EUR/USD Monthly “Long term, a failed breakout and top would keep with the pattern of 3 year cycle tops. The break of 1.3476 completed a topping process with targets of 1.3294 (origin of diagonal), 1.3209 (2 equal legs), and 1.3012 (head and shoulders target...

GBP/JPY Technical Strategy: Flat Support: 172.39-64, 171.79, 170.64 Resistance: 173.33, 174.01, 174.87 The British Pound pulled back after rebounding as expected against the Japanese Yen, testing the upswing’s guiding trend line. A daily close belowthe 172...

Day trading Strategies – Part One - general information about scalping as a method of trading in forex and stocks incl scalping software programs/books reviewed The Definitive Guide to Scalping, Part 7: Scalping Breakouts - this is the 7th part of the scalping tutorial published on mql5 portal Wh...

USD/JPY has been left in a precarious position as Harami threatens to topple the pair. If confirmed by an ensuing down session it could signal a correction towards buying support at the 104.25 floor. However, against the backdrop of a short-term uptrend buying dips would be preferred...

USDJPY Technical Strategy: Pending Long Shooting Star Awaiting Confirmation Doji on H4 USD/JPY’s recent rocket higher is at risk of losing fuel as a Shooting Star begins to take shape on the daily...

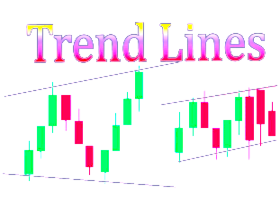

In an uptrend when market tests the resistance level if it can not penetrate and exceed beyond the resistance level a trend reversal, potentially a downtrend, is in progress...

NZD/USD Technical Strategy: Flat Support: 0.8330, 0.8283, 0.8206 Resistance:0.8401-34, 0.8511, 0.8553-73 The New Zealand Dollar may be preparing to bounce against its US counterpart following the formation of a bullish Morning Star candlestick pattern. Near-term resistance is at 0...

Artificial Neural Networks Developers & Programmers - database of programmers making job on NN Successful Trading Using Artificial Intelligence - the book TRADING NEWS EVENTS - Retail Sales - mql5 blog post TRADING LESSON: How to Trade the Gross Domestic Product (GDP) - mql5 blog post Creatin...

Plan to slow 'Flash Boys' already has some holes - The Securities and Exchange Commission announced the proposal Tuesday in which 1,200 small-cap firms will be divided into three equal-sized groups with different standards governing each...

The USDJPY bulls have seemingly lost their grip on the pair after a Doji signaled hesitation from traders near 104.00. The daily close below the critical barrier warns of further weakness and may set the scene for a retest of the 103.00 floor...

NZDUSD may have reached a turning point with a Hammer formation offering a sign of hope for the bulls. An ensuing up-day and close above the 0.8400 hurdle would be required to signal the potential for a more sustained recovery for the pair...

6:00 AM Get up and have breakfast. Check emails to make sure that the overnight cron jobs (automated tasks) ran successfully the night before. These are for downloading financial data and uploading our own internal reports. More on that later. 7:00 AM Head in to Mayfair on the Tube...

Triangles A triangle appears to reflect a balance of forces, causing a sideways movement that is usually associated with decreasing volume and volatility. The triangle pattern contains five overlapping waves that subdivide 3-3-3-3-3 and are labeled A-B-C-D-E...

This Is Your Recovery, And This Is Your Recovery Without Drugs - “It is well enough that people of the nation do not understand our banking and money system, for if they did, I believe there would be a revolution before tomorrow morning...

Neural Network FAQ, by 7 parts incl learning howto, books, data, free software, commercial software, hardware, and more A Novel Approach of Finger Print Recognition Using (Ridge) Minutia Method and Multilayer Neural Network Classifier - the article Thousands Of Gamers Help Scientists Map The Neur...

Expanded Flats In expanded flats, wave B of the 3-3-5 pattern terminates beyond the starting level of wave A, and wave C ends more substantially beyond the ending level of wave A, as shown for bull markets in Figures 1-33 and 1-34 and bear markets in Figures 1-35 and 1-36...

USDCHF is trading pips shy of its YTD high but has pushed above the trendline that extends off of the 2010 and 2013 highs (there is a trendline that extends off of the 1985 and 2001 highs near .9400). The nearly 30 year trendline splits the 50% and 61...

“The miserable trading conditions in USDJPY are probably explained by its long term Elliott wave position. That is, the rate has been mired in a corrective 4th wave all year. The good news is that wave 4 probably ends soon. Keep focused on the Elliott channel...

“Long term, a failed breakout and top would keep with the pattern of 3 year cycle tops. 1.3750 is an important reference point (year open).” The break of 1.3476 completed a topping process with targets of 1.3294 (origin of diagonal), 1.3209 (2 equal legs), and 1.3012 (head and shoulders target...

High Probability Trading : Take The Steps To Become A Successful Trader Before he became a successful trader, Marcel Link spent years wading from one system to the next, using trial and error to figure out what worked, what didn't, and why...