Developed by Marc Chaikin

This an oscillator Indicator, it measure the Accumulation/distribution of money that is flowing into and out of a currency pair. The indicator is based on the fact that the nearer the closing price is to the high of the price, the more the accumulation of the currency pair. Also the nearer the closing price is to the low of the price, the more the distribution of the currency pair.

This indicator will be positive if price consistently closes above the bar's midpoint with increasing volume. However, if price consistently closes below the bar's midpoint with increasing volume the indicator will be negative.

Technical Analysis of Chaikin Oscillator

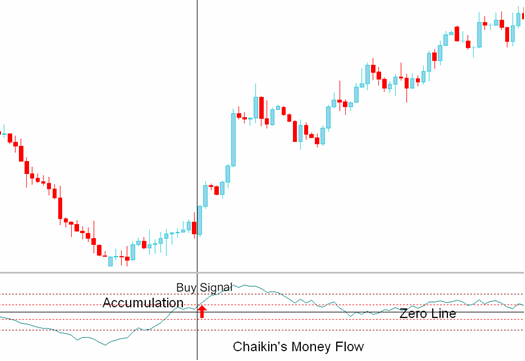

Buy Signal

A crossover of above zero signifies accumulation of a currency pair. A value of above +10 is a buy/bullish signal. Values above +20 signify a strong upward trending market.

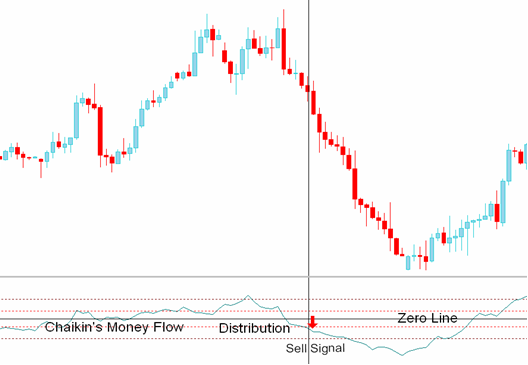

Sell Signal

A Zero line cross of below zero signifies distribution of a currency pair. A value of below -10 is a short/sell signal. Values below -20 signify a strong downward trending market.

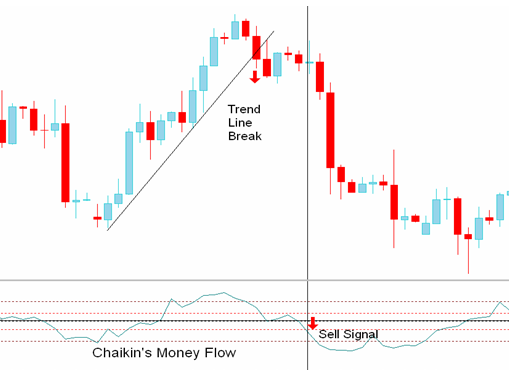

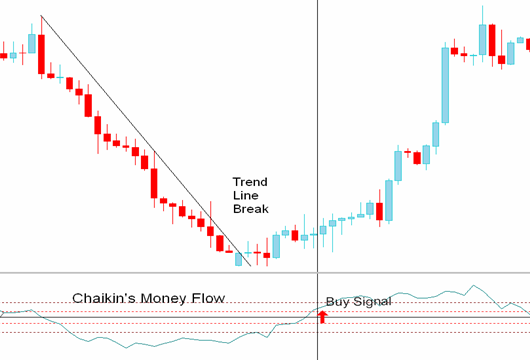

Trend Line break with Chaikin’s money flow indicator

The money flow indicator can be used to confirm trend line breaks or support/resistance level breaks. If price breaks an upward trend line, forex traders should then wait for a confirmation signal from the indicator values of below -10.

If price breaks an downward trend line, forex traders should then wait for a confirmation signal from indicator values of above +10.

Divergence Trading

A divergence between the Money Flow indicator and price often signals a pending reversal in market direction. However as with all divergences its best to wait for confirmation signals before trading the divergence. A bullish divergence signal occurs when price makes a lower low while the Chaikin Money Flow indicator makes a higher low. A bearish divergence signal occurs when price makes a higher high while the Chaikin Money Flow indicator makes a lower high.