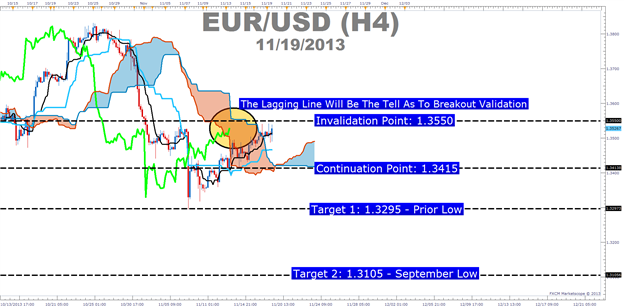

How to Trade - Breakout with Ichimoku and Trading Opportunity in EURUSD

A false breakout takes place when price appears to be making a renewed move in the direction of the trend only to be retraced. A trend trader who is looking for prices to eventually move higher but wants confirmation of a price thrust in the direction of the trend is especially prey to false breakouts. This is because a break of resistance like a trendline that is pierced by price without follow through is ground zero to a false breakout.

How Ichimoku Helps You Recognize a False Breakout

Like many pains of trading such as stops getting hit at an unfortunate

price, false breakouts cannot be avoided. However, they can be minimized

as well as become a nice trading signal upon their failure. The reason I

like looking to false breakouts as a trading opportunities is that they

can often have a sharp reversal in the direction of the prior move with

a good risk to reward ratio.

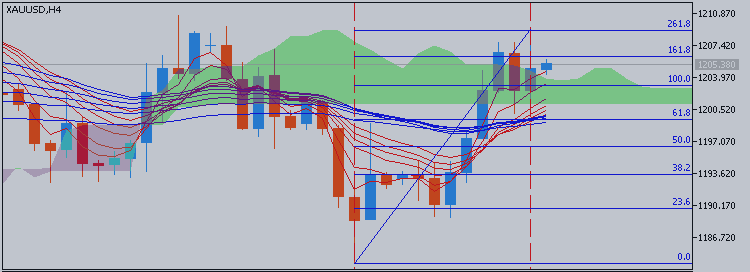

Ichimoku is a technical trading system that helps you catch moves in the direction of the trend on the time frame that you’re trading. Ichimoku is often seen as a difficult system to learn due to the 5 components that are displayed on the chart to explain a trading opportunity but each line serves a purpose and when you understand each purpose, you begin to get a feel for the value that Ichimoku can bring to your technical trading strategy.

If this is your first reading of the Ichimoku report, here is a recap of the traditional rules for a sell trade:

- Price is below the Kumo Cloud (That will be our entry trigger)

- The trigger line (black) is below the base line (light blue) or is crossing below

- Lagging line is below price action from 26 periods ago (bright green line)

- Kumo ahead of price is bearish and falling (red cloud = bearish Kumo)