- The Double-Top and Double-Bottom formation show multiple tests of support (or resistance) at a particular price level.

- Traders can look to trade subsequent tests of these price levels.

The Double-Top or Double-Bottom formation will occur when two separate ‘moves’ bounce from a support or resistance level. This highlights that level as being especially strong, so that the next time price encounters this, traders may be able to look for a significant reaction.

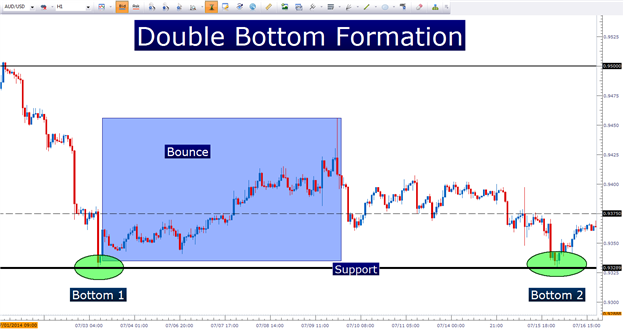

In the below chart, we take a look at a recent double bottom formation in the AUDUSD pair:

Notice how price action has reacted to this level of support two

different occasions. So the next time that we approach this level of

established support, it could be reasonable to assume that some type of

reaction may take place.

Imagine this support level as a theoretical ‘line in the sand’ that

can have the potential to pull additional buyers into the mix. But this

isn’t necessarily a completely bullish prospect… because after this

support level was defended, prices ended up coming right back down.

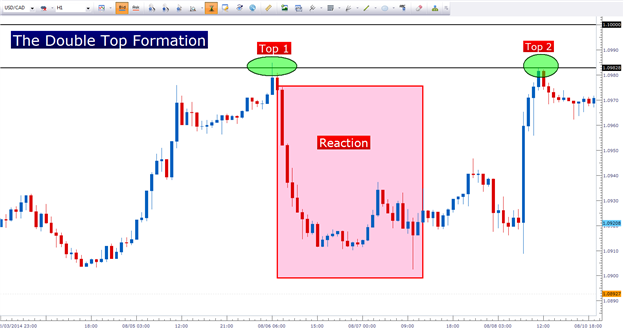

The exact opposite is true of resistance in the Double-Top formation:

Notice how this level of resistance on the chart has been validated

twice by price action, as sellers have come in to push prices lower once

this level was hit.

How to Trade the Double Top/Bottom Formation

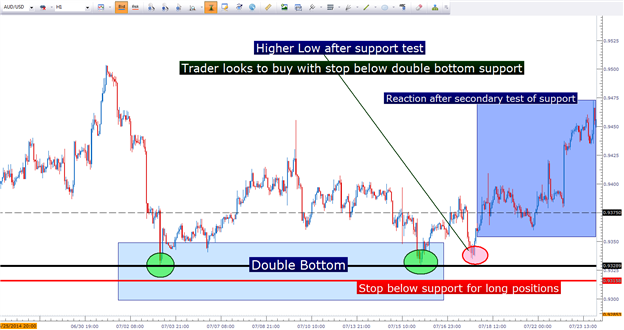

The default mannerism of trading the double bottom is to look for a

bullish price reaction after the second test of support. So, using the

same AUDUSD example we had looked at previously, we look at how a trader

could’ve approached this formation. After support was hit for a second

time, the trader knows that there could potentially be a bullish bias

coming into the market. After all, if buyers jumped in to protect the

‘line-in-the-sand,’ they may do so again.

So after the double bottom was formed – the trader waits: The trader

waits for a ‘higher-low’ to come into the market so that they can look

to ‘buy low,’ with a stop placed below the level of support at the

double-bottom. This way, if the formation doesn’t come to fruition, the

loss can be mitigated; but if the formation does come through, then the

trader can look to reap more upside than they had to put in to risk.

Trading the Double Bottom:

As you can see in the above setup, the real allure of trading the double

top or double bottom is the potential to have a really strong support

or resistance level to use for the basis of a position’s risk

management.

The exact opposite is true for the double top formation; in which the

trader can look to sell ‘lower highs,’ with a stop above resistance so

that if that level holds, the trader can look to manage a profitable

position… but if the high point of resistance doesn’t hold, the trader

can look to exit the position while mitigating the loss.