Fundamental Weekly Forecasts for US Dollar, AUDUSD, GBPUSD and GOLD

US Dollar - "The FOMC decision is certainly the most direct update we will find for gauging monetary policy, but it may not provide the distinct resolution traders are looking for. At the very least there will be some sense of hesitation to adjust to updated views until Thursday’s 2Q GDP numbers are in the books. The US economy contracted in the opening quarter of the year and hawkish views have been built around expectations for a quick recovery - much like it did in 2014."

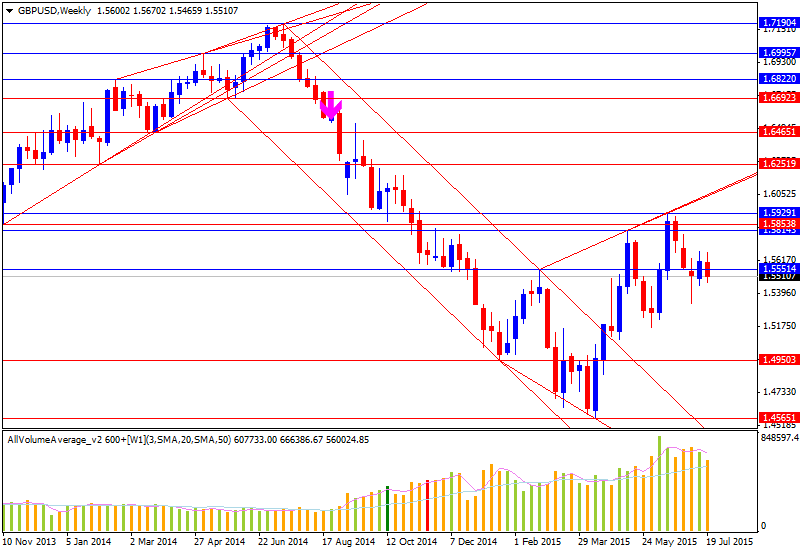

GBPUSD - "Whether or not it presses to fresh highs in the week ahead will likely depend on results from the highly-anticipated UK GDP report and a US Federal Reserve interest rate decision. Barring outright disastrous UK data, however, we remain constructive on the Sterling’s chances versus all majors except the US Dollar."

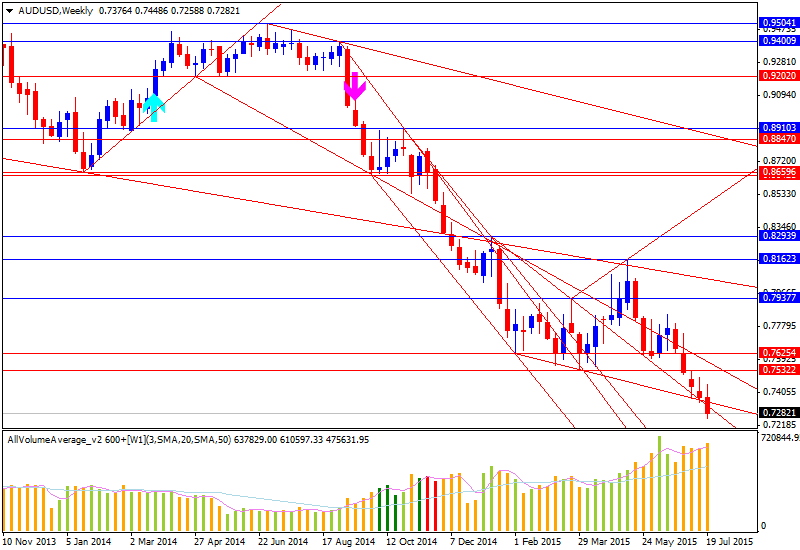

AUDUSD - "AUD/USD may continue to search for support throughout the last full-week of July, and the pair may ultimately give back the advance from back in 2008 as weakening growth prospects across the Asia/Pacific region fuels bets for lower borrowing-costs in Australia. In contrast, the greenback may continue to outperform against its major counterparts as the Fed stays on course to remove the zero-interest rate policy (ZIRP)."

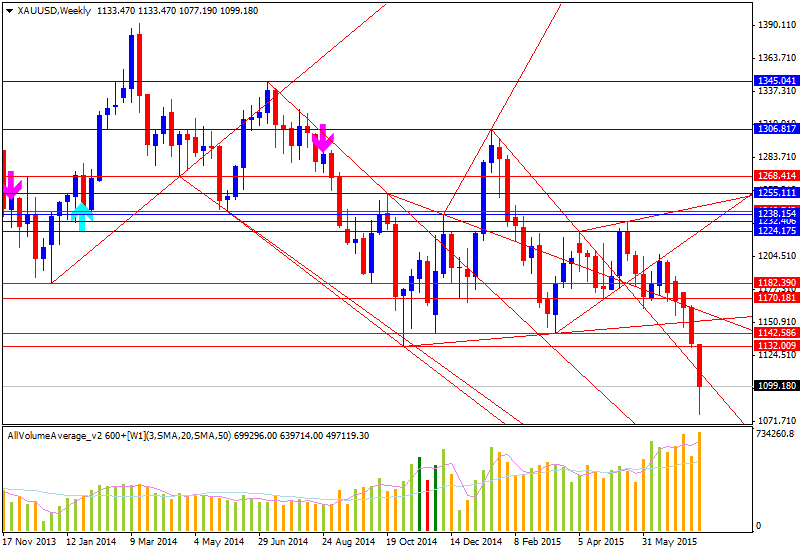

GOLD - "Note that gold is vulnerable for a rebound at these levels heading into the start of next week. Near-term resistance stands at the 2014 low at 1130 with our bearish invalidation level steady at 1150. A break below ML support (~1070/73) targets objectives at the 1044/53 backed by a Fibonacci confluence lower down at 975/80. Keep in mind we’ll be heading into the close of the month with a break of the July opening range having already attained a late-month low & key US event risk on tap."