On Tuesday the U.S. dollar was steady at three-week lows against its Canadian counterpart, as the US currency weakened ahead of a report on U.S. consumer confidence due later in the day. Market players also expect Wednesday's Fed policy statement...

On Tuesday the greenback declined for a fifth day, its longest period of losses since July, on speculation downbeat economic data will delay the US central bank's first interest-rate increase in nine years...

On Tuesday the Australian dollar reached one-month peak against the greenback, following comments by Reserve Bank of Australia Governor Glenn Stevens. The New Zealand dollar declined against its US peer, but losses were limited as the greenback remained vulnerable after recent soft U.S. data...

On Monday the U.S. dollar was lower against its Canadian peer, as Friday's downbeat U.S. economic data dampened optimism over the strength of the country's recovery, weighing broadly on the greenback...

On Monday the greenback regained ground against a basket of other major currencies, as markets digested the previous week's soft U.S. economic reports...

On Monday the pound fell against the U.S. dollar, pulling back from eight-week highs as the greenback regained some strength after downbeat U.S. data released last week sent the currency broadly lower and as markets eyed upcoming U.K. data on first quarter growth...

On Monday the dollar was steady against the euro and the yen after weakening on Friday as downbeat U.S. economic data added to concerns that the recovery is losing momentum...

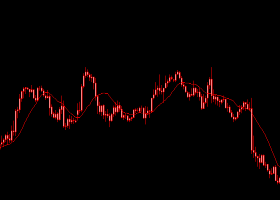

D1 price is on primary bearish located below 200 period SMA and 100 period SMA with ranging market condition: The price is ranging between 1.0461 key support and 1.1395 key resistance levels Triangle price pattern is crossed by the price from below to above on open D1 bar with the nearest 1...

On Friday the euro erased gains against the U.S. dollar, as U.S. durable goods orders data lent support to the greenback, despite an upbeat report on Germany's business climate which continued to boost the single currency...

On Friday the euro declined against the greenback, as the latter slightly recovered from the previous session's downbeat U.S. data. Investors now await an upcoming report on durable goods orders...

On Thursday the euro remained higher against the U.S. dollar, as downbeat U.S. jobless claims and new home sales data undermined demand for the U.S. currency...

On Thursday the greenback rose to one-and-a-half week highs against the yen. The Japanese currency also declined against the euro. Demand for the greenback was boosted by Wednesday's U.S. home sales data and as investors eyed additional U.S. report to be released later in the day...

On Thursday the British currency dropped impacted by disappointing retail sales data from the U.K. and as the previous session's U.S. home sales data continued to lend support to the greenback...

On Thursday the euro inched lower against the U.S. dollar, after data showed that in April the German consumer climate increased less than expected. Investors now anticipate euro zone manufacturing and service sector data due later later in trading session...

BitGo, the leader in Bitcoin security, announces that it has entered into a partnership with online cryptocurrency data provider TradeBlock...

The euro erased gains against the U.S. dollar on Wednesday, after upbeat U.S. home sales data and as concerns over Greece's debt woes continued to undermine demand for the single currency...

The Swiss franc dipped against the euro and the greenback on Wednesday after the Swiss National Bank announced it would eliminate exemptions from its policy of negative interest rates for certain public accounts, including the central bank’s pension fund...

On Wednesday the dollar was broadly lower versus its peers, as growing uncertainty over the timing of a U.S. rate hike weighed on the greenback and investors eyed upcoming data on U.S. home sales...

On Wednesday sterling regained ground after the minutes of the Bank of England’s April meeting indicated there is an improved chance that inflation could bounce back more strongly in 2015...