Technical Analysis for US Dollar, S&P 500, Gold and Crude Oil - Resistance Above $59

US DOLLAR TECHNICAL ANALYSIS

Prices areattempting to launch a

recovery after moving downward as expected. Near-term support is in the

11858-86 area (March 18 low, 23.6% Fibonacci retracement), with a break

below that on a daily closing basis exposing the 38.2% level at 11679.

S&P 500 TECHNICAL ANALYSIS

Prices are consolidating after

moving lower as expected following the appearance of a bearish Evening

Star candlestick pattern. A daily close below the March 12low at 2040.10

exposes the 38.2% Fibonacci retracement at 2004.60.

GOLD TECHNICAL ANALYSIS

Prices paused to digest gains after

rising to test the highest level since mid-February. A daily close above

the 50% Fibonacci expansion at 1216.99 exposes the 61.8% level at

1226.11. Alternatively, a reversal below the 38.2% Fib at 1207.88

targets the 23.6% expansion at 1196.61.

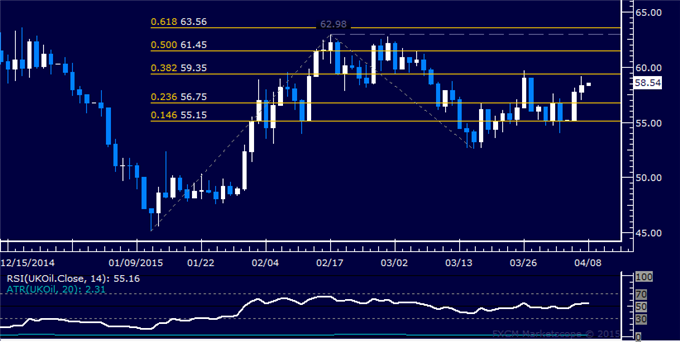

CRUDE OIL TECHNICAL ANALYSIS

Prices are aiming to test

resistance at 59.35, the 38.2% Fibonacci expansion, after pushing above

the 23.6% level at 56.75. A daily close above resistance exposes the 50%

Fib at 61.45. Alternatively, a reversal back below 56.75 targets the

14.6% expansion at 55.15.