USD/JPY took a deep dive to 104 and below on the lack of action from the Bank of Japan. This may well change next month, with fiscal and monetary stimulus in play...

The British pound continues suffering and finally broke down below the 1.41 handle. It now faces strong support, and not at the round level. Here are 3 Brexit-related updates and the levels to watch: Update: the tables have totally turned with the tragic murder of MP Jo Cox...

The impact of the EU Referendum goes well beyond the shores of the UK but impacts many other currencies...

FOMC Statement and Economic Projections will take place today at 7.00pm BST, shortly followed by the Press Conference at 7.30pm BST...

Central banks will be in focus this week with the Federal Reserve, Bank of Japan, Swiss National Bank, and Bank of England all due to announce their latest monetary policy decisions. As always on Mondays kick start the week with my prepared currency update below...

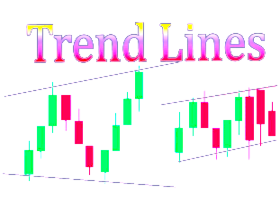

What maintains the trend on a currency i.e. how can we differentiate between when a pair will rally and then sell off and when a pair will rally and remain at new highs...

USD Faces Fresh Headwinds - Westpac Richard Franulovich, Research Analyst at Westpac, suggests that the potentially softer retail sales could weigh while the Fed is likely at best neutral if not negative for the USD. Key Quotes “Risks favour USD index testing recent 92.0 lows...

JPY: Negative External Environment Remains Supportive – MUFG Lee Hardman, Currency Analyst at MUFG, notes that the yen has strengthened modestly overnight supported by the more risk-averse trading conditions...

Brazil: Markets Continue to Price in Perfection - BBH Analysts from Brown Brother Harriman warn that the market is pricing in a very optimist scenario in Brazil and affirm that if global markets turn again it will be amongst the most vulnerable...

Brexit Heating Up: Euro is Taking the Lead So Far - BTMU Analysts at Bank of Tokyo mitsubishi explained that they believe that the pound started to more seriously discount Brexit risk towards the end of last year...

RBNZ Monetary Policy: Assessing Future Bias Reserve bank of New Zealand (RBNZ) has maintained current overnight cash rate at 2.25%. It is vital to see how the bias stands to assess future actions – Global growth stabilized and financial market volatility abated...

NZD/USD : Levels, Ranges, Targets, RBNZ New Zealand House prices lacks adequate supply, Commodities and exchange rates misaligned, Dairy exports below export break even rates, the why is found in the same old lingering effects in New Zealand and its Trade Ables to Non Trade Ables and then the fol...

AUD Performance is Concerning - BBH Research Team at BBH, suggests that concerning is the Australian dollar's performance. Key Quotes “We have brought to your attention the fact that the Aussie has been a good leading indicator of the US dollar's broader direction...

RBNZ: Kiwi's Push to New Highs is a Function of Governor Wheeler's Guidance - BBH Research Team at BBH, notes that the Kiwi is up 1.5% following the RBNZ's decision to leave rates on hold and signal little urgency to cut again in the near-term...

US: Delayed Fed Rate Hike Expectations Prompt Search for Yield - MUFG Lee Hardman, Currency Analyst at MUFG, notes that the US dollar remains on the defensive in the near-term with renewed weakness most evident against commodity related and emerging market currencies...

All About Positioning on Rate Moves The overnight volatility on currencies has come from central bank decision and also lack of them. The main surprise was with the cut in rates from the Bank of Korea, cut to 1.25% (from 1.50...

Long Overdue Correction for Euro Previous: On Wednesday the euro/dollar managed to lift above 1.14. Due to oil and gold prices rising, the euro's strengthening was held back in the EUR/AUD and EUR/CAD crosses...

NZ: Kiwi Flying High in the Aftermath of RBNZ - MUFG Lee Hardman, Currency Analyst at MUFG, suggests that the New Zealand dollar has benefitted from the RBNZ’s decision to leave its key policy rate unchanged overnight at 2.25...