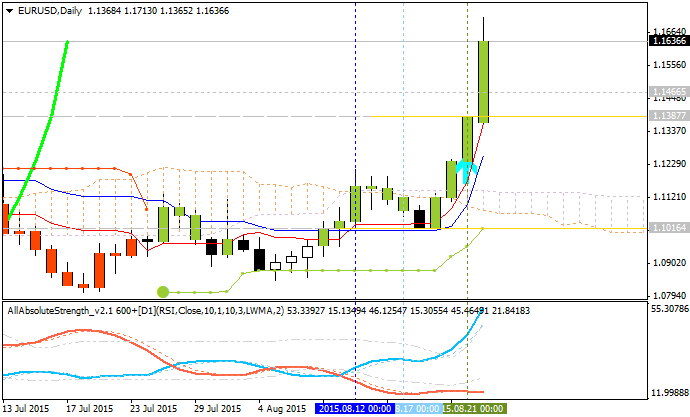

- Weekly price is still on bearish market condition for trying to cross 1.1466 resistance for the bear market rally to be started. The reversal level is 1.2568, and if weekly price will break this reversal level from below to above so it will be the global reversal of the price movement to the primary bullish market condition.

- Daily price is on reversal to the bullish with 1.1466 as the nearest resistance level located in the bullish area of the chart. The price is breaking 200 day SMA, and if 1.1466 resistance will be broken so the price will be reversed to the bullish market condition.

Anyway, Morgan Stanley believes in bullish dollar in short-term situation but we will get the bearish EUR/USD anyway concerning long-term time projection at year-end for example.