Trading News Events: EUR Interest Rate - ECB To Announce Quantitative Easing (QE) Program

EUR/USD may face fresh monthly lows over the next 24-hours of trade as

the European Central Bank (ECB) is widely expected to announce more

non-standard measures to further mitigate the risk for deflation.

What’s Expected:

Why Is This Event Important:

Despite headlines for a EUR 50B/month asset-purchase program, the

details surrounding the new initiative may play a greater role in

driving EUR/USD especially as the Governing Council struggles to achieve

its one and only mandate for price stability. However, the ECB may provide limited details and make an attempt to buy

more time as President Mario Draghi struggles to produce a unanimous

vote within the Governing Council, and we may see a more meaningful

rebound in EUR/USD should the central bank disappoint.

How To Trade This Event Risk

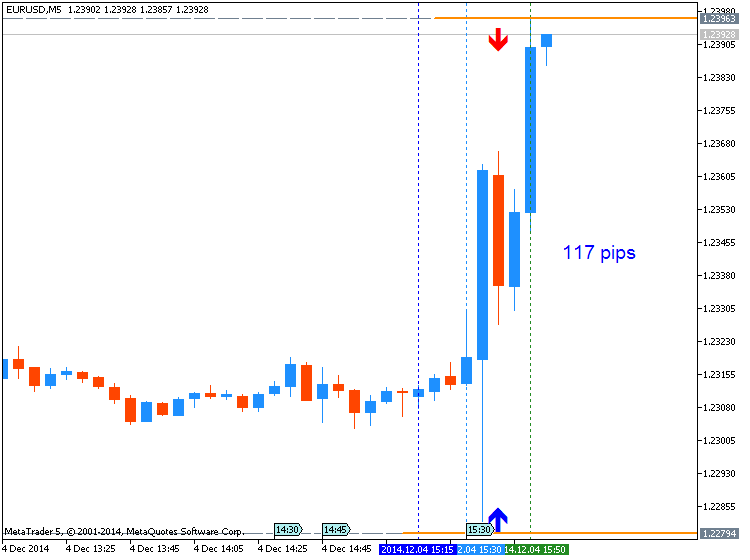

Bearish EUR Trade: ECB Unveils Open-Ended QE Program

- Need red, five-minute candle following the policy announcement to consider a short EUR/USD trade

- If market reaction favors a short Euro trade, sell EUR/USD with two separate position

- Set stop at the near-by swing high/reasonable distance from cost; at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is met, set reasonable limit

- Need green, five-minute candle to favor a long EUR/USD trade

- Implement same strategy as the bearish euro trade, just in the opposite direction

EURUSD Daily

- Despite the string of closing prices above the 1.1500 handle, downside targets remain favored for EUR/USD as the RSI retains the bearish momentum and holds in oversold territory.

- Interim Resistance: 1.1720 (23.6% retracement) to 1.1740 (161.8% expansion)

- Interim Support: 1.1458 (January low) to 1.1500 pivot

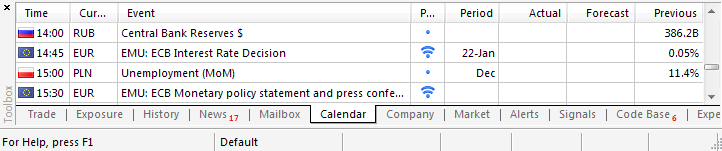

| Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

|---|---|---|---|---|---|

| DEC 2014 | 12/04/2014 12:45 GMT | 0.05% | 0.05% | +41 | +65 |

EURUSD M5: 117 pips range price movement by EUR - ECB Press Conference news event