Hong Ling Mu / Profil

- Information

|

2 Jahre

Erfahrung

|

53

Produkte

|

28

Demoversionen

|

|

0

Jobs

|

1

Signale

|

0

Abonnenten

|

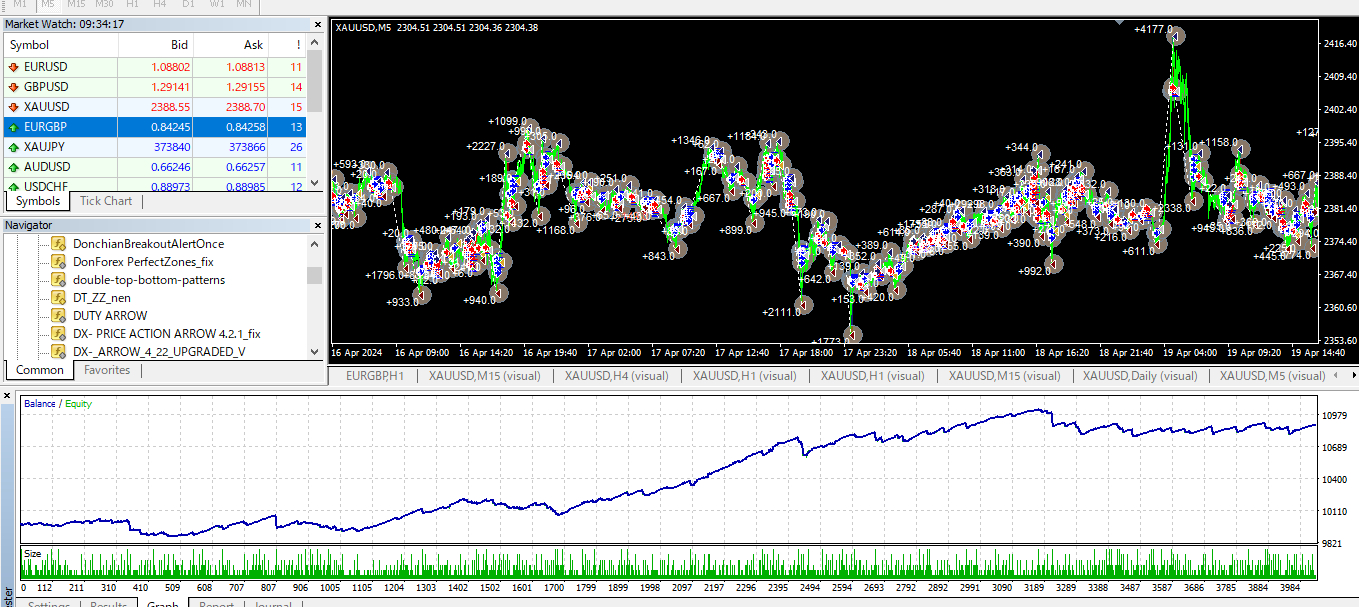

Hedging logic, or simply "hedging," refers to a strategy used in trading and investing to reduce or eliminate the risk of adverse price movements in an asset. This is typically done by taking an offsetting position in a related security or asset. The goal of hedging is to protect the portfolio from significant losses while still allowing for potential gains. Here are a few common hedging methods: 1. **Options**: Buying put options to hedge against potential declines in the value of an asset. 2

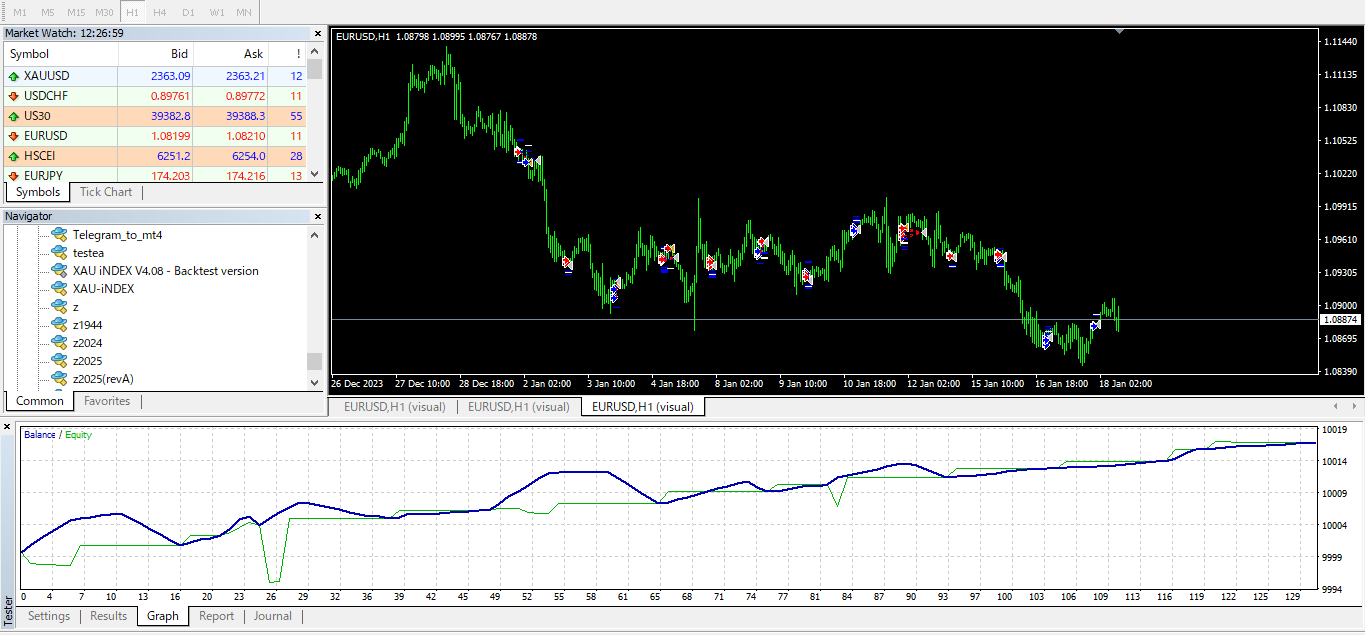

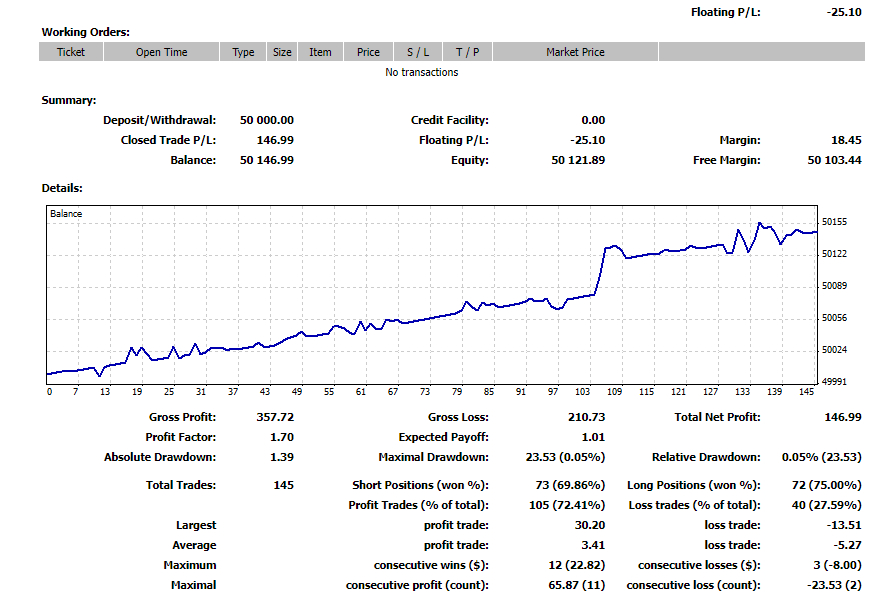

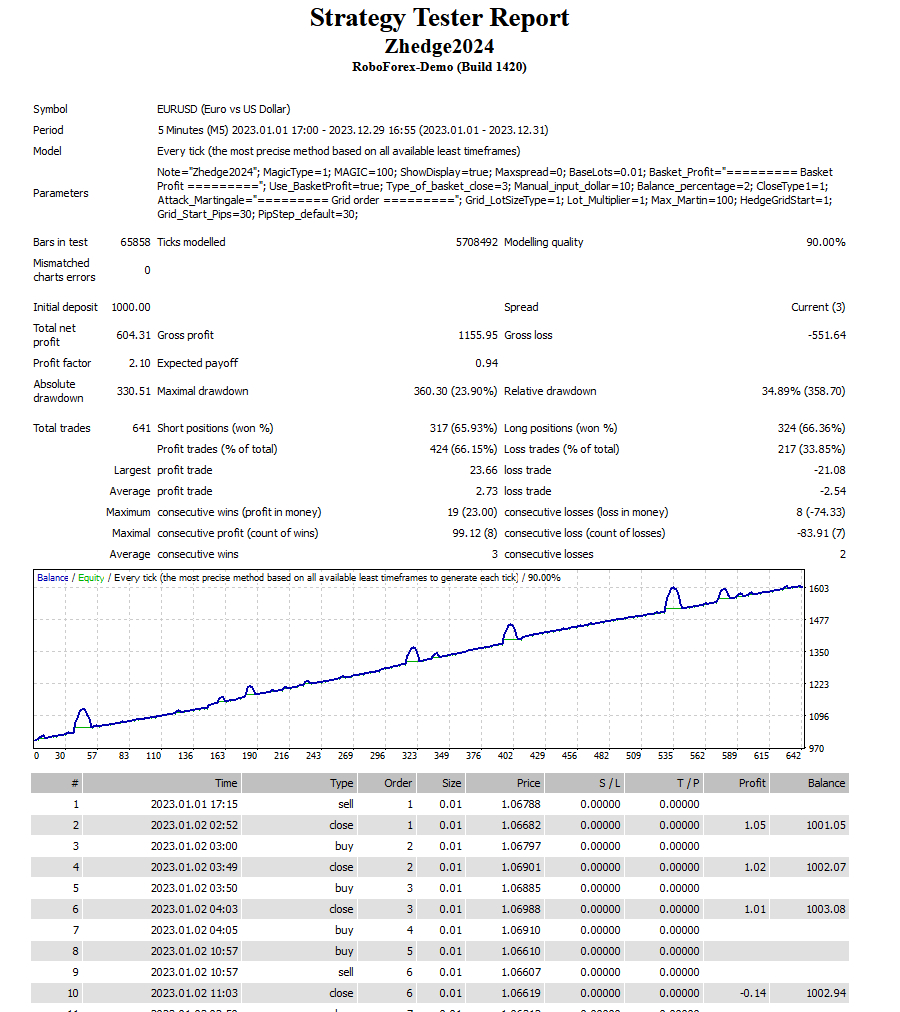

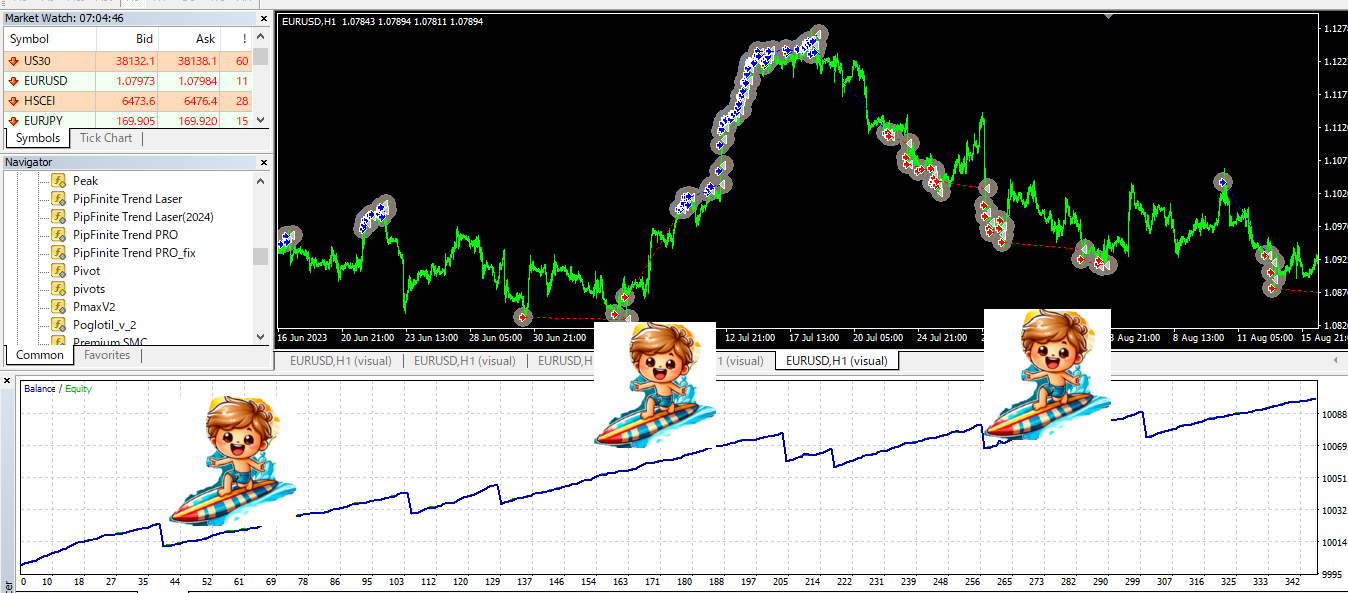

I've created an EA with a simple logic. One day, an idea struck me before bedtime. Without forgetting it, I hurriedly grabbed my laptop from the bag. Just 10 minutes later, the EA was completed. If the price is above the MA, it sells. If the price is below the MA, it buys. It's completely contrary to typical logic, but it showed good results in backtesting. I was so excited that I couldn't sleep. When the price is above the MA, it triggers SELL trades. All SELL trades are closed and modified

Summary of EA logic Secret Range EA, as the name suggests, enters trades based on market ranges. Specifically, the EA will enter a trade when the highest or lowest price over a specified period, based on a long-term timeframe set in the EA settings, is broken. However, a price break does not necessarily mean the price will revert. Therefore, the EA uses GRID orders in conjunction. While the market tends to revert to its original price after a certain period, predicting the exact timing is

Grid distance pips is i-reg channel distance..

#forexlife #forextips #forexsignal #自動売買

## My Dream: Creating a Stable Hedge Robot "This EA is based on a logic that suddenly came to me before going to bed yesterday. I hurriedly took out my PC and created it so I wouldn't forget it." It has long been my dream to develop a stable hedge robot. However, despite years of effort, I have struggled to achieve consistent success. Hedge logic is inherently complex, and increasing the number of open positions often leads to larger drawdowns. To address this challenge, I devised a new