Roberto Jacobs / Profil

- Information

|

8+ Jahre

Erfahrung

|

3

Produkte

|

75

Demoversionen

|

|

28

Jobs

|

0

Signale

|

0

Abonnenten

|

MQL5 Community:

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Roberto Jacobs

China A50 Futures Flat ahead of Shanghai China futures (A50 FTSE - benchmark for investors to access the China domestic market through A Shares – ) is trading flat following the positive close in Wall Street last Friday, and ahead of the Shanghai Composite, due to open at 1.30GMT...

In sozialen Netzwerken teilen · 1

152

Roberto Jacobs

USD/CNY Fix Model: Projection at 6.4810 - Nomura Nomura's model projects the PBOC fix to be higher by 182 pips from the previous fix (6.4810 from 6.4628) and higher by 83 pips from the previous spot USD/CNY official close 6.4727...

In sozialen Netzwerken teilen · 1

105

Roberto Jacobs

USD, JPY Net Longs Fall, GBP Shorts Cut - Nomura As Nomura notes, according to the IMM data for the week ended March 15, non-commercial accounts sold USD to the tune of -$1.7bn, bringing positioning in USD to $9.5bn...

Roberto Jacobs

EURUSD Daily Forecast: March 21 2016 EURUSD Forecast The EURUSD continued its bullish momentum last week topped at 1.1342 but still unable to stay consistently above the trend line resistance as you can see on my H1 chart below. The bias is neutral in nearest term...

Roberto Jacobs

GBPUSD Daily Forecast: March 21 2016 GBPUSD Forecast The GBPUSD attempted to push lower last week, slipped below 1.4130 but whipsawed to the upside and closed higher at 1.4482. The bias is bullish in nearest term testing 1.4580. Immediate support is seen around 1.4400...

Roberto Jacobs

USDJPY Daily Forecast: March 21 2016 USDJPY Forecast The USDJPY had a bearish momentum last week slipped below 110.96 but still unable to make a clear break and consistent move below that area so far...

Roberto Jacobs

USDCHF Daily Forecast: March 21 2016 USDCHF Forecast As expected, the USDCHF had a bearish momentum last week bottomed at 0.9650. The bias remains bearish in nearest term testing 0.9600 – 0.9570 region. Immediate resistance is seen around 0.9730...

Roberto Jacobs

We Can Now Reflect on the FOMC - ANZ Analysts at ANZ explained that with the benefit of a couple more days and the fact that markets have settled somewhat, it is little easier now to reflect on the Fed’s decision and surprise dovishness last week...

Roberto Jacobs

London session outlook. Technical setups for EURUSD, GBPUSD, AUDUSD, USDJPY, FTSE 100, Gold, Crude Oil And DAX 30. Extensive Q/A session...

Roberto Jacobs

Analytical Review of the Stocks of International Paper Company

20 März 2016, 06:32

Analytical Review of the Stocks of International Paper Company International Paper Company, #IP [NYSE] Consumer goods, production of paper & packaging, USA Financial performance of the company: Index – S&P 500...

In sozialen Netzwerken teilen · 2

294

Roberto Jacobs

EUR/USD: Wave analysis and forecast for 18.03 – 25.03 - 2016

20 März 2016, 06:23

EUR/USD: Wave analysis and forecast for 18.03 – 25.03 - 2016 EUR/USD: Wave analysis and forecast for 18.03 – 25.03: The pair is likely to decline within correction. Estimated pivot point is at the level of 1.1350. Our opinion: Sell the pair from correction below the level of 1.13501...

In sozialen Netzwerken teilen · 2

163

Roberto Jacobs

GBP/USD: Wave analysis and forecast for 18.03 – 25.03 - 2016

20 März 2016, 06:20

GBP/USD: Wave analysis and forecast for 18.03 – 25.03 - 2016 GBP/USD: Wave analysis and forecast for 18.03 – 25.03: Correction is nearing completion. Estimated pivot point is at the level of 1.4115. Our opinion: In the short-term: buy the pair above the level of 1.4218 with the target of 1.4690...

In sozialen Netzwerken teilen · 2

125

Roberto Jacobs

USD/CHF: Wave analysis and forecast for 18.03 – 25.03 - 2016

20 März 2016, 06:17

USD/CHF: Wave analysis and forecast for 18.03 – 25.03 - 2016 USD/CHF: Wave analysis and forecast for 18.03 – 25.03: Downtrend continues. Estimated pivot point is at the level of 0.9912. Our opinion: Sell the pair from correction below the level of 0.9912 with the target of 0.95 – 0.9470...

In sozialen Netzwerken teilen · 2

190

Roberto Jacobs

USD/JPY: Wave analysis and forecast for 18.03 – 25.03 - 2016

20 März 2016, 04:57

USD/JPY: Wave analysis and forecast for 18.03 – 25.03 - 2016 USD/JPY: Wave analysis and forecast for 18.03 – 25.03: Downtrend continues. Estimated pivot point is at the level of 113.84. Our opinion: Sell the pair from correction below the level of 113.84 with the targets of 107.00 – 106.60...

In sozialen Netzwerken teilen · 2

129

Roberto Jacobs

USD/СAD: Wave analysis and forecast for 18.03 – 25.03 - 2016

20 März 2016, 04:52

USD/СAD: Wave analysis and forecast for 18.03 – 25.03 - 2016 USD/СAD: Wave analysis and forecast for 18.03 – 25.03: Downtrend dominates. Estimated pivot point is at the level of 1.3396. Our opinion: Wait for the completion of correction and sell the pair below the level of 1...

Roberto Jacobs

Sergey Golubev

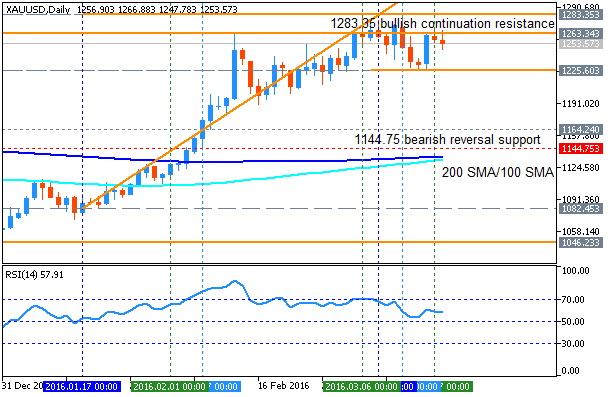

Kommentar zum Thema Forecast for Q1'16 - levels for GOLD (XAU/USD)

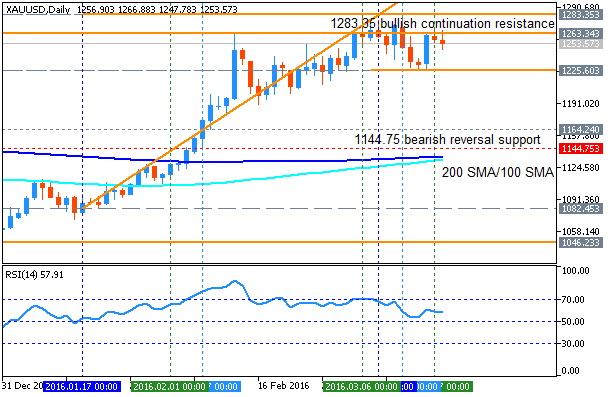

GOLD (XAU/USD): End Of Week Technicals - ranging within bullish resistance level and the bearish reversal support level Daily price is above 100-day SMA/200-day SMA area for the bullish market

: