Technical Analysis for US Dollar, S&P 500, Gold and Crude Oil: negative RSI divergence for crude oil price and S&P 500 to turn lower

US DOLLAR TECHNICAL ANALYSIS

Prices declined for a sixth

consecutive day, dropping to the weakest level in nearly three months.

Near-term support is at 11754, the 123.6% Fibonacci expansion, with a

break below that on a daily closing basis exposing the 138.2% level at

11719.

S&P 500 TECHNICAL ANALYSIS

Prices declined as expected

after putting in a Bearish Engulfing candlestick pattern, hinting a

double top is forming at 2119.40 (February 25 high). Negative RSI

divergence bolsters the case for a downside scenario. A break below the

38.2% Fibonacci retracement at 2093.50 exposes the 50% level at 2083.50.

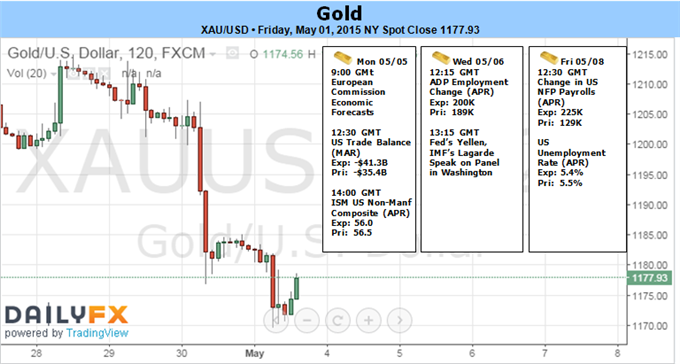

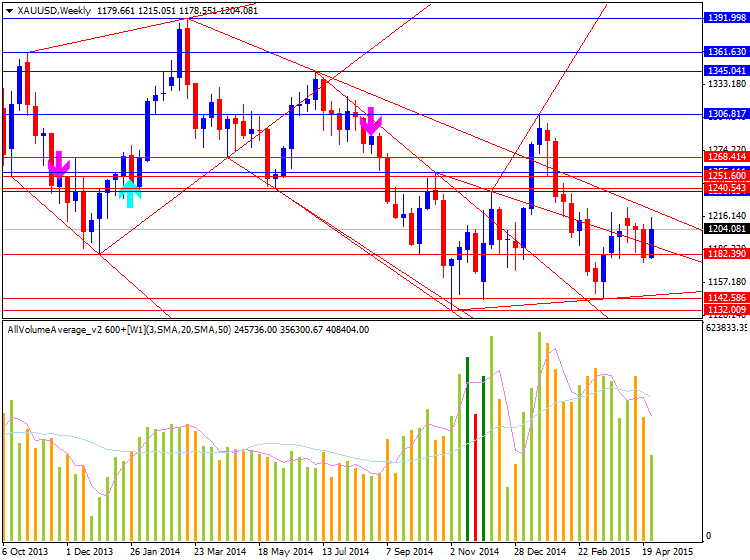

GOLD TECHNICAL ANALYSIS

Prices are attempting to build upward

anew after reclaiming a foothold above the $1200/oz figure. A break

above the April 28 high at 1215.00 exposes the April 6 top at 1224.15.

Alternatively, a turn below falling channel top

resistance-turned-support at 1197.38 targets the March 31 low at

1178.38.

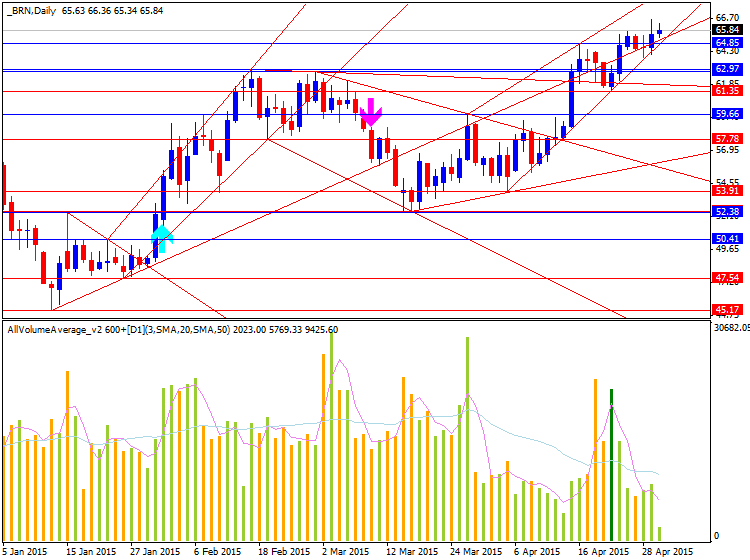

CRUDE OIL TECHNICAL ANALYSIS

Negative RSI divergence hints

prices may be readying to turn lower anew. A break below the 14.6%

Fibonacci retracement at 63.53 exposes the 23.6% level at 61.60.

Alternatively, a move above the 76.4% Fib expansion at 66.16 targets the

100% threshold at 70.36.