China erode Interest

Myself his shaky demand in China, the world's largest commodity buyer, piling up the pressure right to market commodities, causing the price of gold plunged to the lowest level in five years and copper slumped to the lowest level for six years.

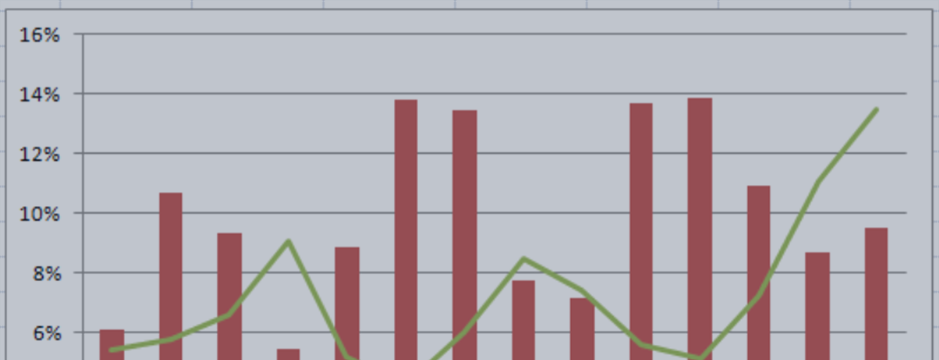

This condition also added woes to the country emerging markets already struggling with the risk of a rise in U.S. interest rates later this year. Market PMI dropped to 48.2 lowest since April last year and the fifth consecutive month below 50. According to government data, industrial production is still increasing.

Bamboo Curtain country is Australia's largest export market and the investors using currency as a proxy in order to address the risks in the country. A survey of executives at more than 420 Chinese manufacturing companies find the output, new orders and export orders, everything is downhill.

"Today, it is a great news and bad with numbers below consensus. It shows no signs of recovery in the medium-small enterprises in China, but I think it also has to do with the summer that erode demand, "said Helen Lau Analyst Argonaut Securities in Hong Kong.

Desperate China survey better news from Japan where the PMI Market Nikkei rises to the level of being a seasonally adjusted 51.4 in July from 50.1 in June end, giving little support do acseleration to economic after a startling slowdown in the last quarter.

In particular, new orders in Japan pushed into positive territory that might help explain the latest data showed companies are becoming more confident in order to increase capital spending. However, the survey finds any occurrence of slowing export orders, the trend troubling Asian and emerging markets in General.

Expectations of U.S. interest rate ascent this year has erode investor interest towards emerging market asset yields are high but risky. The latest poll found a majority of analysts are now convinced the Federal Reserve raised the interest rates in September.

South Africa's Central Bank on Thursday raised interest rates for the first time in a year to prevent inflationary pressures and a weakening of the currency rand.

The RAND remained vulnerable to global market reaction to normalize monetary policy. Lesetja Kganyago Governor warned that the possibility of a US Federal Reserve monetary tightening will trigger the "money exchange rates-sparked inflationary spiral". https://www.mql5.com/en/signals/120434#!tab=history