USD: Neutral

"We see scope for USD to remain supported against most currencies in

G10. Data over the past week has been strong, most notably consumer

confidence. At the same time, the market has pushed back the timing of

the first Fed hike due to uncertainty in Greece. We see scope for this

to come forward on the back of a resolution in Greece in either

direction, offering support to USD."

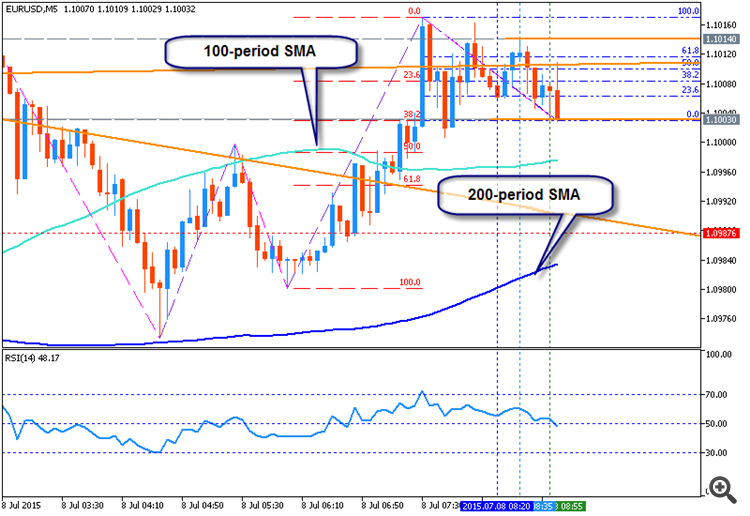

EUR: Bearish

"We believe there is little scope for EUR to rally, regardless of the

outcome in Greece. A ‘No’ vote in the referendum is likely to lead to

Greece exit from the euro over time. The ECB may well have to undertake

aggressive action to stabilize markets, and the enhanced liquidity is

likely to weigh on the currency. On the other hand, a ‘Yes’ vote without

a credible plan for the future, but rather a ‘muddle through’ solution

is likely to keep uncertainty high and reduce appetite for eurozone

assets."

JPY: Bullish

"In an environment of soft risk appetite, we think that JPY is likely to

be an outperformer. Higher volatility is likely to drive some

repatriation flows as well, and we note that portfolio flows have turned

more positive. JPY is the most overvalued G10 currency on a PPP basis,

supporting our view that there is scope for strength. Stronger data mean

the policy tone is changing, and we expect the currency to remain

supported."

GBP: Neutral

"GBPUSD has weakened from Greek risks and weaker-than-expected

manufacturing PMI; however, we still see strength in the more important

services sector. In particular wages here appear to be picking up which

has supported rate expectations in the UK and therefore GBP. We believe

there is potential for GBPUSD to reach 1.60 but prefer buying on the

crosses, in particular against the NOK where an accommodative central

bank highlights the divergences between the two currencies."

CHF: Bearish

"The SNB announced that it intervened following the Greek referendum

announcement. This suggests to us that the SNB is less worried about the

level of EURCHF and intervened more on the anticipation of rapid CHF

strength. While Greek risks remain, the rapid falls in EURCHF are likely

to be limited. We wait for opportunities to buy USDCHF as longer term

we will start to see the negative economic impact of the stronger

currency."