The Currency Wars are still playing out

Everyone knows that it’s illegal for the average ‘Joe Punter’ to partake in insider trading. Central banks have no such restrictions. If they know they’re about to do something tricky with interest rates or the currency, there’s nothing stopping them from front-running the market. In effect, central banks have an exemption to insider trading rules.

So while the recent action with the gold price could be a coincidence, I’m not the sort of bloke who gives coincidences the benefit of the doubt. It just didn’t make much sense to me, in the current environment, for the US dollar and the gold price to both rise at the same time. You can see this on the chart below:

- Blue = USD vs AUD

- Red = gold price as measured by the US gold ETF.

Source: Google Finance

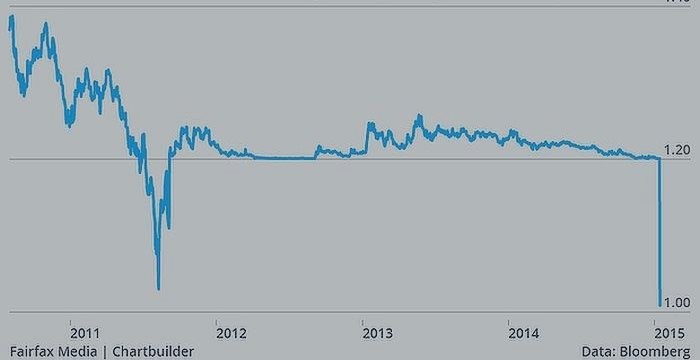

So, just what was it that the Swiss did so unexpectedly last night?

You may recall that a couple of years ago, the Swiss became concerned about the rising Swiss franc. That was during the period we can safely call the ‘Currency Wars’. That was when, rather than trying to preserve the value of their national currencies, the national central banks decided that the best thing would be if they destroyed the value of their currencies.

So they embarked on the money printing and low interest rate programs. But the Swiss National Bank’s (SNB) interest rate was already at rock bottom — a consequence of the SNB trying to discourage worried investors from buying Swiss francs and therefore pushing the franc higher.Why would the SNB want to destroy the value of its currency? For a start, everyone else was doing it. And second, they were worried that the high currency value would harm exports…even though a low currency rate would make imports more expensive.

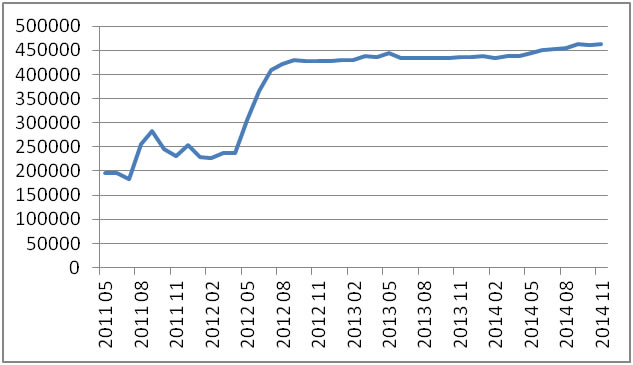

With nowhere to go on interest rates, the SNB decided to peg its currency to the euro. But in order to maintain the peg, the SNB had to sell Swiss francs and buy euros. That seems to have ‘worked’ so far. Although, it caused a huge increase in the SNB’s foreign currency reserves, as the following chart shows:

The SNB implemented the policy in September 2011, but the buying spree of euros had begun four months before that…a clear case of front running the market. But after three years, the SNB has decided to bring the plan to an end. Why?

The European Central Bank (ECB) is set to proceed with a huge round of money printing and bond buying. That creates a big problem for the SNB. In effect, in order to maintain the peg, the SNB would have to print a proportional amount to the ECB. So, the SNB has decided that it has played enough of that game. Instead, it’s going back to the good old tried and tested formula of low interest rates. And oh boy, are the Swiss going low.

As the overnight press release states:

The Swiss National Bank (SNB) is discontinuing the minimum exchange rate of CHF 1.20 per euro. At the same time, it is lowering the interest rate on sight deposit account balances that exceed a given exemption threshold by 0.5 percentage points, to −0.75%. It is moving the target range for the three-month Libor further into negative territory, to between –1.25% and −0.25%, from the current range of between −0.75% and 0.25%.

Yes, those are minus signs. The Swiss are cutting interest rates to -1.25%. Now, that doesn’t mean that depositors will lose money on their deposits, but it does mean that if the big banks hold too much cash at the central bank, they will lose on those deposits.

It’s a funny old world. No wonder the gold price remained steady, despite all the talk about rising interest rates. It will be interesting to see if the SNB has increased its gold holdings in the past few months. Remember that it was only late last year that the Swiss voted down a proposal that would have forced the SNB to buy gold. Wouldn’t it be ironic if they were in the market doing so anyway? We’ll find out over the next month or so when the SNB publishes the updates to its reserves.

First world problem

The move by the Swiss certainly caused ructions. As the Guardian newspaper reported:

One investment firm was forced to admit that the sudden shift in the Swiss franc had cost it as much as £30m.

Ouch! The poor fund managers. That’s one less slap up feed that they’ll be able to enjoy at London’s swanky The Ivy restaurant.

Subscriber Nigel writes in with a solution to what he calls the ECB’s mad plan:

Bearing in mind, the fears of the Bavarian sausage industry, the ECB should immediately buy up, using freshly printed money, all the sausages that the Bavarians can produce. This will help to cause immediate inflation, a key objective of the ECB, because let’s face it, if you knew the bank was going to buy your sausages, you’d put the price up immediately. The sausages should be distributed to every household in the Eurozone by helicopter. Householders can then either eat them or barter them. Because sausages devalue fairly quickly with time, this will also be inflationary as the amount of goods that would be exchanged for one sausage could be expected to fall rapidly. Any spare sausages left over that nobody wants anymore because of the stink can be relabelled as “drachmas” and sent over to Greece, because whatever currency plan they come up with to replace the Euro could hardly stink more.

Not only does this solve Europe’s potential deflation problem, but it is also just about the only solution that would pass muster with the Bundesbank, because they are Germans and therefore will want to protect their very much cherished sausage industry.

I’ll raise a bratwurst to that plan. Now on to another type of hard asset — gold. Several readers have written in responding to my blatherings on gold this week:

In my view it doesn't matter if the price action is up nor down, gold measured only in fiat currency is irrelevant!

What is relevant is...as an investor I own gold (physically).

How do I know when to sell then???

Elementary my dear Kris...look at other metrics that gold is historically measured in.

Regards, Subscriber Bob

In a similar vein, this letter:

I agree with your advice from late 2014 i.e. accumulate gold and buy on dips but don’t worry about the price. After all it is measured in a largely worthless asset and the price is apparently based on futures contracts (manipulated) that never settle in actual gold. I am comforted that the Asian economies are accumulating it and paying quite a premium over the Comex price for large acquisitions. When the western bullion banks run out of gold Shanghai may set the price but who knows when that will be? Will the price rise this year? Everyone has an opinion but I will not sell even if the price goes to US$500. I have no idea what the price will be in 2015 but I know what I want to leave my grandchildren and it is not bits of cloth and plastic with fancy ink drawings on them.

Keep up the good commentary which I read every day as part of my Alliance membership.

Alliance member Roger

They both make an important point. It’s a point I frequently forget. What does it matter, the dollar price of gold. The real value of paper currencies like the Aussie dollar and US dollar are falling all the time anyway. What’s important is whether the gold bars and coins in your hand will still exist 30, 40 or 50 years from now. The answer is, of course, yes. Nearly all gold that has ever been produced is still in use somewhere in the world, either as an investment, in industry, or as jewellery.

What about all those dollar notes, even the plastic ones? The Reserve Bank of Australia periodically scoops up all the old notes and burns them (is that deflation?). They have a limited lifespan. Can you guarantee the Aussie dollar will still exist 50 years from now? I can’t. But I know gold will still be around.

Cheers,

Kris

Port Phillip Insider