Evgeniy Scherbina / Profil

- Information

|

12+ Jahre

Erfahrung

|

33

Produkte

|

595

Demoversionen

|

|

0

Jobs

|

0

Signale

|

0

Abonnenten

|

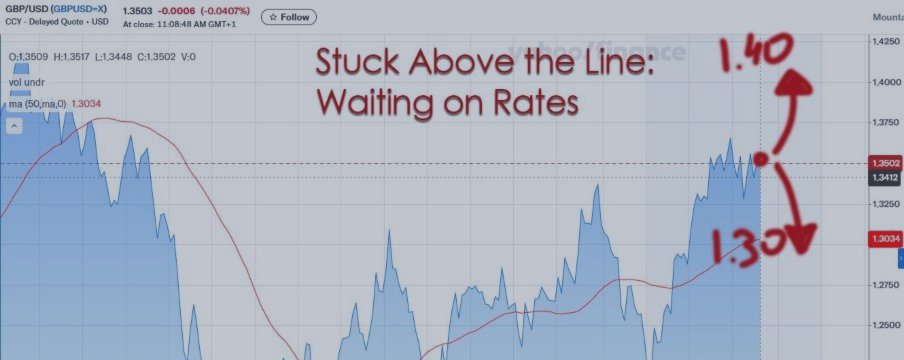

Most likely, that breakout will be to the upside, with potential targets around 1.20 to 1.40. It won't happen overnight, but the setup is already there. So what's been holding EurUsd back? Mainly politics and uncertainty out of France, where the financial and political crises are still dragging on. Germany already went through a similar phase, and its right-centrist forces managed to stabilize things. France, on the other hand, is still trying to figure out what's next — and Macron, being a republican rather than a socialist, has limited room to maneuver.

Once that cloud lifts, the euro could easily regain momentum. Whether it's by the end of the year or even in the next month, a strong rally in EurUsd looks more like a question of when, not if.

My Latte EA operates in a trend-following mode — it's built to catch big moves, not minor noise. And right now, it's been waiting far too long. The market's been quiet, but that silence won't last forever. What's clear is that Latte's cumulative position remains against the USD — and that's the right side to be on. When the breakout finally comes, Latte will already be where it needs to be.

This post is to announce that I'm integrating a small, yet powerful, component of the system—the inside bars—into my top EAs, Latte and Quantum Pip, in the very near future!

Inside bars, or "bars within bars," are simple but seriously effective in Chanlun analysis. They essentially shout, "The market is taking a breather!" They signal a moment of consolidation, which usually precedes a big move. They're all about potential energy building up in a tight range. Given the large, painful flat stalemate we've been stuck in since August, these inside bars are flashing major warnings. This principle is the perfect mechanism to help my EAs overcome this frustrating, sideways chop. October is finally setting up to fire big, and I want my top EAs to catch the full thrust of the breakout!

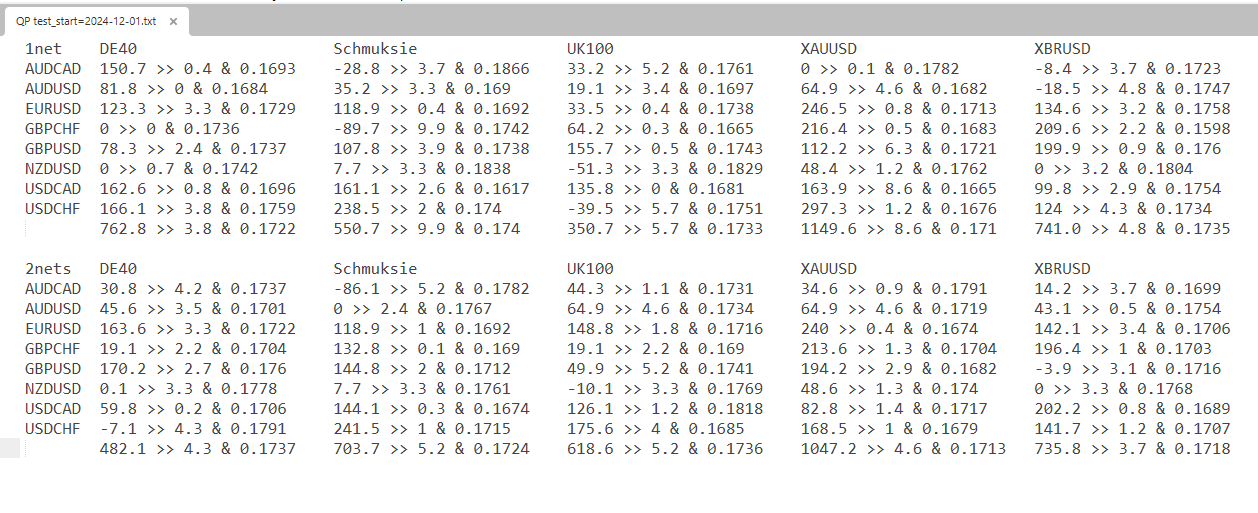

The 6 major symbols are currently at 0 profit with the default settings. However, they are winning for both Filter=ATR and Filter=None (though UsdChf drags down performance for ATR, and EurUsd does the same for None - but the overall profit sum remains positive).

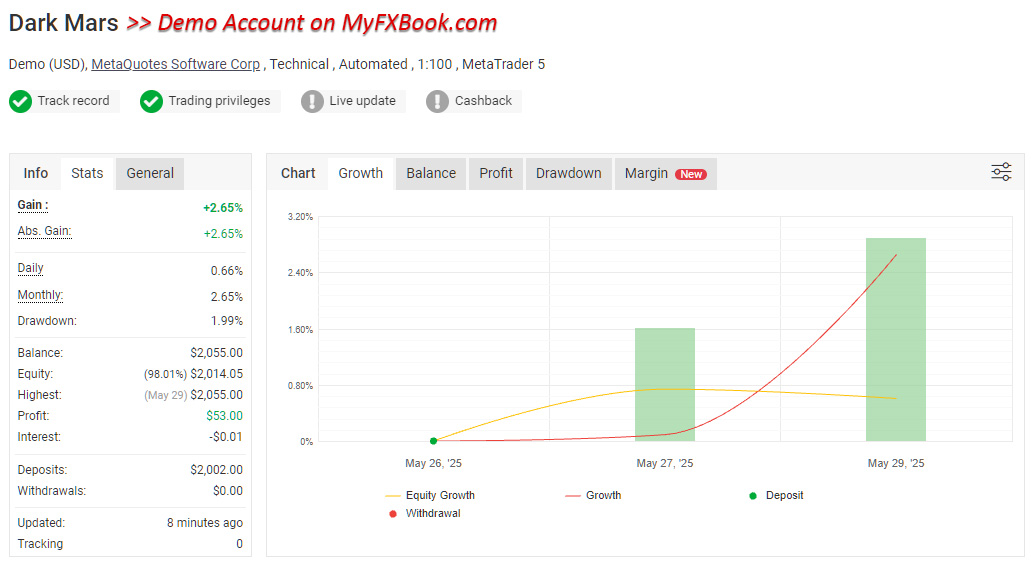

The EA isn’t showing profitability on my Myfxbook demo signal because my server wasn’t fit for the task. All my other strategies are daily, so occasional connection losses weren’t an issue. However, "Dark Mars" is an hourly strategy, meaning it missed many profitable exits due to disconnections. I’ll need to switch to a more reliable server for this EA.

Now, here’s the interesting part! I’ve long suspected that a technical scalper system could deliver outstanding results on cross-pairs - and yes, that’s true! You can test it on "real ticks" and "profit in pips for faster calculations" (it may not calculate profit at all without this flag set). Filter=ATR or Filter=None for cross symbols. It shows amazing results for AudCad, AudNzd, GbpChf, and NzdCad. I haven’t checked larger target values for potentially higher profits. The drawdown is close to 0.

Must try a new server on cross symbols!

Cheers! Stay tuned!

I testing "Dark Mars" with GBPUSD with 5M timeframe and 1H for ATR filter, LSTM for the trend, I'm using ICMarket demo-server with VPS server. Will share the results with you.

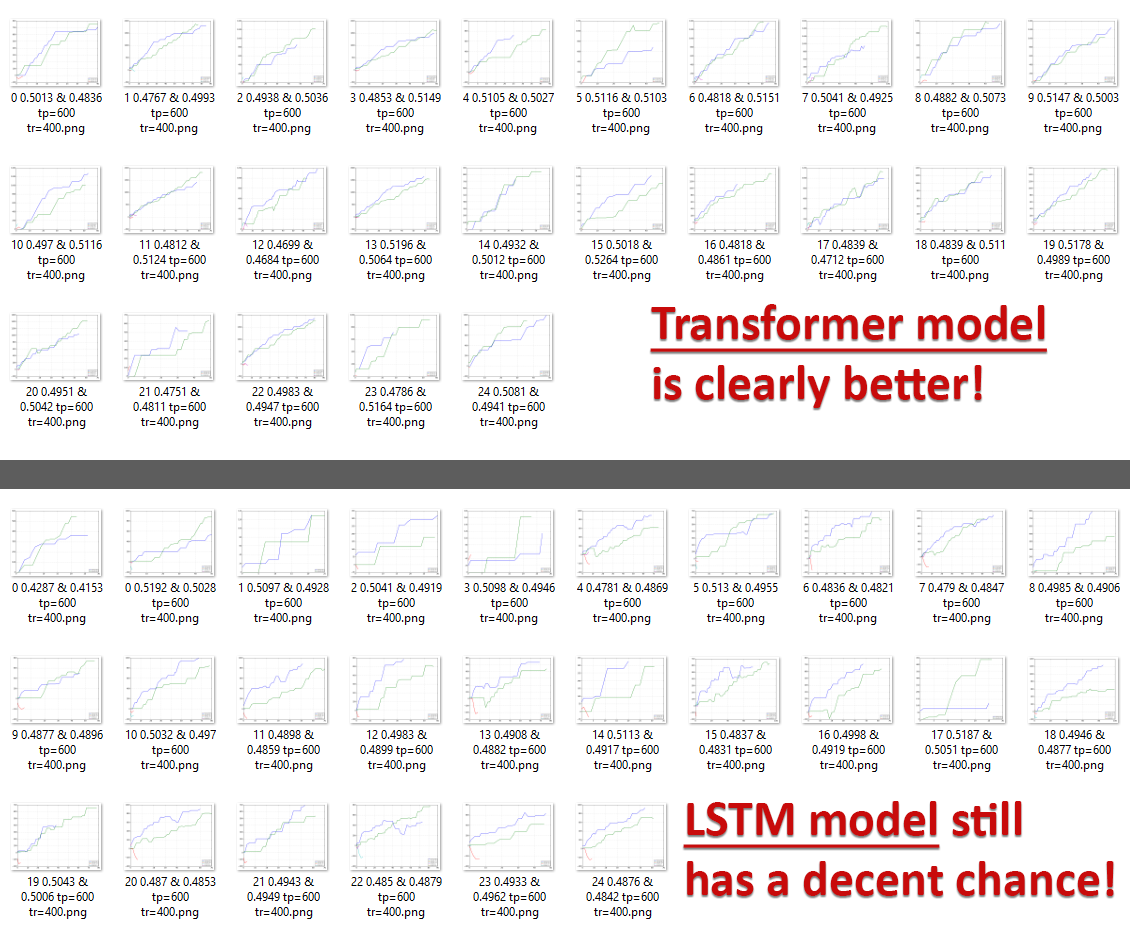

1/ Longer Context: Transformers digest more price bars, spotting trends LSTMs miss.

2/ Cleaner Growth: The attached image shows transformer passes (small pics) trending up steadily; LSTMs jump around.

3/ Efficiency Wins: We don’t need many passes—just one solid one. LSTMs can deliver, but transformers do it more reliably.

4/ Key Insight: My "2 numbers" method (forecast + its accuracy score) cuts noise. Transformers leverage both best.

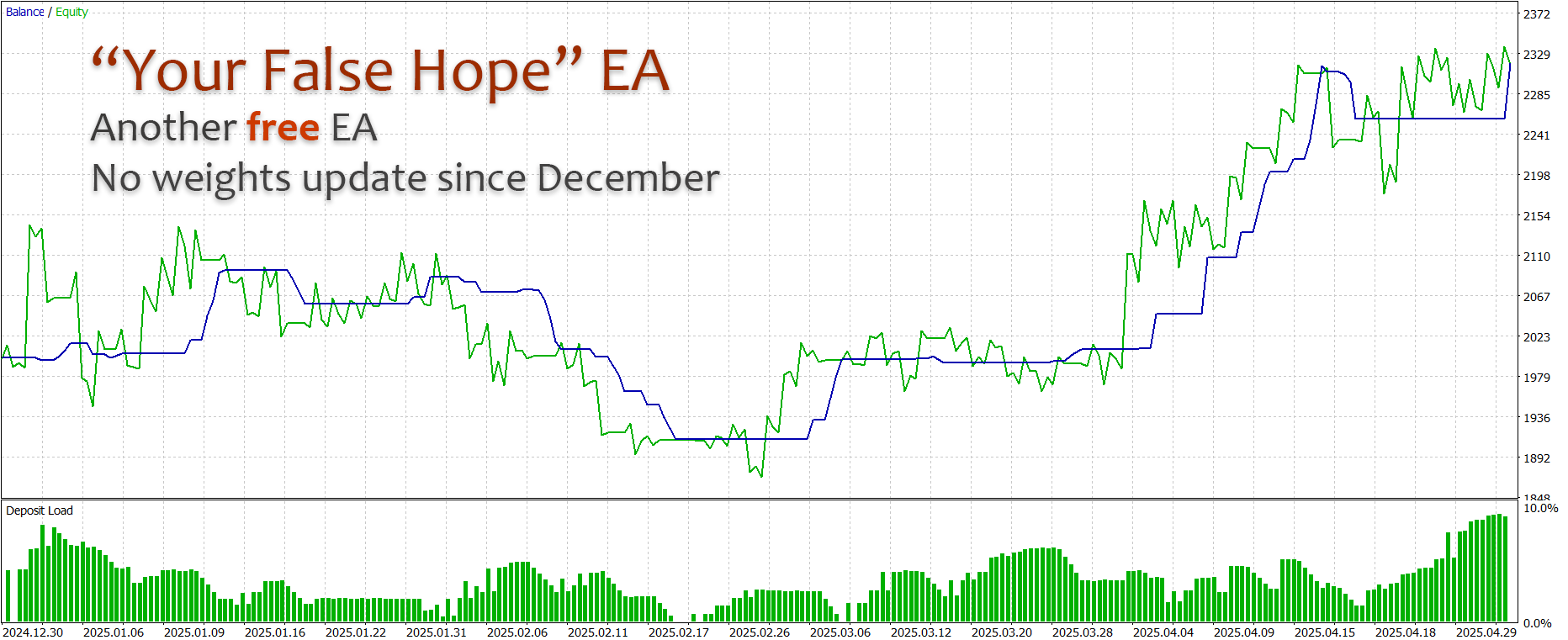

I’m attaching a complete test for Dec 2024 – April 2025 (1net + 2nets) that shows this approach is very viable. Historical curves fluctuate but grow steadily. And the best pass - selected by its F1 metric - always makes the sum for the symbols heavily profitable. I’m going to publish this version very soon, and then I’ll update the transformer-based EAs with this approach, too. Cheers, stay tuned!

Meet Dark Mars—an aggressive scalper that lives on the edge:

⚡ Trades H1 charts but sneaks peeks at D1 trends for extra conviction

⚡ Pulls trades like a machine—stacking positions to average in/out

⚡ Pure scalper mentality: "Grab tiny wins, repeat, survive"

The Raw Truth:

✅ Hyper-active – It trades a lot (you wanted action? Here it is)

✅ Self-healing – Cuts losses by doubling down (high risk, high drama)

✅ Small bites only – Don’t expect home runs; this is a micro-profit grind

Ideal for: Traders who want non-stop adrenaline and trust the math of volume > windfalls.

⚠️ Warning: Not for the faint-hearted. Drawdowns can get spicy before the rebound.

The Gold Chaser EA 3.0 is finally here—smarter, stronger, and packed with upgrades:

✅ Cutting-edge Transformer AI (yes, the tech behind ChatGPT!) for sharper predictions

✅ Dual-network power—1net and 2nets working together to crush market noise

✅ New indices! Trade US30 and US500—more opportunities, same killer logic

✅ Bitcoin just got safer (though stay sharp—it’s still crypto, so expect livelier swings!)

The best part? The system’s built to adapt and recover, no matter what the markets throw at it.

🔥 Ready to test the future? Grab v3.0 now!

Gold Chaser: May-June

QuantumPip and LuminaFX: June

Atari: June-July

It takes a while to make new tests and find better configurations. So stay tuned, profits will be ours!

Der Dark Mars Expert Advisor ist bereit für den vollautomatischen Handel mit verschiedenen Symbolen. Der Dark Mars EA ist ein Scalper, den ich auf den Zeitrahmen M5, M15, M30 und H1 getestet habe. Der EA eröffnet Trades bei Ausbrüchen oder Pullbacks basierend auf dem Bollinger Bands Indikator. Der EA ist mit den Standardeinstellungen sofort handelsbereit - für GBPUSD und USDCAD ist keine Optimierung erforderlich. Ein bekannter Vorteil von Scalpers ist die hohe Anzahl der täglich ausgeführten

Der EA "Latte" ist in der Lage, mehrere Symbole im vollautomatischen Modus von 1 Chart aus zu handeln. Der EA verwendet ein neuronales "Transformer"-Netzwerk zur Vorhersage von Kursbewegungen. Der Hauptvorteil des Transformers gegenüber einem LSTM-Netzwerk liegt in seiner Fähigkeit, Muster auch bei sehr langen Datenfolgen zu finden. Während LSTMs bei Sequenzen, die länger als 2-3 Monate sind, oft Informationen verlieren, können Transformers Sequenzen von bis zu einem Jahr problemlos verarbeiten