The Devastation in Global Commodity Currencies Is Far From Over

4 August 2015, 22:09

0

181

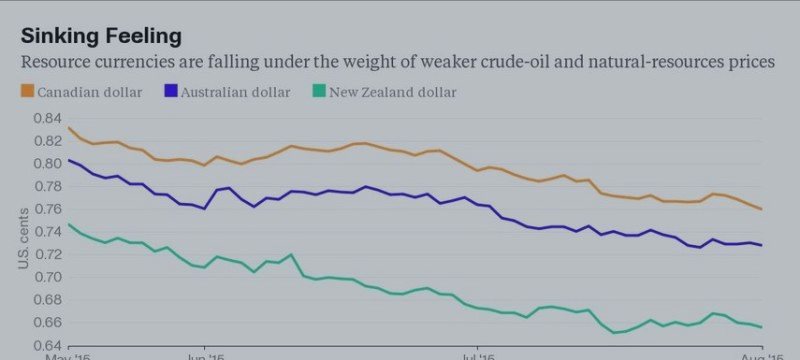

Canada, Australia, New Zealand monetary forms set to dive, OppenheimerFunds says.

A bob in unrefined petroleum and other item costs Tuesday ended a dive in coinage of nations connected to regular asset sends out. The rest will be fleeting, as per OppenheimerFunds Inc.

The Canadian, Australian and New Zealand dollars are set for the most exceedingly bad begin to a year since the budgetary emergency. The countries are pondering a 29 percent drop in crude material costs in the midst of swelling supplies and moderating request in China that may wipe out as much as 14 percent of the Canadian dollar's quality in the following three years.

Next up, they'll need to fight with the Federal Reserve's arrangement to raise interest rates this year, which is figure to help the U.S. dollar.

``Compared to the U.S. discuss raising rates and fixing arrangement, the merchandise monetary forms are going in the definite inverse course,'' Alessio de Longis, a cash administrator in the Global Multi-Asset Group at OppenheimerFunds, said from New York. ``These monetary forms are not shoddy by any methods.''

De Longis, whose organization oversees $233 billion, anticipated the Canadian dollar will debilitate 14 percent in the following one to three years. He assessed the Aussie will fall in the same time allotment to 60 pennies for each U.S. dollar and the kiwi to drop to 50 pennies.

The Canadian dollar debilitated 0.2 percent Thursday to a 11-year low while the kiwi lost 0.5 percent.

Indeed, even as the Reserve Bank of Australia held premium rates consistent and impelled a cash bob, de Longis said he expects national banks in the item trading countries to keep facilitating fiscal approach, sending their coinage tumbling versus the greenback.

The Bloomberg Commodity Index tumbled to a 13-year low Monday after Chinese assembling gages impeded, obfuscating the standpoint for interest. Interestingly, the U.S. cash has revived against each of the 16 noteworthy associates in the previous 12 months on signs that the Fed is getting closer to raising rates.

``Caution is still all together as today's Aussie increases are restorative in nature,'' Marc Chandler, worldwide head of coin procedure at Brown Brothers Harriman & Co., said in a note. ``It is clear that RBA approach must stay accommodative.'' https://www.mql5.com/en/signals/120434#!tab=history

A bob in unrefined petroleum and other item costs Tuesday ended a dive in coinage of nations connected to regular asset sends out. The rest will be fleeting, as per OppenheimerFunds Inc.

The Canadian, Australian and New Zealand dollars are set for the most exceedingly bad begin to a year since the budgetary emergency. The countries are pondering a 29 percent drop in crude material costs in the midst of swelling supplies and moderating request in China that may wipe out as much as 14 percent of the Canadian dollar's quality in the following three years.

Next up, they'll need to fight with the Federal Reserve's arrangement to raise interest rates this year, which is figure to help the U.S. dollar.

``Compared to the U.S. discuss raising rates and fixing arrangement, the merchandise monetary forms are going in the definite inverse course,'' Alessio de Longis, a cash administrator in the Global Multi-Asset Group at OppenheimerFunds, said from New York. ``These monetary forms are not shoddy by any methods.''

De Longis, whose organization oversees $233 billion, anticipated the Canadian dollar will debilitate 14 percent in the following one to three years. He assessed the Aussie will fall in the same time allotment to 60 pennies for each U.S. dollar and the kiwi to drop to 50 pennies.

The Canadian dollar debilitated 0.2 percent Thursday to a 11-year low while the kiwi lost 0.5 percent.

Indeed, even as the Reserve Bank of Australia held premium rates consistent and impelled a cash bob, de Longis said he expects national banks in the item trading countries to keep facilitating fiscal approach, sending their coinage tumbling versus the greenback.

The Bloomberg Commodity Index tumbled to a 13-year low Monday after Chinese assembling gages impeded, obfuscating the standpoint for interest. Interestingly, the U.S. cash has revived against each of the 16 noteworthy associates in the previous 12 months on signs that the Fed is getting closer to raising rates.

``Caution is still all together as today's Aussie increases are restorative in nature,'' Marc Chandler, worldwide head of coin procedure at Brown Brothers Harriman & Co., said in a note. ``It is clear that RBA approach must stay accommodative.'' https://www.mql5.com/en/signals/120434#!tab=history