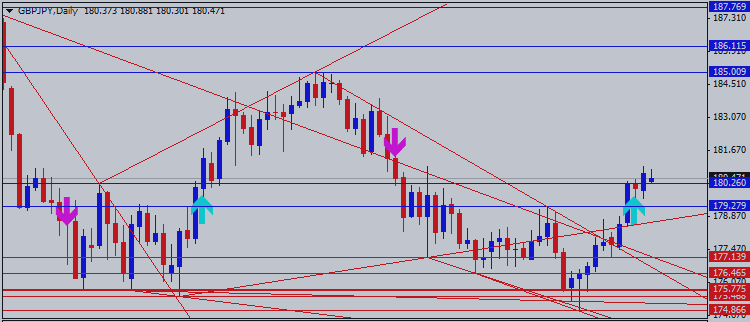

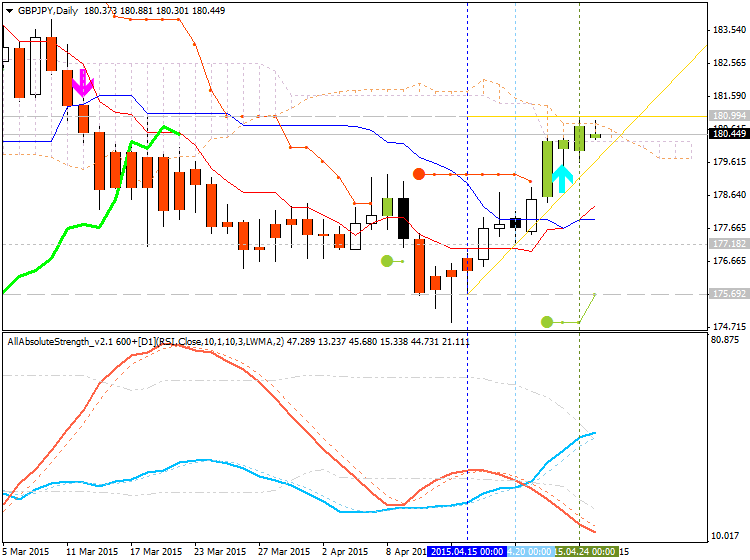

Technical Analysis - GBPJPY for possible bullish breakout with 180.99 resistance level to be broken

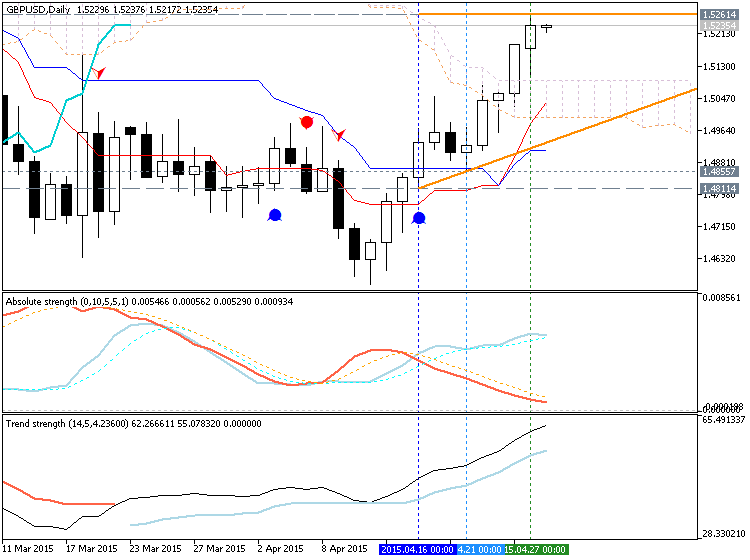

- Tenkan-sen line is located above Kijun-sen line of Ichimoku indicator with 180.99 resistance level on D1 timeframe with good signal for the uptrend to be continuing.

- D1 price is located inside Ichimoku cloud/kumo below Senkou Span A line which is indicating the reanging bearish market condition.

- Senkou Span A line as a virtual border between the primary bullish and the primary bearish areas on the chart are located to be very close to the price for good possible breakout and the reversal of the price movement from bearish to the bullish on daily timeframe.

- AbsoluteStrength indicator and PriceChannel indicators are estimating the local uptrend.bear market rally.

- "British Pound resumed its push higher against the Japanese Yen after a brief bout of consolidation, with buyers aiming above the 181.00 figure. Near-term resistance is at 181.14, the 61.8% Fibonacci retracement, with a break above that on a daily closing basis exposing the 76.4% level at 182.62. Alternatively, a turn below the 50% Fib at 179.94 clears the way for a challenge of the 23.6% retracement at 177.26".

- "The available trading range is too narrow to justify entering a trade on the long or short side from a risk/reward perspective. With that in mind, we will remain flat for now, waiting for price action to offer a more compelling opportunity down the road".

Trend:

- H4 - ranging bullish

- D1 - bear market rally

- W1 - ranging bullish

- MN1 - ranging bullish