Amazon.com Inc announced that it would set up a new hub for cross-border operations in the free trade zone outside of Shanghai. Amazon will use these facilities to connect Chinese consumers to its global platform, allowing imports into China of products that are normally only available to Amazon shoppers in other countries. The facilities will also serve as a logistics warehouse for exporting goods from China to abroad, and a center for organizing cross-border payments.

A little back-story: Amazon has operated in China for about a decade under the Amazon.cn brand. It has built a solid reputation for customer service and product quality, but its market share remains tiny: Amazon.cn had just 2.7% of the business-to-consumer market in 2013, according to Observer Solutions, behind Alibaba’s Tmall.com, JD.com, and Suning’s and Tencent’s B2C sites.

Amazon’s China platform, Amazon.cn, has not been connected

with its international site, Amazon.com. Chinese people do occasionally

use Amazon.com directly, but they have to create new accounts and

navigate foreign payment and delivery systems to do so. Amazon’s bid to

connect these sites more closely is a strong and logical move. Chinese

customers are aware of the company’s extensive supplier network in the

US, and many will undoubtedly be excited to access its foreign products.

This new development will help Amazon to tap into a huge and growing

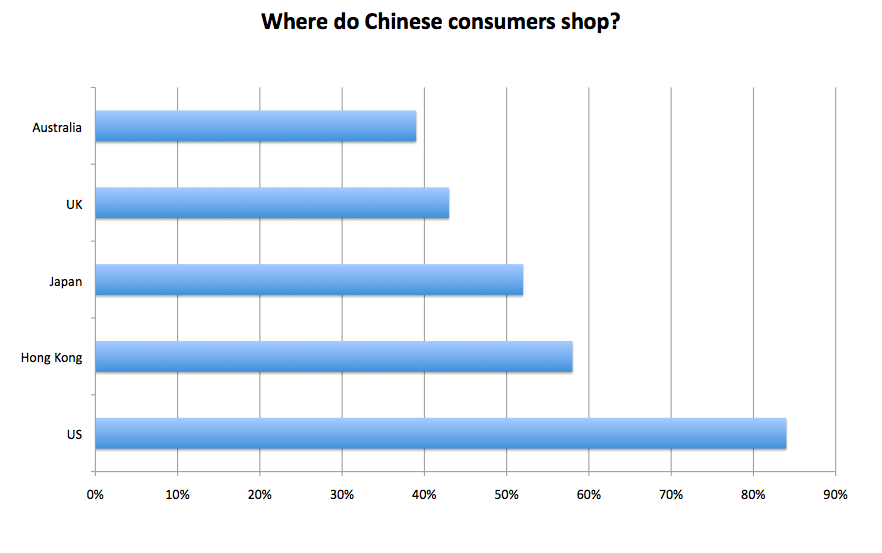

demand for Western products in China. A 2013 report by PayPal and The

Nielsen Company estimated that China’s cross-border shopping market will

grow from 18 million customers spending $35 billion in 2013 to 36

million shopping spending up to $163 billion a year by 2018. For the

Chinese respondents surveyed in this report, the US was by far the most

preferred shopping destination.

In addition to these factors, Alibaba retains an even more important

advantage: its extensive market share in China. Alibaba is the largest

and most profitable e-commerce company in China by every measure,

controlling roughly 80% of China’s e-commerce market. Amazon will

undoubtedly benefit from integrating its Chinese and foreign business,

but it would have to do something remarkable to win the attention of the

Alibaba’s dedicated shoppers.

Alibaba entered the cross-border e-commerce market in February with the launch of Tmall Global (www.tmall.hk),

which sells foreign brands such as GNC, Lancome, and Coach directly to

Chinese shoppers. (Foreign brands can also set up shop on Taobao and

Tmall, but they must have a legal entity in China). The site has

channels for formula and other baby products, nutritional supplements,

clothing, and cosmetics. With its huge user base advantage over

competitors like JD.com, Suning, and Amazon, Tmall is the force to watch

in the cross-border shopping market.