stuartfbs / Profil

Freunde

5

Anfragen

Ausgehend

stuartfbs

LOADING MULTIPAL EAs on to one demo/live account and correlation between the EAs. PART 3

Correlation [positive]-iow Stock correlation is how stock prices move in relation to each other. Positively correlated assets move almost together and overlap like the US 30, US 100 and US 500.

Correlation [negative or inverse] are stocks or assets that are almost opposing like the USDCAD and the EURUSD.

See 1 year png attachment..side note, observe July month [positive correlation]

Some hypothesis[unproven facts] and thoughts on loading multi EAs on 1 account.

After 3 months of almost full time every tick thousands of back tests etc, I have realized that the first month is the most dangerous on a 1 year back test. [We assume your EA has about 25% balance/Equity drawdown and good growth [P.F.] Now Imagine that you load all 3 above indices onto that account. Suddenly when they all trigger together, your DRAWDOWN is or will be 75% or more.

Imagine an even worse case is that you load inter day or swop EAs as well, that are draw downing for hours or days...

It would be wiser to load one EA and to wait 1-2 months for growth on that account and if you are going to load a correlated asset, make sure it is loosely correlated. Even better, load negatively correlated assets. This is why I prefer scalping EAs, Quick enter and exit. It will be impossible to prevent overlapping draw downs, but you can minimize them. Minimal lot size is very important here, but a big lot size is fine for 1 proven EA on 1 account. Use websites to check your 1 year correlations or export all your back test data to Office or Open Office to check overlapping trigger draw down times. Very time consuming..

In closing here's an interesting tip, assume that proven EA has 1000 deposit, run it and write down the results..Now run it with 1500 deposit and compare the results. You can always draw out the 500 after a month or so.

Correlation [positive]-iow Stock correlation is how stock prices move in relation to each other. Positively correlated assets move almost together and overlap like the US 30, US 100 and US 500.

Correlation [negative or inverse] are stocks or assets that are almost opposing like the USDCAD and the EURUSD.

See 1 year png attachment..side note, observe July month [positive correlation]

Some hypothesis[unproven facts] and thoughts on loading multi EAs on 1 account.

After 3 months of almost full time every tick thousands of back tests etc, I have realized that the first month is the most dangerous on a 1 year back test. [We assume your EA has about 25% balance/Equity drawdown and good growth [P.F.] Now Imagine that you load all 3 above indices onto that account. Suddenly when they all trigger together, your DRAWDOWN is or will be 75% or more.

Imagine an even worse case is that you load inter day or swop EAs as well, that are draw downing for hours or days...

It would be wiser to load one EA and to wait 1-2 months for growth on that account and if you are going to load a correlated asset, make sure it is loosely correlated. Even better, load negatively correlated assets. This is why I prefer scalping EAs, Quick enter and exit. It will be impossible to prevent overlapping draw downs, but you can minimize them. Minimal lot size is very important here, but a big lot size is fine for 1 proven EA on 1 account. Use websites to check your 1 year correlations or export all your back test data to Office or Open Office to check overlapping trigger draw down times. Very time consuming..

In closing here's an interesting tip, assume that proven EA has 1000 deposit, run it and write down the results..Now run it with 1500 deposit and compare the results. You can always draw out the 500 after a month or so.

stuartfbs

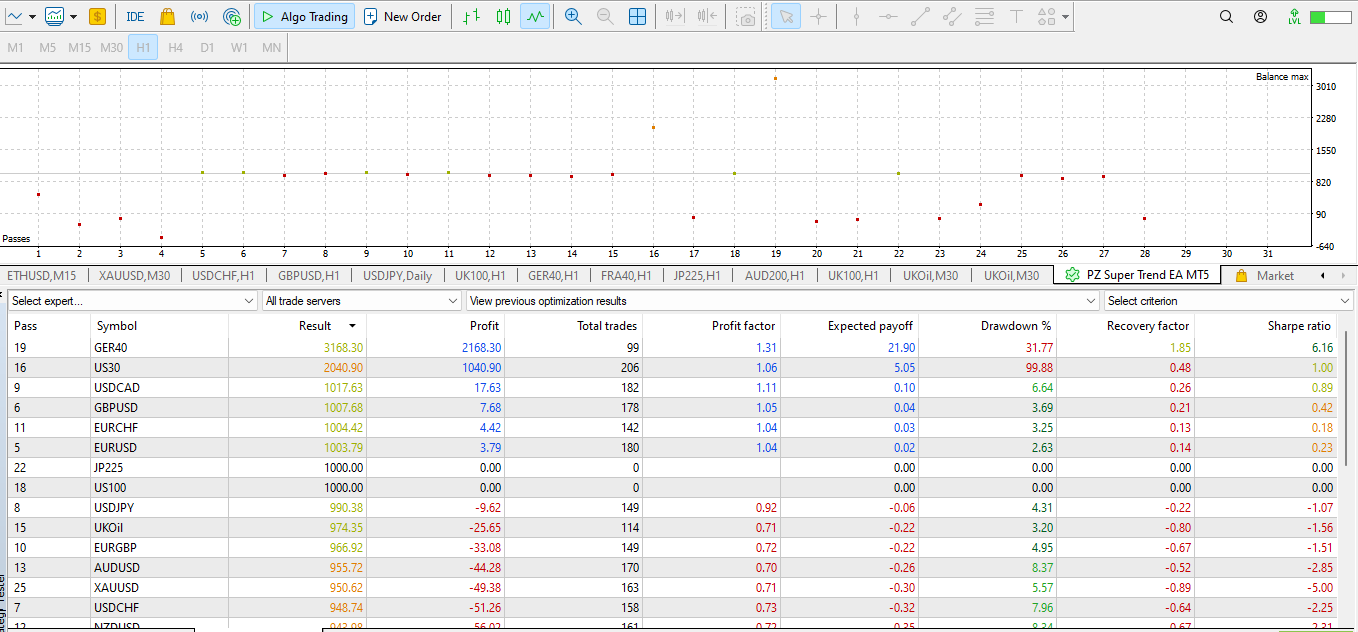

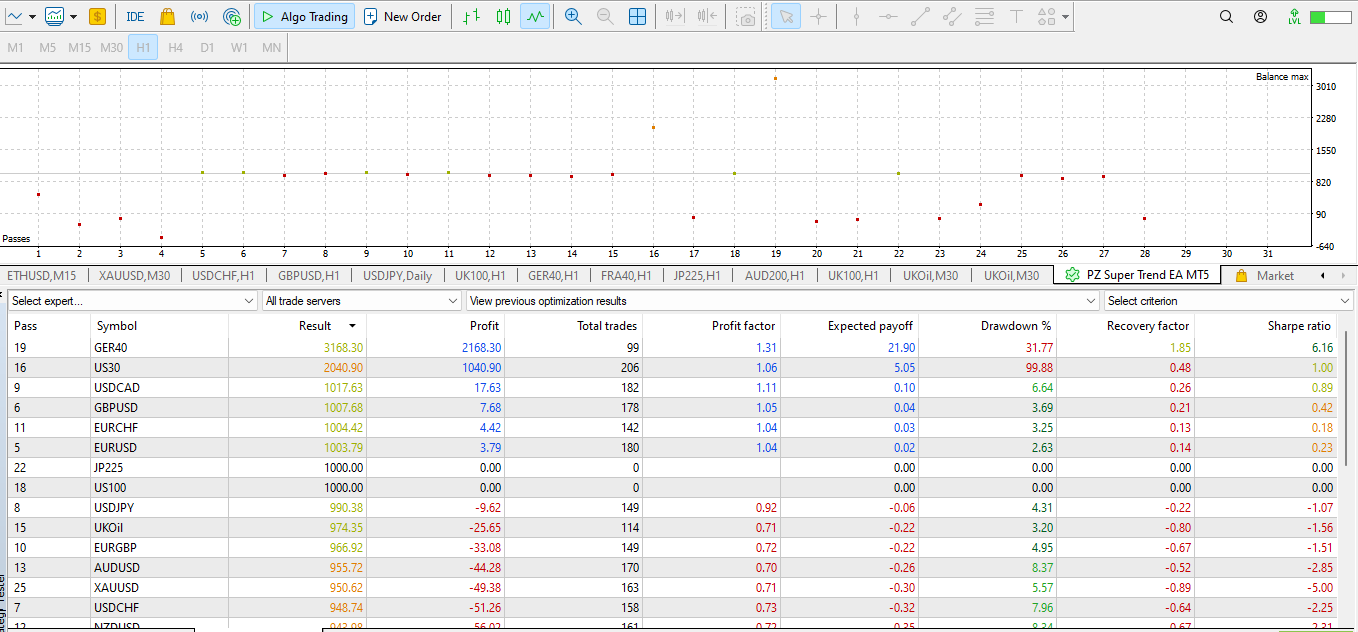

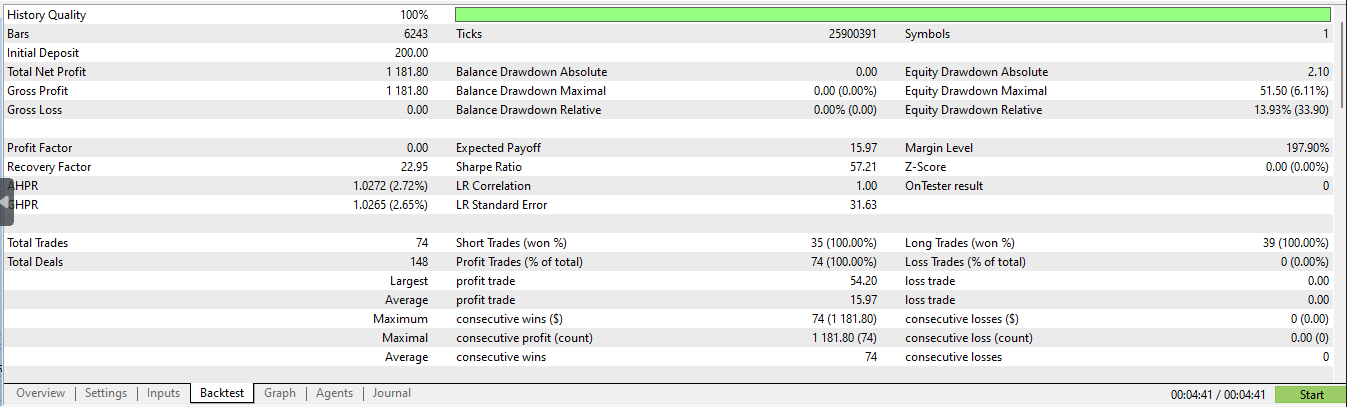

OPTIMIZING PZ SCALPER AND OTHER EAs PART 2. Do not waste your time trying to optimize on a cent, micro or mini type of account, demo or real. The spreads are too big!! Most brokers offer standard, standard plus, pro type accounts from $5. I like hedge, not E.C.N, the commission on my E.C.N was greater than the profits. Download the EA, and load the author's standard settings onto tester. Using 1 year, MODELLING- 1 minute OHLC, TIME FRAME- 1 hour, FORWARD-no, DELAYS-last ping to your server, PROFIT in pips for faster cal.-yes, Deposit 1000, or whatever you might later use on a real account. [very N.B. will explain later] OPTIMIZATION- All symbols selected in market watch. [close or hide everything except the FX majors, US indices, BTCUSD and ETHUSD. And select Max balance. Run it, and choose the best, anything over breakeven and better is for your starting point to optimize!!! IF you cant get some % profit, try changing some inputs- The [trade settings] trigger, min and max settings, on this test, so decide. You now select the best, and start your individual tests, no visual mode with charts, and optimization is disabled..you want to initially aim for the max money amount and a graph that goes up at a nice 45 degree angle, not a snake or domino type graph. set your [money manage ] to auto lot or min lot amount. Now, on paper make COLUMNS. 1] NET-the net profit, 2] PF-the profit factor,[net profit minus net losses as a factor] 3] BDM- balance/equity drawdown max 4] Z- the Z factor, 5] TT- total trades, changing the trade settings influences this. 6] Changes-the one and one only setting, you are going to change in inputs. NOW, work on the trade settings, generally a small value and MAX time[-written as min] is greater than min time Each test you do, write down these values, each time. Use short hand or abbreviations Every POSITIVE results test you do, you now overwrite your saved file [[that you named correctly]]!!! You are going to find the columns are correlated [they work together] the BDM column is reverse correlated. The PF is most important later on,

[tip]- After changing a setting in inputs, left click once on that setting-it WILL blue highlight it, because, when you come back to change it again you can immediately see your previous change. N.B. We are making repetition to try avoid mistakes. [tip] -Work on one EA, on one asset, only! master it, then the next asset!!! As you improve, so your optimizing time improves. [tip] WHEN you get stuck or lost, go for a walk and think, Your fb, vk, tiktok, etc, must be switched off, run that Modelling test, as a last resort. [tip] -if the graph is crashing during your new test, stop it! Saves time. OK, so our graph now passes the 1YR test, without crashing, but it looks like a snake that got electrocuted! Huge BDMs, this is where you start with the trade manage settings-adjusting these inputs will slowly, straighten the graph and improve the 6 columns, in these settings, don't be afraid to go back and change something again. [tip]-Do not disable any hours, days or even months on your tests. Mostly, it is your settings that need optimizing. [tip]- when your PF is as best as you can get it, you now adjust money management to suit your risk. This will make huge changes to your net profit and smile for all your hard work.

[tip] Your BDM should not be more than 20-30%, if an account or back test is going to crash, its always the first month that is the most dangerous.

Do not expect TT total trades on a asset like the DAX to be large or look like the NAS 100

It is better to aim for small quick time profits on scalping EAs, especially those with martingale features.

Lastly, copy this and print it out to better understand, read up in mql5 and google, what each setting result means [eg z factor] its a lot of information to comprehend. coming up- some thoughts on correlating multi EAs on one asset.

[tip]- After changing a setting in inputs, left click once on that setting-it WILL blue highlight it, because, when you come back to change it again you can immediately see your previous change. N.B. We are making repetition to try avoid mistakes. [tip] -Work on one EA, on one asset, only! master it, then the next asset!!! As you improve, so your optimizing time improves. [tip] WHEN you get stuck or lost, go for a walk and think, Your fb, vk, tiktok, etc, must be switched off, run that Modelling test, as a last resort. [tip] -if the graph is crashing during your new test, stop it! Saves time. OK, so our graph now passes the 1YR test, without crashing, but it looks like a snake that got electrocuted! Huge BDMs, this is where you start with the trade manage settings-adjusting these inputs will slowly, straighten the graph and improve the 6 columns, in these settings, don't be afraid to go back and change something again. [tip]-Do not disable any hours, days or even months on your tests. Mostly, it is your settings that need optimizing. [tip]- when your PF is as best as you can get it, you now adjust money management to suit your risk. This will make huge changes to your net profit and smile for all your hard work.

[tip] Your BDM should not be more than 20-30%, if an account or back test is going to crash, its always the first month that is the most dangerous.

Do not expect TT total trades on a asset like the DAX to be large or look like the NAS 100

It is better to aim for small quick time profits on scalping EAs, especially those with martingale features.

Lastly, copy this and print it out to better understand, read up in mql5 and google, what each setting result means [eg z factor] its a lot of information to comprehend. coming up- some thoughts on correlating multi EAs on one asset.

stuartfbs

SOME THOUGHTS ON OPTIMIZING PZ SCALPER AND OTHER EAs Written with a lot of detail, because we are all at different stages of optimizing and maybe English is not your first language..

In order for any EA to run your pc must be switched on 24 hours a day. Wifi and Wifi battery backup in case of power outages. A laptop is probably the best solution. I assume you do not have VPS, you do not need it at this stage, because we are all still learning and optimizing. You need to set up a template screen. No indicators, EAs, lines etc. Just your candles and bid price lines and maybe one click trading. You are going to use this for each asset [indices or fx] you open, before you load an EA. Also very important on each demo or live account, set up a profile when you have finished loading assets. eg [DEMO 2 12345] 12345 is the account number or the last four digits. This is double checking practice, when you change between accounts you can view the account number in top right corner and load that acc. profile, showing that number as well. When you're working with a number of different accounts and dozens of EAs mistakes will happen!!! I blew 35% of my live account the first night, after an EA on my demo was copied to my live account and was triggering. Magic numbers and saving [.set] data settings: each EA on each asset must have a different number or they will not trigger. You must write down each number in a blank note book, you're going to need this book when optimizing. In navigator/history, the magic number will show in the 2nd last column. Right click, enable under columns, the magic number, comments etc, whatever you want extra. This is very important. In the tester, in settings/inputs, You must enter the magic number in the [.set] file. The third last line entry, from the bottom. In PZ scalp. choose in ascending order, your number, from 56789-567890 eg AUXUSD 56799.. Now we going to save our settings: Create a folder, in my docs, maybe call it 'MY OPTIMIZED EAs'... Each EA on each asset will have a different [.set] folder and the name is extremely important, because you are going to make hundreds of changes, every time and you are going to overwrite this file almost every time eg 'US 30 PZ SCALP 1H 1YR ET 1KD 56799' i.o.w 'US 30,PZ scalper EA,1 hour time frame,1 year back test, every tick,1k or 1000 deposit and the magic number[again] OK, so you have done a test, you then save to that file and overwrite it, the date is always there. In my early days, I saved a Dark Venus file settings to a PZ file, 4 hours later to find the problem. LOL. In PZ scalp the trigger, and min and max time window, under 'trade settings' are the most important initial settings. Imagine a bicycle race, that starts and stops many times a day. The trigger is the starter official's firing gun, stop and start are your automatic bids opening and closing.. The author of PZ has made a mistake and has written the min and max time windows, the wrong way around, just understand this and live with this mistake i.o.w 'max is min' to be cont.

In order for any EA to run your pc must be switched on 24 hours a day. Wifi and Wifi battery backup in case of power outages. A laptop is probably the best solution. I assume you do not have VPS, you do not need it at this stage, because we are all still learning and optimizing. You need to set up a template screen. No indicators, EAs, lines etc. Just your candles and bid price lines and maybe one click trading. You are going to use this for each asset [indices or fx] you open, before you load an EA. Also very important on each demo or live account, set up a profile when you have finished loading assets. eg [DEMO 2 12345] 12345 is the account number or the last four digits. This is double checking practice, when you change between accounts you can view the account number in top right corner and load that acc. profile, showing that number as well. When you're working with a number of different accounts and dozens of EAs mistakes will happen!!! I blew 35% of my live account the first night, after an EA on my demo was copied to my live account and was triggering. Magic numbers and saving [.set] data settings: each EA on each asset must have a different number or they will not trigger. You must write down each number in a blank note book, you're going to need this book when optimizing. In navigator/history, the magic number will show in the 2nd last column. Right click, enable under columns, the magic number, comments etc, whatever you want extra. This is very important. In the tester, in settings/inputs, You must enter the magic number in the [.set] file. The third last line entry, from the bottom. In PZ scalp. choose in ascending order, your number, from 56789-567890 eg AUXUSD 56799.. Now we going to save our settings: Create a folder, in my docs, maybe call it 'MY OPTIMIZED EAs'... Each EA on each asset will have a different [.set] folder and the name is extremely important, because you are going to make hundreds of changes, every time and you are going to overwrite this file almost every time eg 'US 30 PZ SCALP 1H 1YR ET 1KD 56799' i.o.w 'US 30,PZ scalper EA,1 hour time frame,1 year back test, every tick,1k or 1000 deposit and the magic number[again] OK, so you have done a test, you then save to that file and overwrite it, the date is always there. In my early days, I saved a Dark Venus file settings to a PZ file, 4 hours later to find the problem. LOL. In PZ scalp the trigger, and min and max time window, under 'trade settings' are the most important initial settings. Imagine a bicycle race, that starts and stops many times a day. The trigger is the starter official's firing gun, stop and start are your automatic bids opening and closing.. The author of PZ has made a mistake and has written the min and max time windows, the wrong way around, just understand this and live with this mistake i.o.w 'max is min' to be cont.

stuartfbs

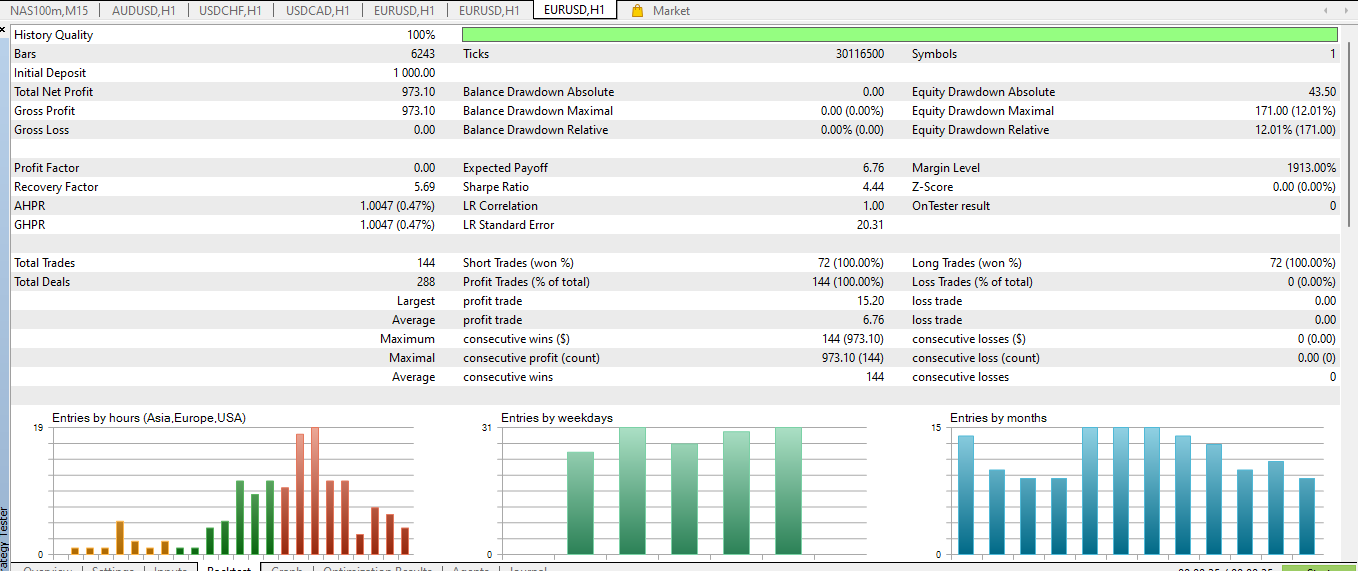

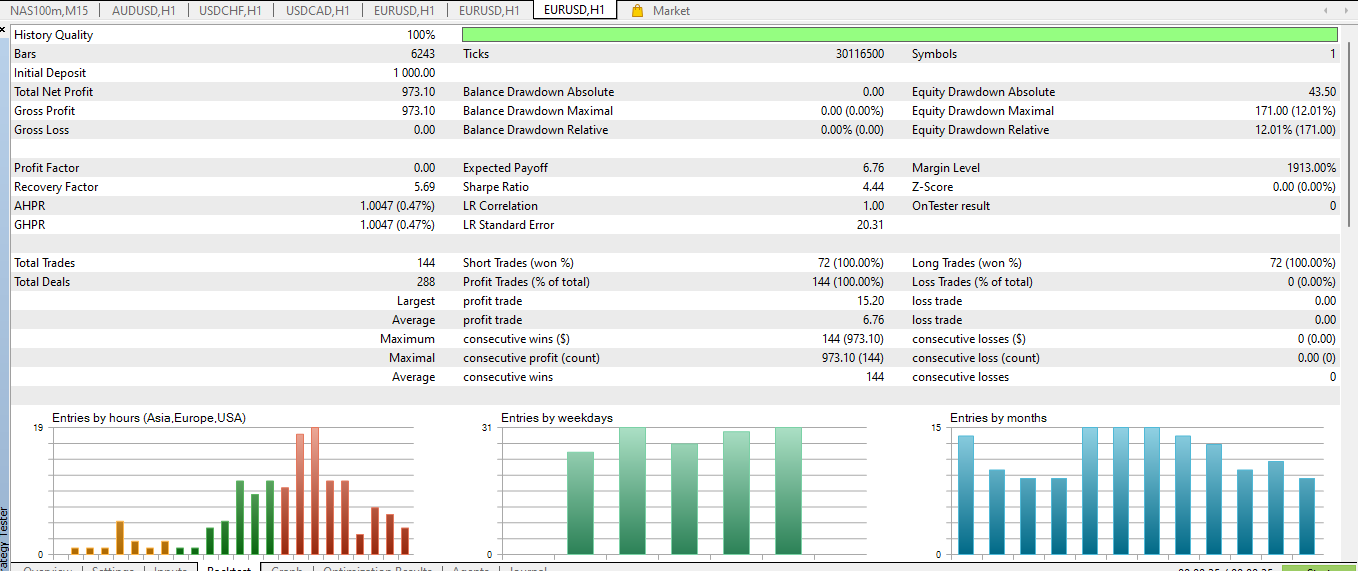

PZ Super trend, So far this EA looks stunning, 1 year back test, every tick, on EURUSD 1 HR, using [0.1] lot size,100% win rate on 288 total deals [trades placed by EA] increasing the lot size obviously increases the nett profit.

SmailR

2024.06.09

Hello! Please tell me what settings have you selected for PZ Super trend? Share it if you don't mind.

stuartfbs

1]Actual account, 2]every tick, 3]real tick. Not a very good reflection, as the real test account hasn't run for very long. What was interesting is the almost identical actual account vs every tick triggering[buy and sell orders], although the monetary values were very different. I will post an update when more data is available. I had to change the trigger settings to get real tick to work, also made it 'manual lot size'

stuartfbs

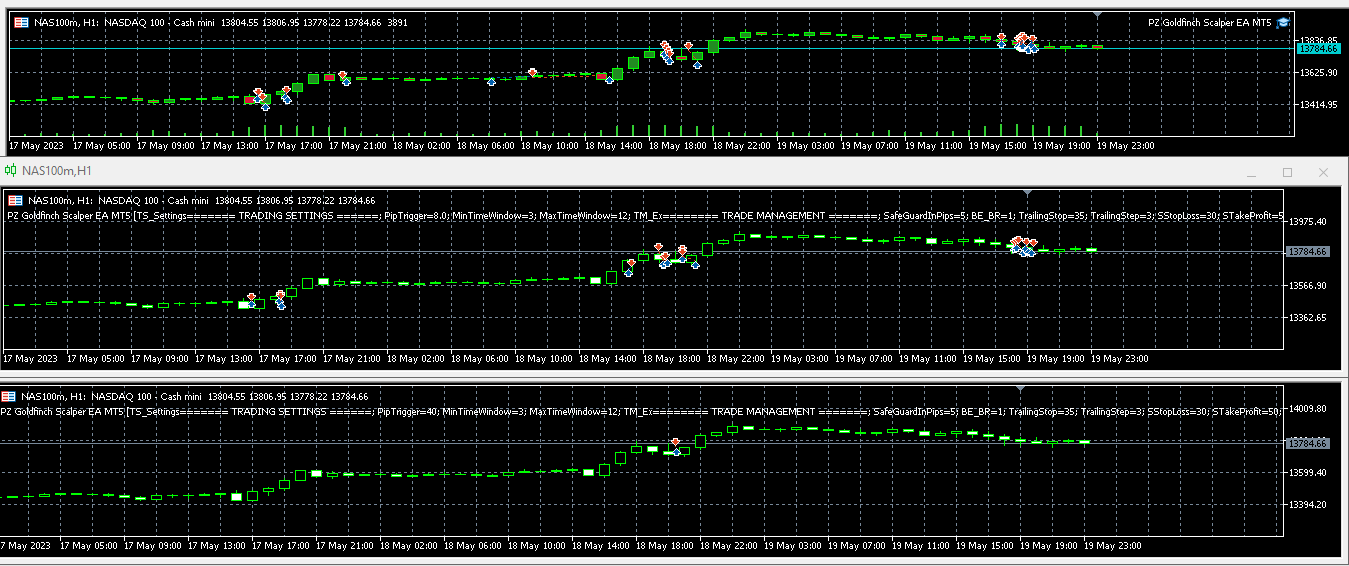

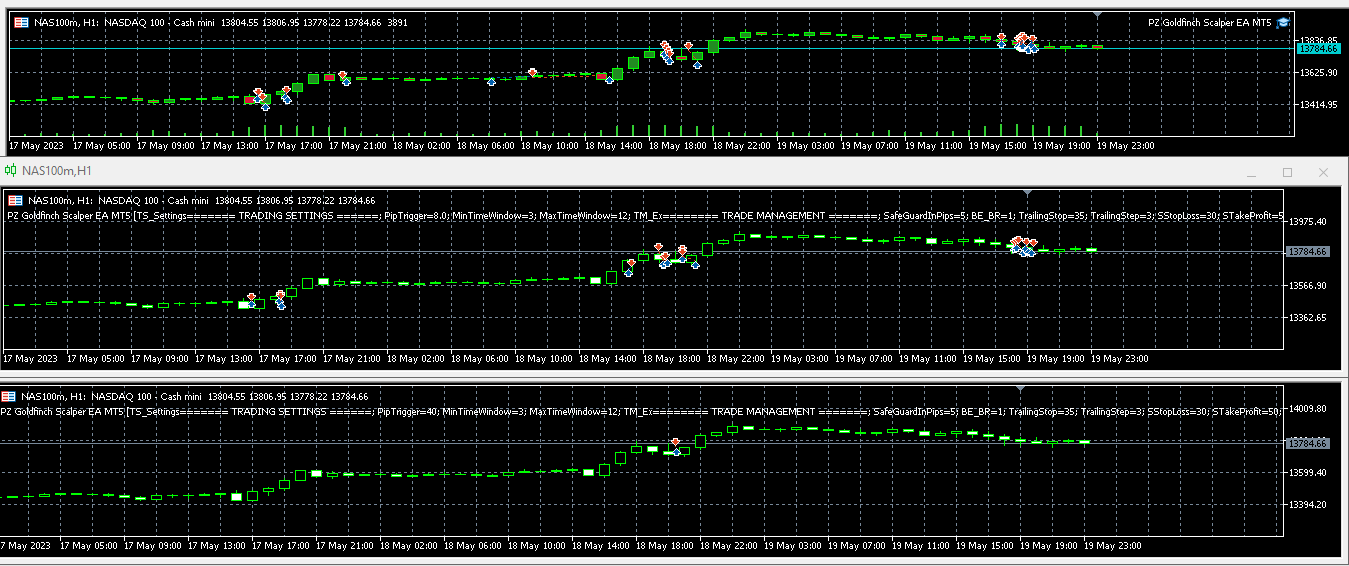

And you dont believe in EAs autobots...If you have no patience, you will have no faith, in yourself and in everything! Look CAREFULLY at this optimization! 1 year every tick, back test..

: