On Thursday the pound pulled back from session lows against the dollar after Bank of England Governor Mark Carney said the time for a

rate hike is drawing closer, but added that the timing could not be

predicted in advance.

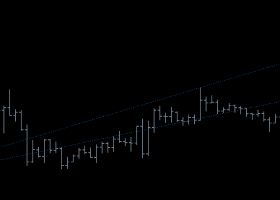

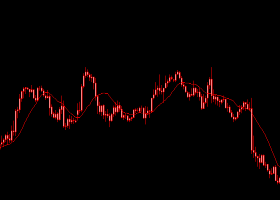

GBP/USD was last at 1.5514, off 0.56% for the day, up from session lows of 1.5468.

The Bank of England pointed to a possible increase in interest rates in early 2016, after only one of its top policymakers supported an immediate move and the Bank forecast a slow rise in inflation from zero thanks to a strong pound.

Sterling turned broadly lower before regaining ground after BoE Governor Mark Carney said the time for the Bank to start undoing its stimulus for Britain's economy is approaching.

Carney also warned markets not to be too lax in the path or 'curve' that

it predicts for rates.

"The market curve does not deliver a sustainable return of inflation to target, because there is an overshoot," Carney told a news conference.

The BoE trimmed interest rates to 0.5 percent in the depths of the financial crisis in 2009 and has not changed them since that time. With the economy now recovering strongly and wages finally rising quickly, speculation is growing about when it might decide to start weaning Britain off low rates.

The Bank said it expected inflation to be back to target in two years' time. That was matching its previous forecast, made in May, despite a fresh plunge in oil prices and a jump of sterling since then.

In the U.S., the Labor Department reported earlier that the number of Americans filing new applications for unemployment benefits climbed less than expected last week, suggesting labor market conditions are continuing to tighten.

Initial claims for state unemployment benefits increased 3,000 to a seasonally adjusted 270,000 for the week ended Aug. 1. Claims for the prior week were unrevized.

It was the 22nd consecutive week that claims held below the 300,000 threshold, which is associated with a strengthening labor market. Economists had expected claims to rise to 273,000 last week.

Claims are volatile during the summer when automakers usually shut assembly plants for annual retooling. Some firms keep production lines running, which can throw off a model the government uses to smooth the data for seasonal variations.

However, an analyst from the Department said there were no special factors influencing the data and no states had been calculated.

The greenback has been generally higher with EUR/USD trading last at 1.0917, higher 0.11%.

The dollar index rose 0.03% to 98.00.

Investors were now eyeing the upcoming U.S. nonfarm payrolls report due on Friday, which could reinforce expectations for higher interest rates by the Federal Reserve.