Current trend

Yesterday, the CHF significantly grew against the USD, which was a result of the poor FOMC Minutes, published on Wednesday. Furthermore, Jobless Claims in the US grew from 273 K to 277 K.

At the same time, the CHF was supported by macroeconomic statistics, published on Thursday. The Balance of Trade for July showed a surplus increase from 3,509 million to 3,741 million Francs, while exports grew from 17,921 million to 17,929 Francs.

Support and resistance

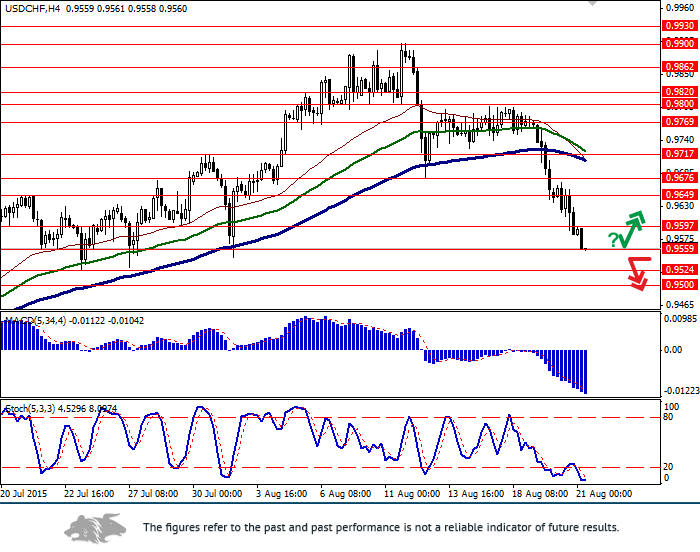

Bollinger Bands on the daily chart is trying to turn up, while the price range is widening. The indicator formed a buy signal as the price has left the range. MACD is falling and is giving a sell signal. Stochastic reached the oversold zone that could indicate a possibility of the correctional growth in the beginning of the next week.

The indicators are not giving a clear trading signal.

Support levels: 0.9559 (local low), 0.9524 (23 July low), 0.9500, 0.9460, 0.9400, 0.9329 (10 July low).

Resistance levels: 0.9600 (local high), 0.9649, 0.9676 (support level from 12 August), 0.9717, 0.9769, 0.9820, 0.9862, 0.9900 (11 August highs), 0.9930.

Trading tips

Open long positions after the price rebound from the levels of 0.9559, 0.9524, 0.9500 (with the appropriate indicators signals) with targets at 0.9676, 0.9717 and stop-loss at 0.9500.

Short positions can be opened after the breakdown of the level of 0.9500 with the target at 0.9400 and stop-loss at 0.9600.