Julian Robertson: Euro could easily go below parity

Hedge fund pioneer Julian Robertson believes the euro could easily go below parity with the U.S. dollar, and if Greece exits the euro, it could happen fairly quickly, he said Tuesday.

The billionaire, who has been short the euro, cited contagion possibilities as the potential cause for a swift decline.

"If Greece goes, Spain—which really has a serious problem with individual debt throughout the country—Spain could have problems and they could be tempted to leave, too. And then perhaps Italy. That would be serious," the founder of Tiger Management said in an interview with CNBC's "Closing Bell."

However, if Greece stays in the euro, parity could take "a long time."

He also doesn't think Greece alone is terribly important and doesn't think it will trigger another global financial crisis.

Greece faces a 1.5 billion euro ($1.7 billion) payment due to the International Monetary Fund at midnight CEST (6 p.m. ET) Tuesday. A euro zone official said in a Reuters report that there's "no way" the Eurogroup will release funds for Greece to meet the deadline.

Another Eurogroup meeting is scheduled for Wednesday, and a new Greek proposal is expected.

Read MoreGreece Crisis: Eurogroup denies bailout extension

A default is also looming in Puerto Rico, where the governor has said it can't pay its $72 billion debt. The island's ongoing problems are what led Robertson to short Assured Guaranty. The bond insurer has been hit by the island's debt woes, and Robertson thinks there is still substantial downside to the name.

"I think there's enough probably there to put them out of business just like Puerto Rico."

Credit bubble

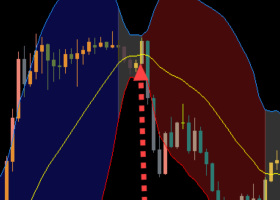

Meanwhile, Robertson believes the U.S. market is overheated and reiterated his belief that there is a "very serious credit bubble."

He noted that near-zero interest rates on savings accounts are forcing people into stocks.

"As yields go up, that will be heightened by people coming out of stocks and going into where they belong in the first place: bonds."

Read MoreBill Gross: Six conditions for a bond crisis

Where he's investing

Robertson said he is "very positive" on Apple and called the tech giant, Google and Netflix the "greatest value stocks around."

He is also proud to be a shareholder in Gilead Sciences because of its Hepatitis C drug.

As for Europe, it has been a very good place to be and could possibly get better, as long as investors hedge the currency, Robertson said.

Presidential pick

When it comes to politics, Robertson said he's backing former Florida Gov. Jeb Bush in his bid for the White House.

"I think it is very important that we have a manager in here that has managed a state or managed something and managed well," he said, calling Bush a "very smart guy."

"We have a brilliant, attractive guy in there now but as a manager and leader I think he's pathetic."

Hedge fund pioneer Julian Robertson believes the euro could easily go below parity with the U.S. dollar, and if Greece exits the euro, it could happen fairly quickly, he said Tuesday.

The billionaire, who has been short the euro, cited contagion possibilities as the potential cause for a swift decline.

"If Greece goes, Spain—which really has a serious problem with individual debt throughout the country—Spain could have problems and they could be tempted to leave, too. And then perhaps Italy. That would be serious," the founder of Tiger Management said in an interview with CNBC's "Closing Bell."

However, if Greece stays in the euro, parity could take "a long time."

He also doesn't think Greece alone is terribly important and doesn't think it will trigger another global financial crisis.

Greece faces a 1.5 billion euro ($1.7 billion) payment due to the International Monetary Fund at midnight CEST (6 p.m. ET) Tuesday. A euro zone official said in a Reuters report that there's "no way" the Eurogroup will release funds for Greece to meet the deadline.

Another Eurogroup meeting is scheduled for Wednesday, and a new Greek proposal is expected.

Read MoreGreece Crisis: Eurogroup denies bailout extension

A default is also looming in Puerto Rico, where the governor has said it can't pay its $72 billion debt. The island's ongoing problems are what led Robertson to short Assured Guaranty. The bond insurer has been hit by the island's debt woes, and Robertson thinks there is still substantial downside to the name.

"I think there's enough probably there to put them out of business just like Puerto Rico."

Credit bubble

Meanwhile, Robertson believes the U.S. market is overheated and reiterated his belief that there is a "very serious credit bubble."

He noted that near-zero interest rates on savings accounts are forcing people into stocks.

"As yields go up, that will be heightened by people coming out of stocks and going into where they belong in the first place: bonds."

Read MoreBill Gross: Six conditions for a bond crisis

Where he's investing

Robertson said he is "very positive" on Apple and called the tech giant, Google and Netflix the "greatest value stocks around."

He is also proud to be a shareholder in Gilead Sciences because of its Hepatitis C drug.

As for Europe, it has been a very good place to be and could possibly get better, as long as investors hedge the currency, Robertson said.

Presidential pick

When it comes to politics, Robertson said he's backing former Florida Gov. Jeb Bush in his bid for the White House.

"I think it is very important that we have a manager in here that has managed a state or managed something and managed well," he said, calling Bush a "very smart guy."

"We have a brilliant, attractive guy in there now but as a manager and leader I think he's pathetic."

Robertson thinks Wisconsin Gov. Scott Walker would be a great vice presidential pick for Bush.