Due to the tensions in the Middle East affecting surrounding countries most notably the Euro and Yen, the Dollar appreciated big time. With that in mind, U.S. economic data in general were pretty positive, which further drove up the prices over the last few weeks. However, USD does not look good against Franc and Canadian dollar. Pulling up the daily charts, the U.S. dollar is moving away from historical highs and appears to be a good time to do some long term shorting. Keep in mind not to get swapped out for this long term position trade. If obtaining a swap-free account is not possible, repeated close-outs and correction re-entries is also a possibility.

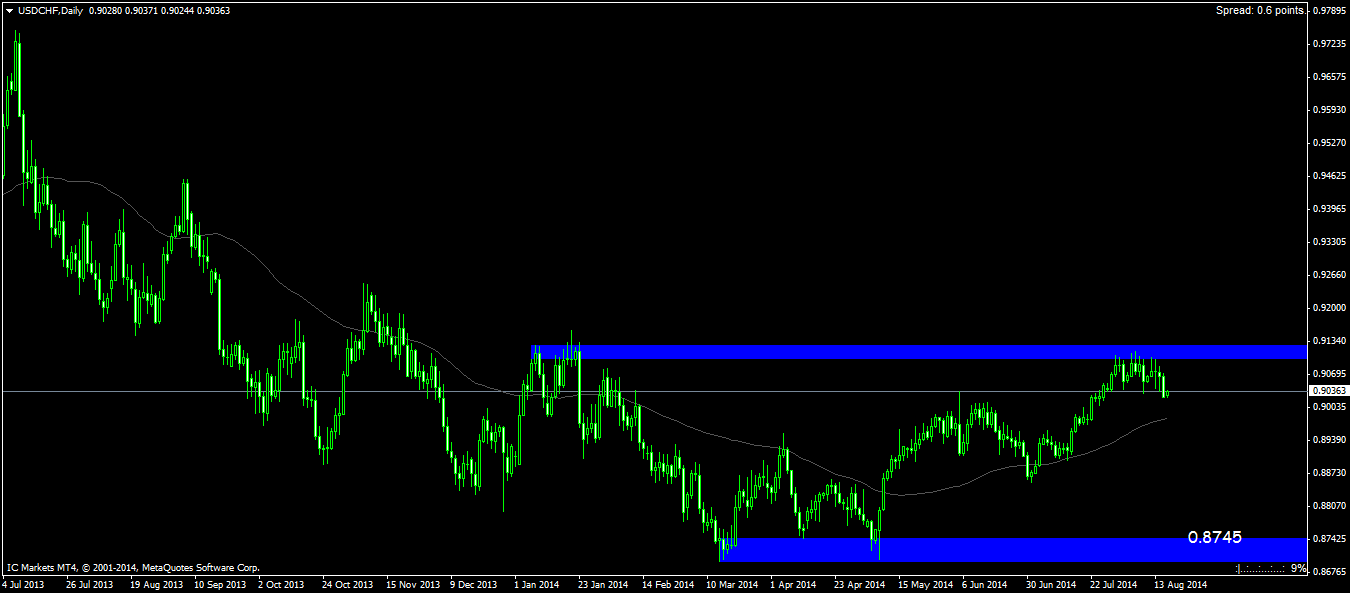

The USDCHF is a rather boring pair to trade. I was able to take quite a bit of profits from the CADCHF move, but generally not a lot of action. This is actually good to see as we look to exploit this pair in a high probability shorting. We see a very unclear double double in early January, 2014. Starting in July, it appears to be a heads and shoulders pattern leading to a reversal. In other words, notice how each fall day ended up with major selling while it took several days to of buying pressure to push the price back up. Sellers are clearly in control here. Therefore, the buy backs can be treated as cover buy-backs. Once this buy back period is over, sellers are back in control once again. We will see this pattern a few more times as it looks also looks like an uptrend forming if we were to draw a trend line from late April, 2014 to what appears to be late June, 2014. That topped off with my moving average setup acting as a dynamic s/r level, which in this case looks to be a support, be prepared to see a good deal of buying pressure. Nevertheless, buying pressure is expected to be relatively weaker than the selling pressure.

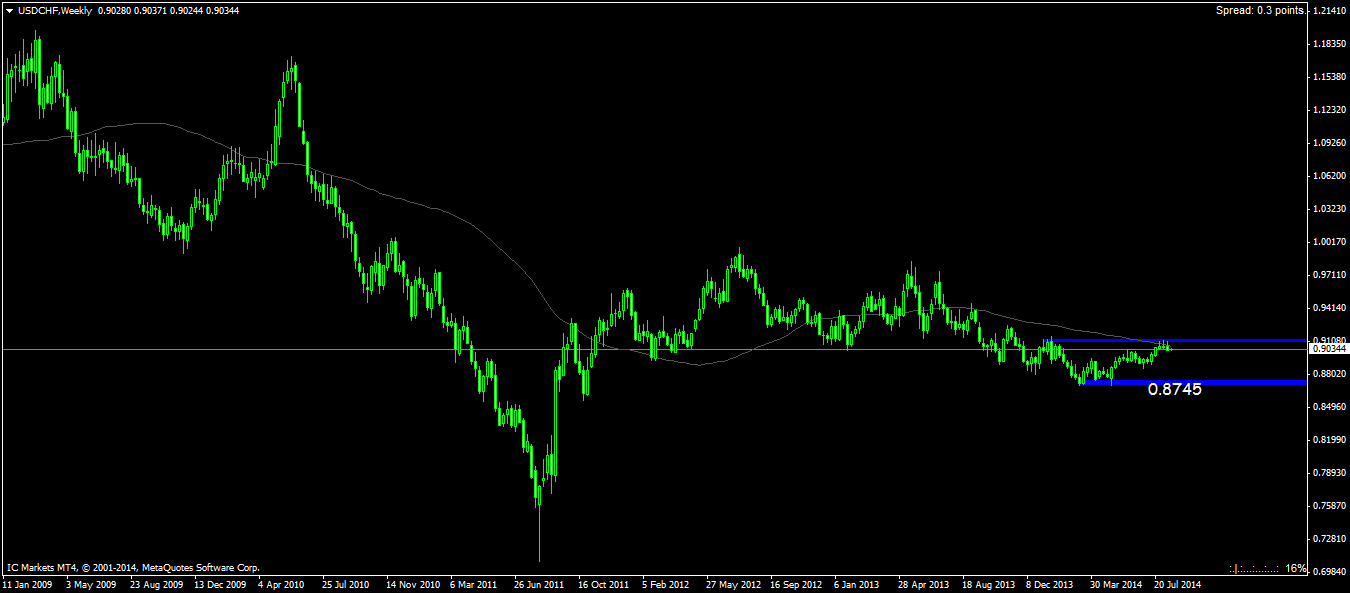

Switching over the weekly time-frame. The moving average plays the role of a dynamic resistance level. The Swiss is also being helped by the Russia-Ukraine tension further driving up this currency. The only fear right now is the strong U.S. dollar. Recommendation is to go for a conservative short with closure on pull-backs as they will be expected.

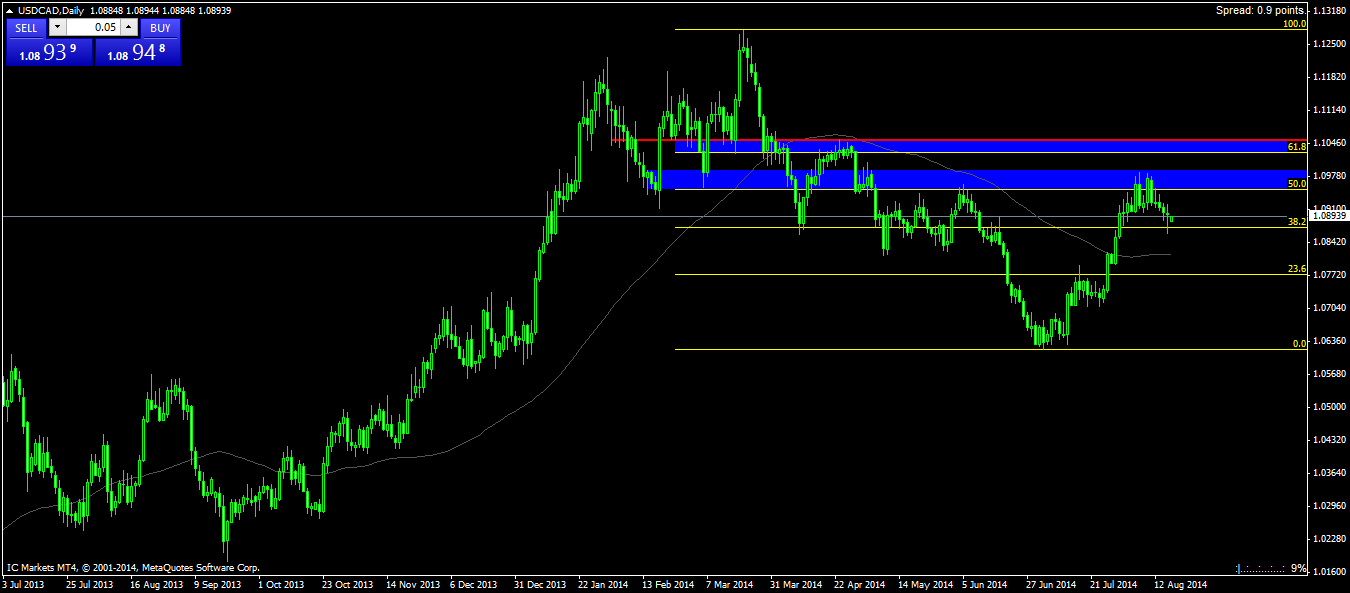

USDCAD also looks to rebound from a May, 2014 high. It looks like a double top has already been made with the first top on August 6th, 2014 and second two days later on August 8, 2014. Directional bias is still to go short here despite the possibilities of bullish pressure as the 61.8 Fibonacci level marks off another sell zone for this pair. Buying is strongly discouraged as this pair was able to fall despite the weak candle performance over the past few days. Expect to see one more correction before a continuation fall. Moderately aggressive traders should go for a short right now and prepare to scale-in if this pair rises. The Loonie weakened due to poor employment data, but improved on positive sales data. The Canadian manufacturing sales data should soften up future employment data. The Loonie is still expected to strengthen nevertheless.