MQL5 Wizard: Placing Orders, Stop-Losses and Take Profits on Calculated Prices. Standard Library Extension

Introduction

The MQL5 Standard Library is a useful aid in developing large projects that require a strict architecture. The MQL5 Wizard allows assembling ready made parts into an extensive scheme in the dialog mode within a few minutes, which cannot be overestimated. The MQL5 Wizard automates gathering all parts of the Expert together and automatically declares module parameters in the Expert according to their handles. When there is a great number of various modules involved, such automation saves a lot of time and routine operations.

It sounds good however there is an obvious disadvantage - capabilities of trading systems created with the Wizard based on standard classes are limited. This article considers a universal method allowing to significantly extend functionality of created Experts. When this method is implemented, compatibility with the Wizard and standard modules remains the same.

The idea of the method is using mechanisms of inheritance and polymorphism in Object-Oriented Programming or creating classes to substitute standard classes in the code of generated Experts. This way all advantages of the Wizard and the Standard Library are utilized, which results in developing an Expert with required capabilities. To get there though, code has to be reduced a little, only by four strings.

The practical purpose of this article is adding to generated Experts a capability to place orders, Stop Losses and Take Profits at required price levels, not only at the specified distance from the current price.

Similar idea was discussed in the article "MQL5 Wizard: How to Teach an EA to Open Pending Orders at Any Price". The significant drawback of the suggested solution is the "forced" change of the parameter of the trading signal module from the subordinate filter. This approach does not abet working with a lot of modules and using the Wizard for process optimization makes no sense.

Implementation of placing orders as well as Stop Losses and Take Profits at any prices in classes inherited from the standard ones is considered in detail further down. That said, any conflicts between modules are impossible. I hope that this article serves an example and inspires readers for writing own improvements of the standard framework and also allows users to implement the developed Library extension.

1. Standard Algorithm of Decision Making

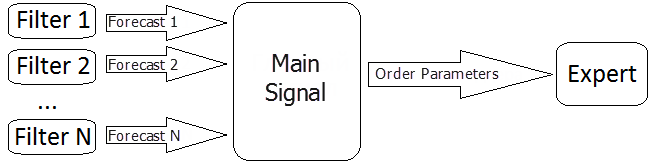

Experts, generated in the MQL5 Wizard are based on the CExpert class instance. The pointer to the object of the CExpertSignal class is declared in this class. Further in the article this object is called the main signal for brevity's sake. The main signal contains pointers to the subordinate filters (signal modules are the inheritors of the CExpertSignal class).

If there are no open positions and orders, the Expert refers to the main signal to check for an opportunity to open a position on a new tick. The main signal inquires subordinate filters one by one and calculates weighted average forecast (direction) based on the obtained forecast. If its value exceeds the threshold (value of the m_threshold_open parameter in the main signal), order parameters and results of check for conditions of the bool type are passed to the Expert. If these conditions are met, either a position on the market price gets opened or a pending order at a certain distance from it (see Fig. 1). Stop Losses can be placed only at a fixed distance. The opening price indentions, Stop Loss and Take Profit from the market price are specified in the Expert settings and stored in the main signal, in the m_price_level, m_stop_level and m_take_level variables respectively.

So, currently two conditions have to be met for an order to be placed:

- No open positions for the current symbol;

- Absolute value of weighted average forecast exceeds the threshold value, which means that a trend is rather strong).

Fig. 1. Pattern of decision making on entering the market

The current pattern of decision making on Fig. 1 significantly limits the application area of the MQL5 Wizard. Strategies with fixed value of Stop Loss are rarely efficient in long term trading due to changeable volatility. Systems employing pending orders usually require placing them on dynamically calculated levels.

2. Modified Algorithm of Decision Making

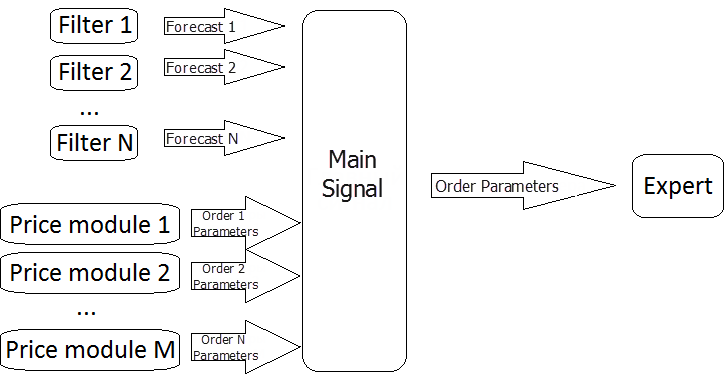

From the perspective of calculating levels and placing orders, this is a dead-end situation as signal modules cannot generate anything other than a forecast value and the main signal was not designed for work with levels. In this regard it is suggested:

- To introduce a new type of signal modules (we are going to call them price modules) able to generate order parameters;

- Train the main signal to handle those parameters, i.e. select the best ones and pass them on to the Expert.

Modified algorithm (Fig. 2) allows working with other requests besides pending orders. The essence of this algorithm is that it separates the entry point (price) from defining a trend (weighted average forecast). That means that to make a decision, the preferred direction of trading with filters is defined and a set of order parameters with suitable direction obtained from price modules is selected. If there are several similar sets available, the set received from the module with the greatest weight (parameter value m_weight is chosen). If the direction has been determined but there are no entry points currently available, the Expert is inactive.

Fig. 2. Modified pattern of decision making on entering the market

To place a new order, the following requirements have to be met:

- No open positions and orders for the current symbol;

- Absolute value of weighted average forecast exceeds the threshold value;

- At least one opening price of the order has been found.

The algorithm of Fig. 2 enables handling many possible entry points, filtering them by direction and choosing the best one in one Expert.

3. Development of Modified Classes of the Expert and the Signal Module

The extension of the Library is based on two classes: CExpertSignalAdvanced and CExpertAdvanced, inherited from CExpertSignal and CExpert respectively.

All measures on adding new capabilities aimed at changing interfaces employed for data exchange between different blocks of the Expert. For instance, to implement the algorithm by the pattern on Fig.2 it is required to organize interaction of the main signal (class CExpertSignalAdvanced) with price modules (descendants of that class). Updating already placed orders when data change, implies interaction of the Expert (class CExpertAdvanced) with the main signal.

So at this stage we are going to implement the pattern on Fig. 2 for opening positions and organize updating of already placed orders when parameters change (for example, when a more favorable entry point appears). Let us consider the CExpertSignalAdvanced class.

3.1. CExpertSignalAdvanced

This class is going to substitute its ancestor in the role of the main signal and become the basic one for price modules the same way as its ancestor is basic for signal modules.

class CExpertSignalAdvanced : public CExpertSignal { protected: //---data members for storing parameters of the orders being placed double m_order_open_long; //opening price of the order to buy double m_order_stop_long; //Stop Loss of the order to buy double m_order_take_long; //Take Profit of the order to buy datetime m_order_expiration_long; //expiry time of the order to buy double m_order_open_short; //opening price of the order to sell double m_order_stop_short; //Stop Loss of the order to sell double m_order_take_short; //Take Profit of the order to sell datetime m_order_expiration_short; //expiry time of the order to sell //--- int m_price_module; //index of the first price module in the m_filters array public: CExpertSignalAdvanced(); ~CExpertSignalAdvanced(); virtual void CalcPriceModuleIndex() {m_price_module=m_filters.Total();} virtual bool CheckOpenLong(double &price,double &sl,double &tp,datetime &expiration); virtual bool CheckOpenShort(double &price,double &sl,double &tp,datetime &expiration); virtual double Direction(void); //calculating weighted average forecast based on the data received from signal modules virtual double Prices(void); //updating of parameters of the orders being placed according to the data received from price modules virtual bool OpenLongParams(double &price,double &sl,double &tp,datetime &expiration); virtual bool OpenShortParams(double &price,double &sl,double &tp,datetime &expiration); virtual bool CheckUpdateOrderLong(COrderInfo *order_ptr,double &open,double &sl,double &tp,datetime &ex); virtual bool CheckUpdateOrderShort(COrderInfo *order_ptr,double &open,double &sl,double &tp,datetime &ex); double getOpenLong() { return m_order_open_long; } double getOpenShort() { return m_order_open_short; } double getStopLong() { return m_order_stop_long; } double getStopShort() { return m_order_stop_short; } double getTakeLong() { return m_order_take_long; } double getTakeShort() { return m_order_take_short; } datetime getExpLong() { return m_order_expiration_long; } datetime getExpShort() { return m_order_expiration_short; } double getWeight() { return m_weight; } };

Data members for storing order parameters have been declared in the CExpertSignalAdvanced class. The values of these variables get updated in the Prices() method. These variables act as a buffer.

Then the parameter m_price_module gets declared. It stores the index of the first price module in the m_filters array declared in CExpertSignal. This array contains the pointers to included signal modules. Pointers to standard modules (filters) are stored in the beginning of the array. Then, starting from the m_price_module index, price modules come. To avoid the necessity of changing initialization methods of indicators and timeseries, it was decided to store everything in one array. Moreover, there is a possibility to include 64 modules through one array and usually it is sufficient.

In addition, helper methods were declared in the CExpertSignalAdvanced class for obtaining values of protected data members. Their names start with get (see class declaration).

3.1.1. Constructor

The constructor CExpertSignalAdvanced initializes variables declared inside the class:

CExpertSignalAdvanced::CExpertSignalAdvanced()

{

m_order_open_long=EMPTY_VALUE;

m_order_stop_long=EMPTY_VALUE;

m_order_take_long=EMPTY_VALUE;

m_order_expiration_long=0;

m_order_open_short=EMPTY_VALUE;

m_order_stop_short=EMPTY_VALUE;

m_order_take_short=EMPTY_VALUE;

m_order_expiration_short=0;

m_price_module=-1;

}

3.1.2. CalcPriceModuleIndex()

The method CalcPriceModuleIndex() assigns in m_price_module current number of array elements, which is equal to the index of the following added module. This method is called before adding the first price module. The function body is in the class declaration.

virtual void CalcPriceModuleIndex() {m_price_module=m_filters.Total();}

3.1.3. CheckOpenLong(...) and CheckOpenShort(...)

The method CheckOpenLong(...) is called from the CExpert class instance and works as described below:

- Check for included price modules. If there are none, then call the eponymous method of the parent class;

- Receive weighted average forecast (direction) from the Direction() method;

- Verify if entry conditions are met by comparing the direction with EMPTY_VALUE and the threshold value of m_threshold_open;

- Renew values of order parameters by the Prices(), method and pass them on to the Expert with the OpenLongParams(...) function. Save the result of this function;

- Return the saved result.

bool CExpertSignalAdvanced::CheckOpenLong(double &price,double &sl,double &tp,datetime &expiration) { //--- if price modules were not found, call the method of the basic class CExpertSignal if(m_price_module<0) return(CExpertSignal::CheckOpenLong(price,sl,tp,expiration)); bool result =false; double direction=Direction(); //--- prohibitive signal if(direction==EMPTY_VALUE) return(false); //--- check for exceeding the threshold if(direction>=m_threshold_open) { Prices(); result=OpenLongParams(price,sl,tp,expiration);//there's a signal if m_order_open_long!=EMPTY_VALUE } //--- return the result return(result); }

CheckOpenShort(...) has the same operation principle and is used the same way, that is why we are not going to consider it.

3.1.4 Direction()

The Direction() method queries filters and calculates weighted average forecast. This method is very similar to an eponymous method of the parent class CExpertSignal with an exception that in the loop we do not refer to all elements of the m_filters array but only to those having an index that varies from 0 to the one less than m_price_module. Everything else is similar to CExpertSignal::Direction().

double CExpertSignalAdvanced::Direction(void) { long mask; double direction; double result=m_weight*(LongCondition()-ShortCondition()); int number=(result==0.0)? 0 : 1; // number of queried modules //--- loop by filters for(int i=0;i<m_price_module;i++) { //--- mask for bitmaps (variables, containing flags) mask=((long)1)<<i; //--- checking for a flag of ignoring a filter signal if((m_ignore&mask)!=0) continue; CExpertSignal *filter=m_filters.At(i); //--- checking for a pointer if(filter==NULL) continue; direction=filter.Direction(); //--- prohibitive signal if(direction==EMPTY_VALUE) return(EMPTY_VALUE); if((m_invert&mask)!=0) result-=direction; else result+=direction; number++; } //--- averaging the sum of weighted forecasts if(number!=0) result/=number; //--- return the result return(result); }

3.1.5. Prices()

The method Prices() iterates over the second part of the m_filters array starting from the m_price_module index up to the end. This queries price modules and renews the values of the class variables with the functions OpenLongParams(...) and OpenShortParams(...). Before the cycle, the parameter values get cleared.

During the cycle, parameter values get overwritten if the weight of the current price module (m_weight) is greater than the one of the previously queried modules, which provided the values. As a result, either empty parameters are left (if nothing was found) or parameters with the best weight available at the time of calling a method.

double CExpertSignalAdvanced::Prices(void) { m_order_open_long=EMPTY_VALUE; m_order_stop_long=EMPTY_VALUE; m_order_take_long=EMPTY_VALUE; m_order_expiration_long=0; m_order_open_short=EMPTY_VALUE; m_order_stop_short=EMPTY_VALUE; m_order_take_short=EMPTY_VALUE; m_order_expiration_short=0; int total=m_filters.Total(); double last_weight_long=0; double last_weight_short=0; //--- cycle for price modules for(int i=m_price_module;i<total;i++) { CExpertSignalAdvanced *prm=m_filters.At(i); if(prm==NULL) continue; //--- ignore the current module if it has returned EMPTY_VALUE if(prm.Prices()==EMPTY_VALUE)continue; double weight=prm.getWeight(); if(weight==0.0)continue; //--- select non-empty values from modules with the greatest weight if(weight>last_weight_long && prm.getExpLong()>TimeCurrent()) if(prm.OpenLongParams(m_order_open_long,m_order_stop_long,m_order_take_long,m_order_expiration_long)) last_weight_long=weight; if(weight>last_weight_short && prm.getExpShort()>TimeCurrent()) if(prm.OpenShortParams(m_order_open_short,m_order_stop_short,m_order_take_short,m_order_expiration_short)) last_weight_short=weight; } return(0); }

3.1.6. OpenLongParams(...) and OpenShortParams(...)

Within the CExpertSignalAdvanced class, the method OpenLongParams(...) passes parameter values of the order to buy by reference from the class variables to the input parameters.

The role of this method in the parent class was slightly different. This was calculating required parameters based on the market price and specified indentations in the main signal. Now this only passes ready parameters. If the opening price is correct (not equal to EMPTY_VALUE), then the method returns true, otherwise false.

bool CExpertSignalAdvanced::OpenLongParams(double &price,double &sl,double &tp,datetime &expiration) { if(m_order_open_long!=EMPTY_VALUE) { price=m_order_open_long; sl=m_order_stop_long; tp=m_order_take_long; expiration=m_order_expiration_long; return(true); } return(false); }

We are not going to consider OpenShortParams(...) as its operation principle is the same and it is used similarly.

3.1.7. CheckUpdateOrderLong(...) and CheckUpdateOrderShort(...)

The methods CheckUpdateOrderLong(...) and CheckUpdateOrderShort(...) are called the CExpertAdvanced class. They are used for updating already placed pending order according to the last price levels.

We are going to examine the method CheckUpdateOrderLong(...) more closely. At first price levels get updated when calling the method Prices(...), then a check for data updates is carried out to exclude possible modification errors. Finally, the method OpenLongParams(...) is called for passing updated data and returning the result.

bool CExpertSignalAdvanced::CheckUpdateOrderLong(COrderInfo *order_ptr,double &open,double &sl,double &tp,datetime &ex) { Prices(); //update prices //--- check for changes double point=m_symbol.Point(); if( MathAbs(order_ptr.PriceOpen() - m_order_open_long)>point || MathAbs(order_ptr.StopLoss() - m_order_stop_long)>point || MathAbs(order_ptr.TakeProfit()- m_order_take_long)>point || order_ptr.TimeExpiration()!=m_order_expiration_long) return(OpenLongParams(open,sl,tp,ex)); //--- update is not required return (false); }

CheckUpdateOrderShort(...) is not going to be considered as it operates similarly and applied the same way.

3.2. CExpertAdvanced

Changes in the class of Expert concern only modifying already placed orders according to the updated data on the prices in the main signal. The CExpertAdvanced class declaration is presented below.

class CExpertAdvanced : public CExpert { protected: virtual bool CheckTrailingOrderLong(); virtual bool CheckTrailingOrderShort(); virtual bool UpdateOrder(double price,double sl,double tp,datetime ex); public: CExpertAdvanced(); ~CExpertAdvanced(); };

As we can see, the methods are few, the constructor and destructor are empty.

3.2.1. CheckTrailingOrderLong() and CheckTrailingOrderShort()

The method CheckTrailingOrderLong() overrides an eponymous method of the basic class and calls the method CheckUpdateOrderLong(...) of the main signal to figure out the necessity of modifying the order. If modification is required, the method UpdateOrder(...) is called and result gets returned.

bool CExpertAdvanced::CheckTrailingOrderLong(void) { CExpertSignalAdvanced *signal_ptr=m_signal; //--- check for the opportunity to modify the order to buy double price,sl,tp; datetime ex; if(signal_ptr.CheckUpdateOrderLong(GetPointer(m_order),price,sl,tp,ex)) return(UpdateOrder(price,sl,tp,ex)); //--- return with no actions taken return(false); }

The method CheckTrailingOrderShort() is similar and is used the same way.

3.2.2. UpdateOrder()

The UpdateOrder() function starts with the check for a relevant price (not EMPTY_VALUE). If there is none, the order gets deleted, else the order is modified according to received parameters.

bool CExpertAdvanced::UpdateOrder(double price,double sl,double tp,datetime ex) { ulong ticket=m_order.Ticket(); if(price==EMPTY_VALUE) return(m_trade.OrderDelete(ticket)); //--- modify the order, return the result return(m_trade.OrderModify(ticket,price,sl,tp,m_order.TypeTime(),ex)); }

Development of inheritors of standard classes is complete.

4. Developing Price Modules

We already have the base for creating Experts that place orders and Stop Losses at calculated levels. To be precise, we have classes ready to use for work with price levels. Now only the modules to generate those levels are left to be written.

The process of developing price modules is similar to writing modules of trading signals. The only difference between them is that it is Prices(), the method responsible for price updating within the module, has to be overridden, not LongCondition(), ShortCondition() or Direction() like in signal modules. Ideally, the reader should have a clear idea about signal modules development. The articles "Create Your Own Trading Robot in 6 Steps!" and "Trading Signal Generator Based on a Custom Indicator" may be useful in this.

Code of several price modules is going to serve an example.

4.1. Price Module Based on the "Delta ZigZag" Indicator

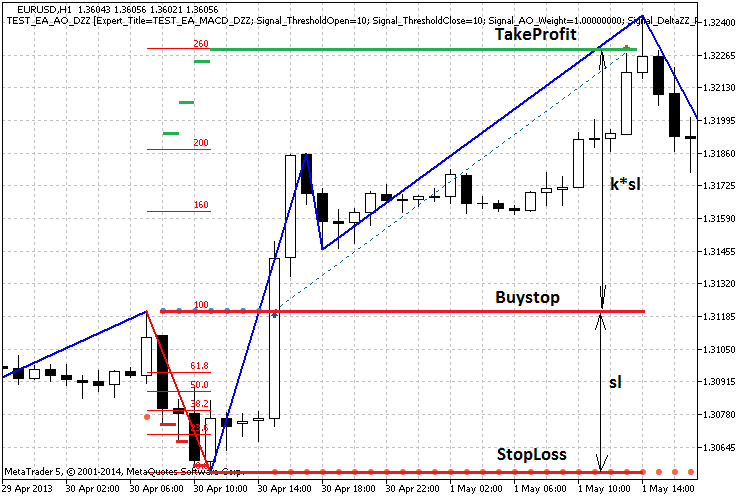

The indicator Delta ZigZag draws levels by the specified number of several latest peaks. If the price crosses those levels, it means a probable trend reversal.

The goal of the price module is to take the entry level from the indicator buffer, find the nearest local extremum for placing Stop Loss, calculate Take Profit by multiplying Stop Loss by the coefficient specified in the settings.

Fig. 3. Illustration of the price module operation on the Delta ZigZag indicator using the order to buy as an example

Fig 3. represents the levels generated by the price module. Before the order triggers, Stop Loss and Take Profit change accordingly following the updates of the minimum.

4.1.1. Module Descriptor

// wizard description start //+------------------------------------------------------------------+ //| Description of the class | //| Title=DeltaZZ Price Module | //| Type=SignalAdvanced | //| Name=DeltaZZ Price Module | //| ShortName=DeltaZZ_PM | //| Class=CPriceDeltaZZ | //| Page=not used | //| Parameter=setAppPrice,int,1, Applied price: 0 - Close, 1 - H/L | //| Parameter=setRevMode,int,0, Reversal mode: 0 - Pips, 1 - Percent | //| Parameter=setPips,int,300,Reverse in pips | //| Parameter=setPercent,double,0.5,Reverse in percent | //| Parameter=setLevels,int,2,Peaks number | //| Parameter=setTpRatio,double,1.6,TP:SL ratio | //| Parameter=setExpBars,int,10,Expiration after bars number | //+------------------------------------------------------------------+ // wizard description end

The first five parameters in the descriptor are required for setting up the indicator in use. Then come the coefficient for calculating Take Profit based on Stop Loss and expiration time in the bars for orders from the current price module.

4.1.2. Class Declaration

class CPriceDeltaZZ : public CExpertSignalAdvanced { protected: CiCustom m_deltazz; //object of the DeltaZZ indicator //--- module settings int m_app_price; int m_rev_mode; int m_pips; double m_percent; int m_levels; double m_tp_ratio; //tp:sl ratio int m_exp_bars; //lifetime of the orders in bars //--- method of indicator initialization bool InitDeltaZZ(CIndicators *indicators); //--- helper methods datetime calcExpiration() { return(TimeCurrent()+m_exp_bars*PeriodSeconds(m_period)); } double getBuySL(); //function for searching latest minimum of ZZ for buy SL double getSellSL(); //function for searching latest maximum of ZZ for sell SL public: CPriceDeltaZZ(); ~CPriceDeltaZZ(); //--- methods of changing module settings void setAppPrice(int ap) { m_app_price=ap; } void setRevMode(int rm) { m_rev_mode=rm; } void setPips(int pips) { m_pips=pips; } void setPercent(double perc) { m_percent=perc; } void setLevels(int rnum) { m_levels=rnum; } void setTpRatio(double tpr) { m_tp_ratio=tpr; } void setExpBars(int bars) { m_exp_bars=bars;} //--- method of checking correctness of settings virtual bool ValidationSettings(void); //--- method of creating indicators virtual bool InitIndicators(CIndicators *indicators); //--- main method of price module updating the output data virtual double Prices(); };

Protected data - object of the indicator of the CiCustom type and parameters according to the types specified in the descriptor are declared in the module.

4.1.3. Constructor

Constructor initializes class parameters with default values. Later, these values get initialized once again when the module gets included into the main signal according to the input parameters of the Expert.

CPriceDeltaZZ::CPriceDeltaZZ() : m_app_price(1), m_rev_mode(0), m_pips(300), m_percent(0.5), m_levels(2), m_tp_ratio(1), m_exp_bars(10) { }

4.1.4. ValidationSettings()

ValidationSettings() is an important method for checking input parameters. If the values of the module parameters are invalid, the result false is returned and an error message is printed in the journal.

bool CPriceDeltaZZ::ValidationSettings(void) { //--- checking for settings of additional filters if(!CExpertSignal::ValidationSettings()) return(false); //--- initial data check if(m_app_price<0 || m_app_price>1) { printf(__FUNCTION__+": Applied price must be 0 or 1"); return(false); } if(m_rev_mode<0 || m_rev_mode>1) { printf(__FUNCTION__+": Reversal mode must be 0 or 1"); return(false); } if(m_pips<10) { printf(__FUNCTION__+": Number of pips in a ray must be at least 10"); return(false); } if(m_percent<=0) { printf(__FUNCTION__+": Percent must be greater than 0"); return(false); } if(m_levels<1) { printf(__FUNCTION__+": Ray Number must be at least 1"); return(false); } if(m_tp_ratio<=0) { printf(__FUNCTION__+": TP Ratio must be greater than zero"); return(false); } if(m_exp_bars<0) { printf(__FUNCTION__+": Expiration must be zero or positive value"); return(false); } //--- parameter check passed return(true); }

4.1.5. InitIndicators(...)

The InitIndicators(...) method calls an eponymous method of the basic class and initializes the indicator of the current module by the InitDeltaZZ(...) method.

bool CPriceDeltaZZ::InitIndicators(CIndicators *indicators) { //--- initialization of indicator filters if(!CExpertSignal::InitIndicators(indicators)) return(false); //--- creating and initializing of custom indicator if(!InitDeltaZZ(indicators)) return(false); //--- success return(true); }

4.1.6. InitDeltaZZ(...)

The InitDeltaZZ(...) method adds the object of custom indicator to the collection and creates the new indicator "Delta ZigZag".

bool CPriceDeltaZZ::InitDeltaZZ(CIndicators *indicators) { //--- adds to collection if(!indicators.Add(GetPointer(m_deltazz))) { printf(__FUNCTION__+": error adding object"); return(false); } //--- specifies indicator parameters MqlParam parameters[6]; //--- parameters[0].type=TYPE_STRING; parameters[0].string_value="deltazigzag.ex5"; parameters[1].type=TYPE_INT; parameters[1].integer_value=m_app_price; parameters[2].type=TYPE_INT; parameters[2].integer_value=m_rev_mode; parameters[3].type=TYPE_INT; parameters[3].integer_value=m_pips; parameters[4].type=TYPE_DOUBLE; parameters[4].double_value=m_percent; parameters[5].type=TYPE_INT; parameters[5].integer_value=m_levels; //--- object initialization if(!m_deltazz.Create(m_symbol.Name(),m_period,IND_CUSTOM,6,parameters)) { printf(__FUNCTION__+": error initializing object"); return(false); } //--- number of the indicator buffers if(!m_deltazz.NumBuffers(5)) return(false); //--- ок return(true); }

After successful completion of the methods ValidationSettings(), InitDeltaZZ(...) and InitIndicators(...), the module is initialized and is ready for work.

4.1.7. Prices()

This method is basic for the price module. This is the very place where order parameters get updated. Their values are passed on to the main signal. This method returns the operation result of the double type. This was implemented mainly for the future development. The result of the method Prices() can code some peculiar situations and events so the main signal could handle them accordingly. Currently only handling of the returned value EMPTY_VALUE is intended. Upon receiving this result, the main signal will ignore the parameters suggested by the module.

Operation algorithm of the Prices() method in this module:

- Take the opening prices of the orders from the indicator buffers 3 and 4 for buying and selling respectively;

- Zeroize final parameters of the orders;

- Check for the price to buy. If there is one, identify the level to place Stop Loss by the getBuySL() method, calculate Take Profit level by the Stop Loss value and the opening price and calculate the order expiration time;

- Check for the price to sell. If detected, find the level to place Stop Loss by the getSellSL()method, calculate Take Profit level by Stop Loss value and opening price and calculate the order expiration time;

- Exit.

double CPriceDeltaZZ::Prices(void) { double openbuy =m_deltazz.GetData(3,0);//receive the last value from buffer 3 double opensell=m_deltazz.GetData(4,0);//receive the last value from buffer 4 //--- clear parameter values m_order_open_long=EMPTY_VALUE; m_order_stop_long=EMPTY_VALUE; m_order_take_long=EMPTY_VALUE; m_order_expiration_long=0; m_order_open_short=EMPTY_VALUE; m_order_stop_short=EMPTY_VALUE; m_order_take_short=EMPTY_VALUE; m_order_expiration_short=0; int digits=m_symbol.Digits(); //--- check for the prices to buy if(openbuy>0)//if buffer 3 is not empty { m_order_open_long=NormalizeDouble(openbuy,digits); m_order_stop_long=NormalizeDouble(getBuySL(),digits); m_order_take_long=NormalizeDouble(m_order_open_long + m_tp_ratio*(m_order_open_long - m_order_stop_long),digits); m_order_expiration_long=calcExpiration(); } //--- check for the prices to sell if(opensell>0)//if buffer 4 is not empty { m_order_open_short=NormalizeDouble(opensell,digits); m_order_stop_short=NormalizeDouble(getSellSL(),digits); m_order_take_short=NormalizeDouble(m_order_open_short - m_tp_ratio*(m_order_stop_short - m_order_open_short),digits); m_order_expiration_short=calcExpiration(); } return(0); }

4.1.8. getBuySL() and getSellSL()

Methods getBuySL() and getSellSL() are looking for local respective minimums and maximums for placing Stop Losses. The last non-zero value in a relevant buffer – the price level of the last local extremum is sought in every method.

double CPriceDeltaZZ::getBuySL(void) { int i=0; double sl=0.0; while(sl==0.0) { sl=m_deltazz.GetData(0,i); i++; } return(sl); } double CPriceDeltaZZ::getSellSL(void) { int i=0; double sl=0.0; while(sl==0.0) { sl=m_deltazz.GetData(1,i); i++; } return(sl); }

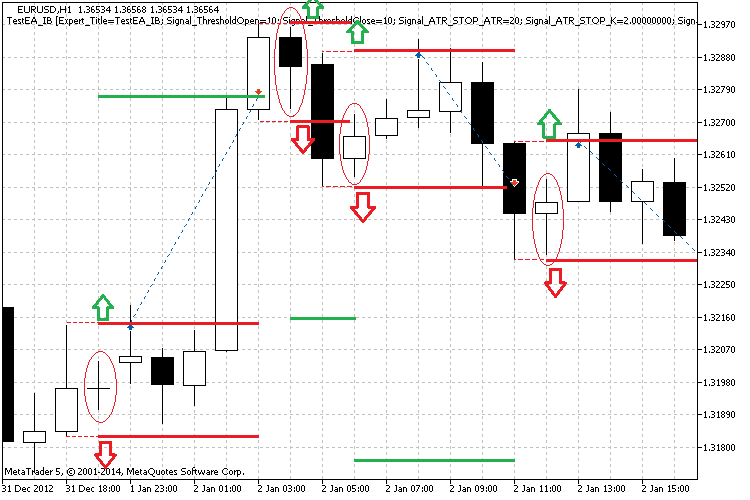

4.2. Price Module Based on Inside Bar

Inside bar is one of the widely used models or patterns in the trading with no indicators called Price action. An inside bar is a bar having High and Low within the extrema of the previous bar. An inside bar indicates the beginning of consolidation or possible reversal of the price movement.

On Fig. 4 inside bars are inside red ellipses. When an inside bar is detected, the price module generates opening prices of the buystop and sellstop orders on the extrema of the bar preceding the inside bar.

Opening prices are the Stop Loss levels for opposite orders. Take Profit is calculated the same way as in the module discussed above - by multiplying the Stop Loss level by the coefficient specified in the settings. Opening prices and Stop Losses are marked with red horizontal lines and Take Profits with green ones.

Fig. 4. Illustration of inside bars and levels of the price module

On Fig. 4 orders to sell are not placed as the trend is upcoming. Nevertheless, price module generates entry levels in both directions. Some Take Profit levels are outside the plot.

Unlike the previous module, algorithm of this module is simple and does not require initialization of indicators. There is little code in the module, it is presented below in full. We are not going to analyze every function separately though.

#include <Expert\ExpertSignalAdvanced.mqh> // wizard description start //+------------------------------------------------------------------+ //| Description of the class | //| Title=Inside Bar Price Module | //| Type=SignalAdvanced | //| Name=Inside Bar Price Module | //| ShortName=IB_PM | //| Class=CPriceInsideBar | //| Page=not used | //| Parameter=setTpRatio,double,2,TP:SL ratio | //| Parameter=setExpBars,int,10,Expiration after bars number | //| Parameter=setOrderOffset,int,5,Offset for open and stop loss | //+------------------------------------------------------------------+ // wizard description end //+------------------------------------------------------------------+ //| Class CPriceInsideBar | //| Purpose: Class of the generator of price levels for orders based | //| on the "inside bar" pattern. | //| Is derived from the CExpertSignalAdvanced class. | //+------------------------------------------------------------------+ class CPriceInsideBar : public CExpertSignalAdvanced { protected: double m_tp_ratio; //tp:sl ratio int m_exp_bars; //lifetime of the orders in bars double m_order_offset; //shift of the opening and Stop Loss levels datetime calcExpiration() { return(TimeCurrent()+m_exp_bars*PeriodSeconds(m_period)); } public: CPriceInsideBar(); ~CPriceInsideBar(); void setTpRatio(double ratio){ m_tp_ratio=ratio; } void setExpBars(int bars) { m_exp_bars=bars;} void setOrderOffset(int pips){ m_order_offset=m_symbol.Point()*pips;} bool ValidationSettings(); double Prices(); }; //+------------------------------------------------------------------+ //| | //+------------------------------------------------------------------+ CPriceInsideBar::CPriceInsideBar() { } //+------------------------------------------------------------------+ //| | //+------------------------------------------------------------------+ CPriceInsideBar::~CPriceInsideBar() { } //+------------------------------------------------------------------+ //| Validation of protected settings | //+------------------------------------------------------------------+ bool CPriceInsideBar::ValidationSettings(void) { //--- verification of the filter parameters if(!CExpertSignal::ValidationSettings()) return(false); //--- initial data check if(m_tp_ratio<=0) { printf(__FUNCTION__+": TP Ratio must be greater than zero"); return(false); } if(m_exp_bars<0) { printf(__FUNCTION__+": Expiration must be zero or positive value"); return(false); } //--- check passed return(true); } //+------------------------------------------------------------------+ //| Price levels refreshing | //+------------------------------------------------------------------+ double CPriceInsideBar::Prices(void) { double h[2],l[2]; if(CopyHigh(m_symbol.Name(),m_period,1,2,h)!=2 || CopyLow(m_symbol.Name(),m_period,1,2,l)!=2) return(EMPTY_VALUE); //--- check for inside bar if(h[0] >= h[1] && l[0] <= l[1]) { m_order_open_long=h[0]+m_order_offset; m_order_stop_long=l[0]-m_order_offset; m_order_take_long=m_order_open_long+(m_order_open_long-m_order_stop_long)*m_tp_ratio; m_order_expiration_long=calcExpiration(); m_order_open_short=m_order_stop_long; m_order_stop_short=m_order_open_long; m_order_take_short=m_order_open_short-(m_order_stop_short-m_order_open_short)*m_tp_ratio; m_order_expiration_short=m_order_expiration_long; return(0); } return(EMPTY_VALUE); } //+------------------------------------------------------------------+

In the method Prices() of this module, the return of the EMPTY_VALUE result is used to demonstrate to the main signal that there are no available price levels.

4.3. Price Module Based on Outside Bar

Outside bar is another popular pattern of Price Action also called "absorption". Outside bar is called so because its High and Low overlap High and Low of the previous bar. Appearance of an outside bar is an indication of the volatility increase followed by a directed price movement.

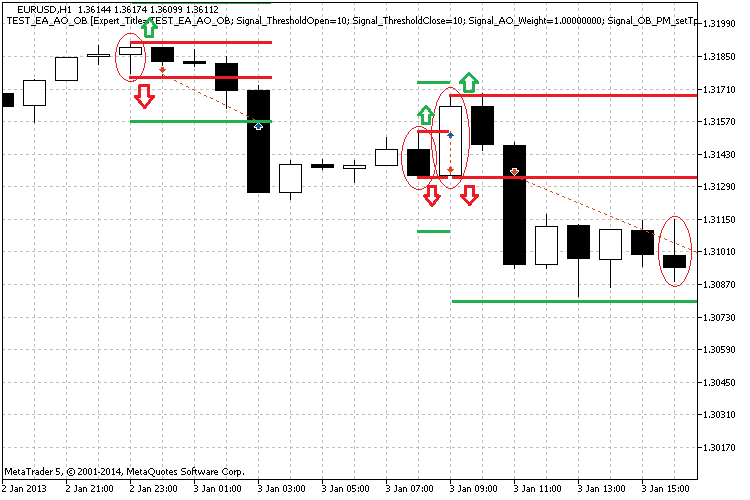

On Fig. 5 outside bars are marked by red ellipses. Upon detecting an outside bar, the price module generates opening prices of the buystop and sellstop orders on its extrema.

Opening prices are the Stop Loss levels for opposite orders. Take Profit is calculated the same way as in the module discussed above - by multiplying the Stop Loss level by the coefficient specified in the settings. Opening prices and Stop Losses are marked with red horizontal lines and Take Profits with green ones.

Fig. 5. Illustration of outside bars and price module levels

On Fig. 5 outside bars are marked with red ellipses. Horizontal lines reflect the opening prices of pending orders generated by the price module.

In this case, only orders to sell are opened because there is a downtrend. The operation of this module is essentially similar to the previous one. The only difference between its code is only the Prices() method, other parts are exactly the same and have the same names. Below is code of Prices().

double CPriceOutsideBar::Prices(void) { double h[2],l[2]; if(CopyHigh(m_symbol.Name(),m_period,1,2,h)!=2 || CopyLow(m_symbol.Name(),m_period,1,2,l)!=2) return(EMPTY_VALUE); //--- check of outside bar if(h[0] <= h[1] && l[0] >= l[1]) { m_order_open_long=h[1]+m_order_offset; m_order_stop_long=l[1]-m_order_offset; m_order_take_long=m_order_open_long+(m_order_open_long-m_order_stop_long)*m_tp_ratio; m_order_expiration_long=calcExpiration(); m_order_open_short=m_order_stop_long; m_order_stop_short=m_order_open_long; m_order_take_short=m_order_open_short-(m_order_stop_short-m_order_open_short)*m_tp_ratio; m_order_expiration_short=m_order_expiration_long; return(0); } return(EMPTY_VALUE); }

4.4. Module Performance Test

In the next section three examples of modules are tested to check their individual and then joined work in one Expert and make sure that the system works as designed. As a result, four Experts are generated. Trading signal module based on the indicator Awesome Oscillator working on the H12 timeframe is used as a filter in each of the generated Experts. Price modules are working on H6.

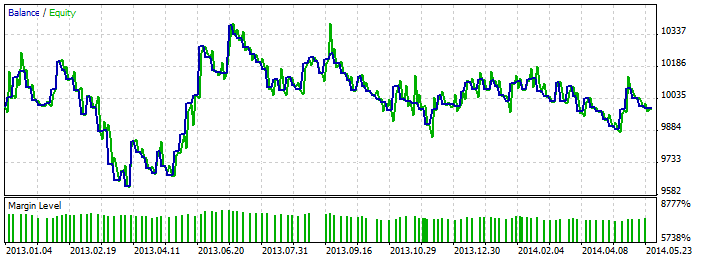

Money management: fixed lot and Trailing Stop are not used. All tests are carried out on the EURUSD quotes from the demo account of the MetaQuotes-Demo server for the period from 2013.01.01 till 2014.06.01. Terminal version: 5.00, build 965 (June, 27 2014).

To keep it short, test results are represented only by balance plots. They are enough to get the Expert's behavior in every particular case.

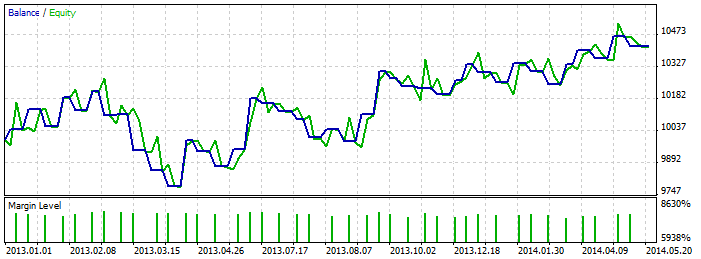

4.4.1. Testing the Module Based on the Delta ZigZag Indicator

Fig. 6. Balance plot in testing the price module based on the "Delta ZigZag" indicator

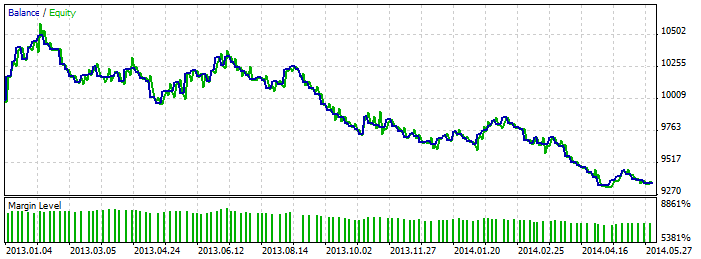

4.4.2. Testing the Module Based on the "Inside Bar" Pattern

Fig. 7. Balance plot in testing the price module based on the inside bar

Looking at Fig. 7., it should be kept in mind that the purpose of the tests at this stage is to check the code performance, not to get a winning strategy.

4.4.3. Testing the Module Based on the "Outside Bar" Pattern

Fig. 8. Balance plot in testing the price module based on the outside bar

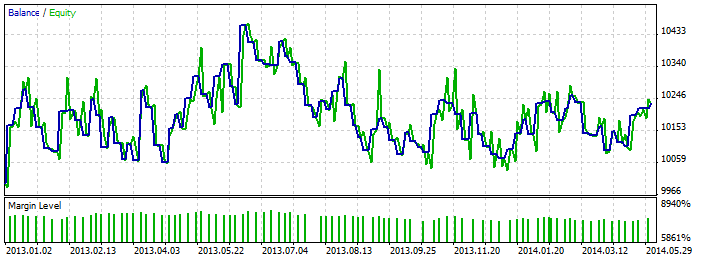

4.4.4. Testing Joint Work of Developed Price Modules

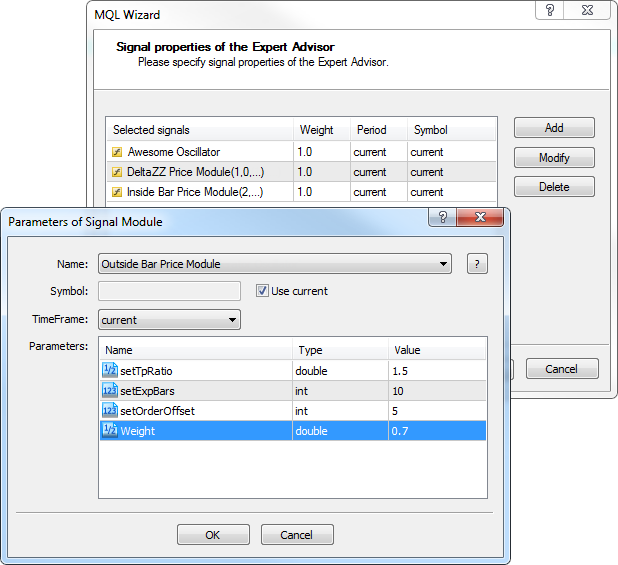

Taking into consideration previous test results, price modules based on DeltaZigZag, inside bar and outside bar received weight coefficients of 1, 0.5 and 0.7 respectively. Weight coefficients define priorities of the price modules.

Fig. 9. Balance plot in testing the Expert with three price modules

At every stage of testing, all performed operations on the price plots were carefully analyzed. Strategy errors and deviations were not elicited. All the suggested programs are attached to this article and you can test them yourself.

5. Instruction for Use

We are going to consider the stages of the Expert development using the developed extension on the example of Expert with three price modules and Awesome Oscillator as a filter.

Before the generation starts, make sure that the header files "CExpertAdvanced.mqh" and "CExpertSignalAdvanced.mqh" are in the catalog of the MetaTrader 5 terminal in the folder MQL5/Include/Expert and files of the price modules are in the folder MQL5/Include/Expert/MySignal. Before launching the Expert, ensure that compiled indicators are in the MQL5/Indicators folder. In this case it is the file "DeltaZigZag.ex5". In the attached archive, all files are in their places. All it takes is unpacking this archive into a folder with MetaTrader 5 terminal and confirm merging catalogs.

5.1. Expert Generation

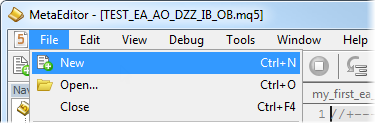

To start Expert generation, select "File"->"New" in the MetaEditor.

Fig. 10. Creating a new Expert using the MQL5 Wizard

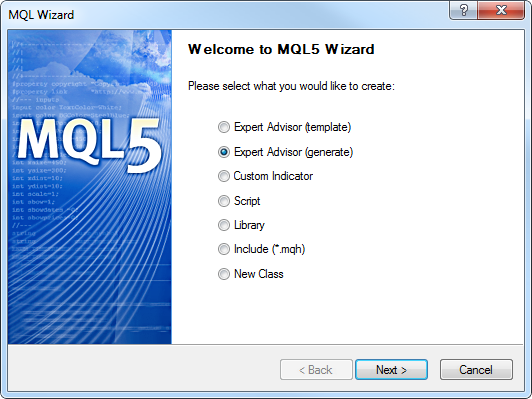

In the new window select "Expert Advisor (generate)" and then press "Next".

Fig. 11. Generating an Expert using the MQL5 WIzard

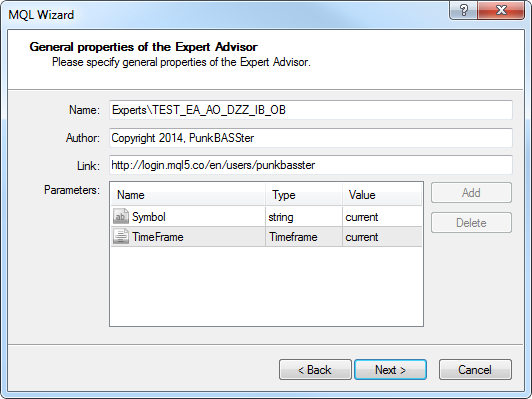

It will bring up a window where you can specify the name. In this particular example, the name of the Expert is "TEST_EA_AO_DZZ_IB_OB", parameters Symbol and TimeFrame have default values. Then click "Next".

Fig. 12. General properties of the Expert Advisor

In the appeared window add include modules one by one pressing "Add". The whole process is presented below.

PLEASE NOTE! When you are adding modules, at first include all signal modules (inheritors CExpertSignal) and then price modules (inheritors CExpertSignalAdvanced). The result of disrupting this order of including modules is going to be unpredictable.

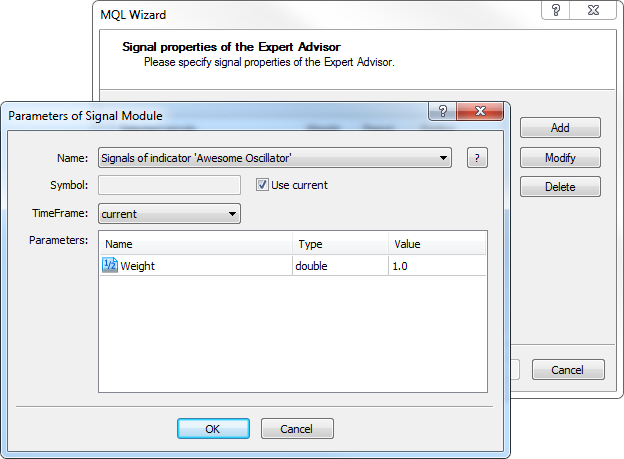

So, we start with including modules of signals from Awesome Oscillator. It is the only filter in this example.

Fig. 13. Including the module of signals from Awesome Oscillator

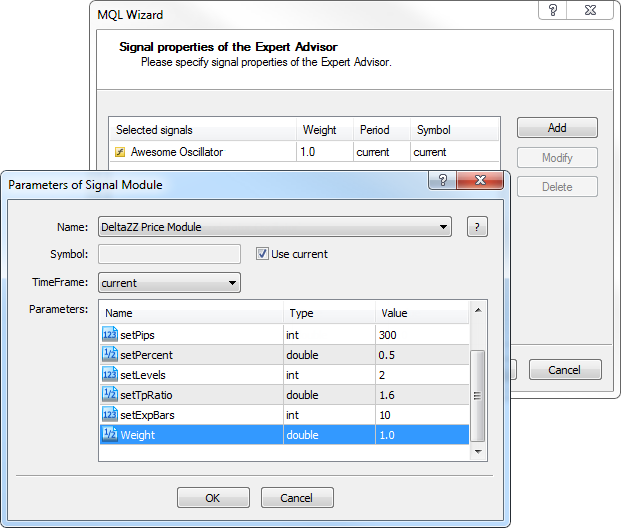

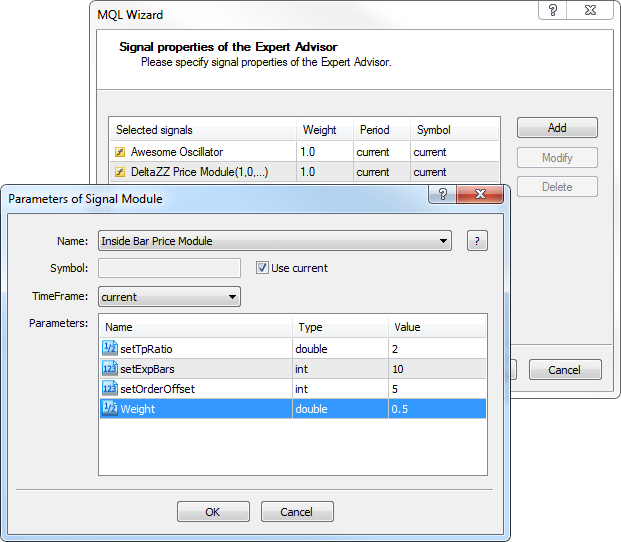

Include required price modules in a random order after all signal modules have been included. There are three of them in this example.

Fig. 14. Including the module of signals from DeltaZZ Price Module

Fig. 15. Including the module of signals from Inside Bar Price Module

Fig. 16. Including the module of signals from Outside Bar Price Module

After all modules were added, the window will look as follows:

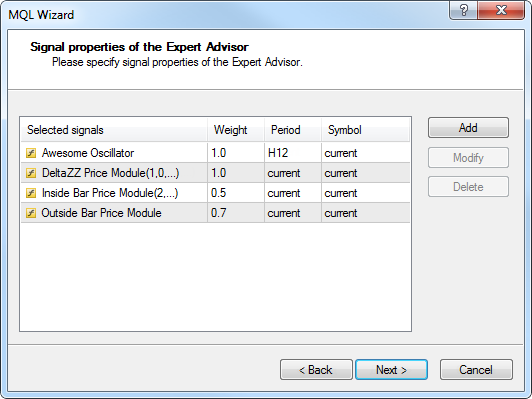

Fig. 17. List of included modules of trading signals

Value of the "Weight" parameter for the price module defines its priority.

After the "Next" button has been pressed, the Wizard suggests selecting money management modules and Trailing Stop modules. Select one of those or leave as it is, pressing "Next" or "Ready".

Pressing "Ready" we shall receive generated code of Advisor.

5.2. Editing Generated Code

So, we have code.

1. Find string in the very beginning

#include <Expert\Expert.mqh>

and edit it so it looks like

#include <Expert\ExpertAdvanced.mqh>It is required to include the files of developed classes.

2. Then find the string

CExpert ExtExpert;

and change for

CExpertAdvanced ExtExpert;

This will change the Expert standard class for its descendant with required functions.

3. Now find the string

CExpertSignal *signal=new CExpertSignal;

and change for

CExpertSignalAdvanced *signal=new CExpertSignalAdvanced;

This is the way to change the standard class of the main signal for its descendant with required functions.

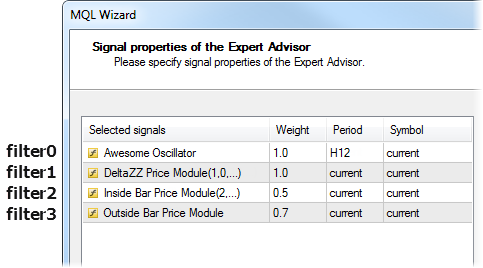

4. Find the string implementing the addition of the first price module to the m_filters array of the main signal. In this example it looks like:

signal.AddFilter(filter1);

Before this we insert the string

signal.CalcPriceModuleIndex();

This is required for the main signal to recognize up to which index in the m_filters array there are signal module pointers and starting from which there are price module pointers.

Finding the right position for inserting the specified string may cause difficulty. Use the number after the word "filter" as a reference point. It will simplify the search and allow not to miss the right position. The MQL5 Wizard names included modules automatically in their order. The first module is called filter0, the second one – filter1, the third – filter2 etc. In our case there is only one signal module. Therefore, the first included price module is number two and we need to search for the string "signal.AddFilter(filter1);" for adding the filter as numbering in the code starts with zero. The illustration is on Fig. 18:

Fig. 18. Module names in code according to the order of inclusion

5. This part is not compulsory. Through introduced changes, Expert parameters responsible for opening price indentations, Stop Losses, Take Profits and order expiration time lost their use. To make code more compact, you can delete the following strings:

input double Signal_PriceLevel =0.0; // Price level to execute a deal input double Signal_StopLevel =50.0; // Stop Loss level (in points) input double Signal_TakeLevel =50.0; // Take Profit level (in points) input int Signal_Expiration =4; // Expiration of pending orders (in bars)

Compilation error encountered after deleting the above strings takes us to the next group of strings to be deleted:

signal.PriceLevel(Signal_PriceLevel); signal.StopLevel(Signal_StopLevel); signal.TakeLevel(Signal_TakeLevel); signal.Expiration(Signal_Expiration);

After the latter have been deleted, compilation is going to be successful.

Comments and explanations of editing can be found in the attached code of the Expert "TEST_EA_AO_DZZ_IB_OB". Strings of the code that could be deleted have accompanying comments.

Conclusion

In this article we significantly expanded the application area of the MQL5 Wizard. Now it can be used for development optimization of automatic trading systems that require placing orders, Stop Losses and Take Profits at different price levels irrespective to the current price.

Generated Experts may include a set of price modules calculating parameters of the orders being sent. The most suitable parameter set is selected out of the available ones. Preferences are specified in the settings. It allows using many various entry points with maximum efficiency. This approach makes Experts selective. If the direction is known but the entry point is undefined, then the Expert will wait for it to appear.

Introducing standard compatible modules responsible for search of price levels is a significant advantage and is meant to simplify development of Experts. Though at the moment there are only three modules, their number will no doubt increase in the future. If you have found this article useful, please suggest algorithms of price modules operation in the comments. Interesting ideas will be implemented in code.

This article also features a method for further extension of Expert capabilities developed in the Wizard. Inheritance is the optimal way of introducing changes.

Users with no programming skills though capable to edit code following instructions, will have an opportunity to create more advanced Experts based on the available models.

Translated from Russian by MetaQuotes Ltd.

Original article: https://www.mql5.com/ru/articles/987

Warning: All rights to these materials are reserved by MetaQuotes Ltd. Copying or reprinting of these materials in whole or in part is prohibited.

This article was written by a user of the site and reflects their personal views. MetaQuotes Ltd is not responsible for the accuracy of the information presented, nor for any consequences resulting from the use of the solutions, strategies or recommendations described.

Random Forests Predict Trends

Random Forests Predict Trends

Liquid Chart

Liquid Chart

Programming EA's Modes Using Object-Oriented Approach

Programming EA's Modes Using Object-Oriented Approach

MQL5 Programming Basics: Global Variables of the Terminal

MQL5 Programming Basics: Global Variables of the Terminal

- Free trading apps

- Over 8,000 signals for copying

- Economic news for exploring financial markets

You agree to website policy and terms of use

Hi, thank you for your code and perspective on employing a different logic to the CSignal class. What would the opposite for this be?

To allow signals to be taken on each opportunity regardless of running positions?