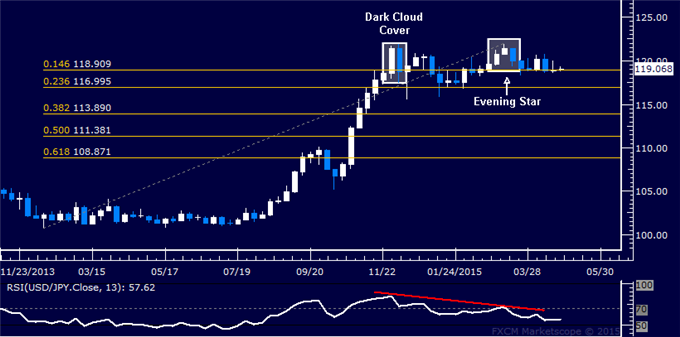

USD/JPY Candlestick Analysis: Support Below 119.00 in Focus

Arguments:

USD/JPY Strategy: Flat

Drawback Reversal Cues Remain

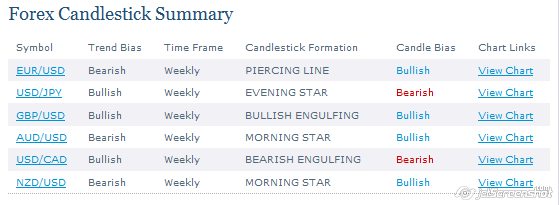

The US Dollar is sitting tight for finish on bearish inversion signals against the Japanese Yen built up by Dark Cloud Cover and Evening Star sconce designs. Negative RSI difference apparently strengthens the possibility of a pullback. Backing is at 118.91, the 14.6% Fibonacci retracement, with a move beneath that uncovering the 23.6% level at 117.00. The principal layer of resistance stays at 122.01, the March swing top.

Arguments:

USD/JPY Strategy: Flat

Drawback Reversal Cues Remain

Sitting tight for Pullback to Get Long

The US Dollar is sitting tight for finish on bearish inversion signals against the Japanese Yen built up by Dark Cloud Cover and Evening Star sconce designs. Negative RSI difference apparently strengthens the possibility of a pullback. Backing is at 118.91, the 14.6% Fibonacci retracement, with a move beneath that uncovering the 23.6% level at 117.00. The principal layer of resistance stays at 122.01, the March swing top.

The predominant long haul USD/JPY pattern keeps on looking bullish. Because of that, we will take a gander at further misfortunes as remedial and regard them as a chance to enter long at more appealing levels once the pullback is depleted. https://www.mql5.com/en/signals/120434