Roberto Jacobs / Profil

- Information

|

8+ Jahre

Erfahrung

|

3

Produkte

|

75

Demoversionen

|

|

28

Jobs

|

0

Signale

|

0

Abonnenten

|

MQL5 Community:

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Programmer + Forex Trader

Product on Market:

Forex Currency Power Index indicator for MT5

https://www.mql5.com/en/market/product/101322

Forex Currency Power Index indicator for MT4

https://www.mql5.com/en/market/product/101328

TrendColorBars

https://www.mql5.com/en/market/product/14715

Roberto Jacobs

UK: On the Slide? - ING James Knightley, Senior Economist at ING, suggests that the concerns about what Brexit could mean have already hurt UK sentiment, but there is growing evidence that the broader economy is now feeling the pain...

Roberto Jacobs

Dollar Index: Risk of Double Top Confirmation – SocGen Research Team at Societe Generale, suggests that the Dollar Index is now at the ‘make or break level’ of 92.50/92...

In sozialen Netzwerken teilen · 2

131

Roberto Jacobs

FxWirePro: AUD/JPY Edges Higher from 6-Month Lows at 79.53, Bias Lower The pair is seeing a double whammy after BoJ surprised markets last week with inaction. AUD/JPY hit fresh 6-month lows at 79.53 on Tuesday's trade and has pare some losses to currently trade at 79.90 levels...

Roberto Jacobs

S&P500 Breaks Major Support 2050, Targets 2023/2000 Major support - 2050 Major Intraday resistance - 2070 Short term trend reversal Level- 2085 The index has broken major support 2050 and declined till 2046.6 at the time of writing. It is currently trading around 2047...

Roberto Jacobs

USD/CHF Could be Eyeing to Reclaim 0.9600 Mark The USD/CHF pair managed to build on Tuesday's recovery from multi-month lower levels and is now holding 0.9550 level. Although the pair has cooled off a bit from day's peak of 0.9575 it is still trading with some marginal gains...

In sozialen Netzwerken teilen · 1

124

Roberto Jacobs

Potential for a Test of 94-95 in DXY – Westpac In view of strategists at Westpac, the greenback – tracked by the US Dollar Index (DXY) – could squeeze higher toward the 94-95 area...

Roberto Jacobs

US ADP: What to Expect of USD/JPY? The US publishes its ADP Employment Change report later in the European afternoon, with market consensus expecting the US private sector to remain in a healthy form and add near 200K jobs during April, all ahead of the critical Non-farm Payrolls due on Friday...

Roberto Jacobs

US: Recession Fears Resurface - ING Research Team at ING, suggests that the further decline in US GDP growth in 1Q16 could resurrect thoughts of a US hard landing – the evidence is still mixed, but warning signs are mounting...

In sozialen Netzwerken teilen · 1

129

Roberto Jacobs

RBA: Further Rate Cut is Likely – Goldman Sachs Research Team at Goldman Sachs, notes that the RBA cut the cash rate by 25bps to a record low of 1.75% at its May meeting, on the 1 year anniversary of its last rate cut...

In sozialen Netzwerken teilen · 1

167

Roberto Jacobs

EUR/USD Attempts to Clinch 1.1500 Ahead of ADP The single currency seems to be gathering some traction ahead of the NA session today, now lifting EUR/USD to test the 1.1500 neighbourhood. EUR/USD almost unchanged pre-ADP After briefly testing lows near 1...

Roberto Jacobs

Gold Slides Further Below $1280 Ahead of ADP Report After failing to sustain above $1300 mark, Gold bulls continue to lose grip as the precious metal extends its slide below $1280 level...

Roberto Jacobs

USD/JPY Focus is Now on 107.40 – UOB According to the research team at UOB Group, the pair has now shifted its focus to the 107.40 level. Key Quotes “The strong rebound from the low of 105.52 clearly indicates that a short-term bottom is in place...

Roberto Jacobs

GBP/JPY Breaks Through 155.00 Important Support The bears seem to regain control over the GBP/JPY pair as it drops back below 155.00 handle on weaker-than-expected UK construction PMI print. The pair is now headed towards the two week low level of 154.42 tested on Tuesday...

Roberto Jacobs

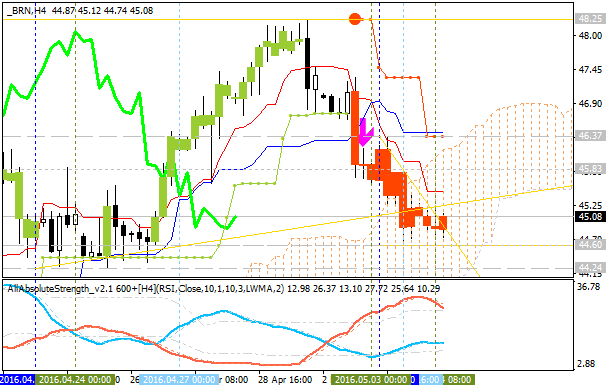

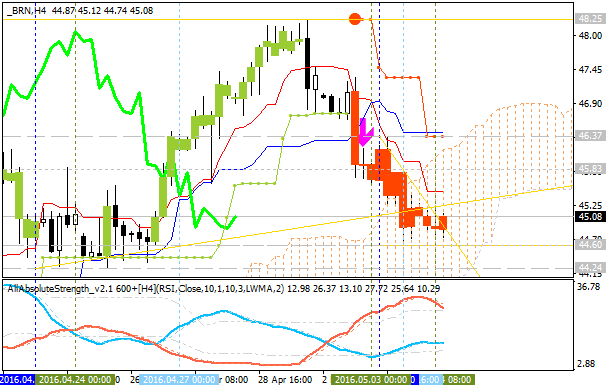

Sergey Golubev

Kommentar zum Thema Forecast for Q2'16 - levels for Brent Crude Oil

Technical Analysis for Brent Crude Oil: intra-day bearish breakdown with secondary ranging; daily correction H4 price is on breakdown with the bearish reversal: the price broke key support levels

Roberto Jacobs

USD Weakness has Likely Overshot in the Near-term – MUFG Lee Hardman, Currency Analyst at MUFG, notes that the US dollar has continued to rebound in the Asian trading after the dollar index hit its lowest level yesterday since January of last year...

Roberto Jacobs

USD Reversal Supported by the Comments from Fed Officials – Deutsche Bank Research Team at Deutsche Bank, suggests that some attributed yesterday’s reversal in the US Dollar off the lows to the comments from Fed officials yesterday...

Roberto Jacobs

AUD/USD Slides Further, Drops to Seven Week Low The AUD/USD pair built on to its Tuesday's sharp fall and erased its Asian session recovery to currently trade near day's low of 0.7460. On Tuesday, RBA unexpectedly lowered its key benchmark interest rates by 25bps to a new record low of 1.75...

Roberto Jacobs

USD/CAD Pushes Higher, Near 1.2780 The buying interest around the greenback remains unabated for the second session in a row, now sending USD/CAD to post daily highs near 1.2780...

Roberto Jacobs

FxWirePro Short Term Outlook: another 800 Pips Drop in Pound Likely Against Yen Since Bank of Japan (BOJ) decided to stay hold in its April meeting Yen has strengthened about 800 pips against Pound, however our calculation matrix suggests that run may not be over and Pound may drop another 800 pi...

In sozialen Netzwerken teilen · 1

156

Roberto Jacobs

Technical Analysis of USD/CAD for May 4, 2016 General overview for 04/05/2016: As it had been anticipated, yesterday the market made one more marginal wave down and then strongly rebounded to the upside in impulsive fashion...

In sozialen Netzwerken teilen · 2

103

: