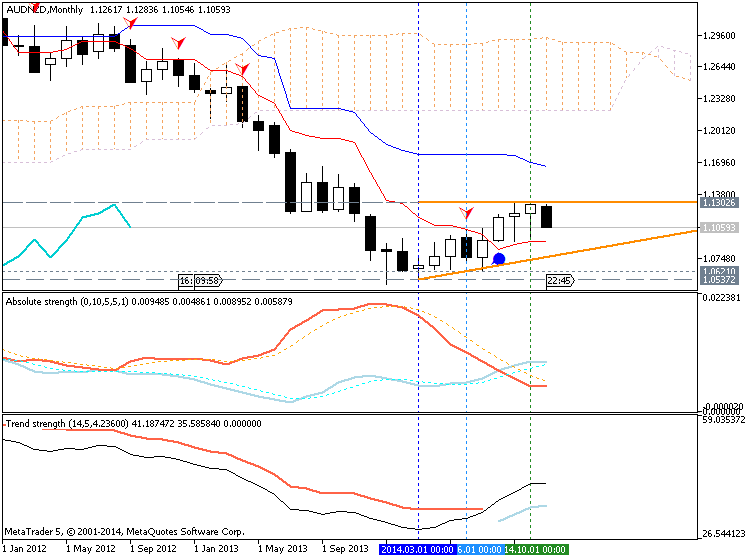

AUDNZD Technical Analysis - Monthly Forecast for 2015: Bearish with Counter-Trend Rally

MN price.

Ichimoku Analysis

The price is on bearish market condition with secondary rally for now, and it is located far below Ichimoku cloud/kumo. Kijun-sen and Tenkan-sen lines of Ichimoku indicator is located far from each other as well. Chinkou Span line is located below the price with 2K pips distance from it.

Bearish.

- If the price will cross Senkou Span B line (1.2209) so we may see the ranging market condition within primary bearish..

- If

not so the price will be continuing the primary bearish trend with secondary market rally as counter-trend situation.

Support & Resistance Analysis

MN price is floating for now between 1.1302 resistance and 1.0537 support levels. Those levels are key ones to understand about where the price will be going to be moved in 2015 for example.

- If MN1 price will cross 1.1302 resistance on close monthly bar so the secondary market rally will be continuing for whole 2015 (good for counter-trend systems, martingale and scalping systems).

- If MN price will break 1.0537 support level so the primary bearish will be continuing for whole 2015 year (good for trend following systems)/

- If not so we may see the ranging market condition within this primary bearish.

| Resistance | Support |

|---|---|

| 1.1302 | 1.0621 |

| 1.2209 | 1.0537 |

To make it shorter - I am expecting the secondary ranging with the primary bearish for the next year.

Trading Summary: bearish

If we look at patterns for MN1 timeframe so we can see bullish Retracement forming pattern:

Thus, I think - the most effective way to know about where the price will

go to the next year is to watching the levels for MN1 timeframe (1.1302 and 1.0537). My

expectation for 2015 is ranging bearish sorry.