FxStairsGann

- Experten

- Laszlo Daniel Toeroek

- Version: 1.12

- Aktivierungen: 5

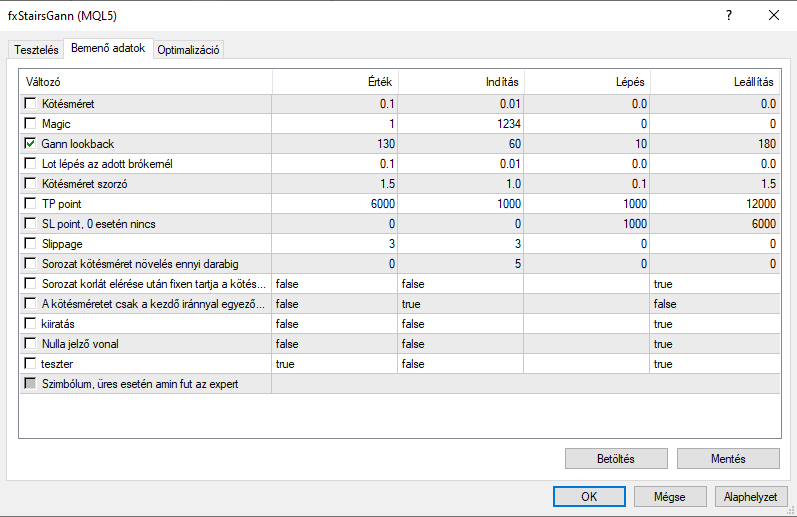

This is a specific trading strategy based on the movement of the Gann indicator, utilizing a conservative martingale approach. The strategy involves closing the previous trade when a trade in the opposite direction is opened. The use of a stop-loss (SL) value is optional in this case. The expert advisor is designed primarily for trading the SP500 index on a Renko chart, but it can also be applied to regular charts, other currencies, and indices. It is recommended to have a minimum leverage of 1:20 or 1:30, although higher leverage (1:50, 1:200, 1:500) can provide added safety.

Before engaging in live trading using this expert advisor, it is crucial to optimize the Gann indicator and take profit (TP) values. Optimization helps fine-tune these parameters to improve the strategy's performance and profitability.

Please keep in mind that while discussing trading strategies can be informative, it's important to exercise caution and conduct thorough testing and analysis before applying any strategy to real-world trading. Additionally, consider seeking advice from professional financial advisors or conducting your own research to ensure you make informed trading decisions.

Here are the key points you mentioned about the strategy:

-

Gann Indicator: The strategy is based on the movement of the Gann indicator. The specific rules for entering and exiting trades would depend on the interpretation and signals generated by this indicator.

-

Conservative Martingale Approach: The strategy incorporates a conservative martingale approach. In a martingale strategy, after a losing trade, the next trade is opened with an increased position size in order to recover the losses. However, using a conservative approach implies that the position size is increased gradually and with caution.

-

Stop Loss (SL): The strategy does not necessarily require specifying a stop-loss (SL) value for each trade. Instead, when a trade in the opposite direction is opened, the previous trade is closed. This suggests that the new trade serves as a hedge against the previous trade, reducing the need for a predefined stop loss.

-

Optimization: Before engaging in live trading with this strategy, it's important to optimize the Gann values and take profit (TP) levels. Optimization involves testing different parameter values to find the combination that yields the best results based on historical data. This step helps fine-tune the strategy and improve its performance.

-

Leverage: The minimum required leverage for trading this strategy is suggested to be 1:20 or 1:30. However, it's mentioned that trading with higher leverage (1:50, 1:200, 1:500) can enhance safety. It's essential to understand the risks associated with leverage and ensure that the chosen leverage level aligns with your risk tolerance and trading goals.

Remember that trading strategies involve risk, and past performance is not indicative of future results. It's always recommended to thoroughly understand the strategy, test it with historical data, and consider risk management techniques before implementing it in live trading. Consulting with a financial advisor or experienced trader may also be beneficial.

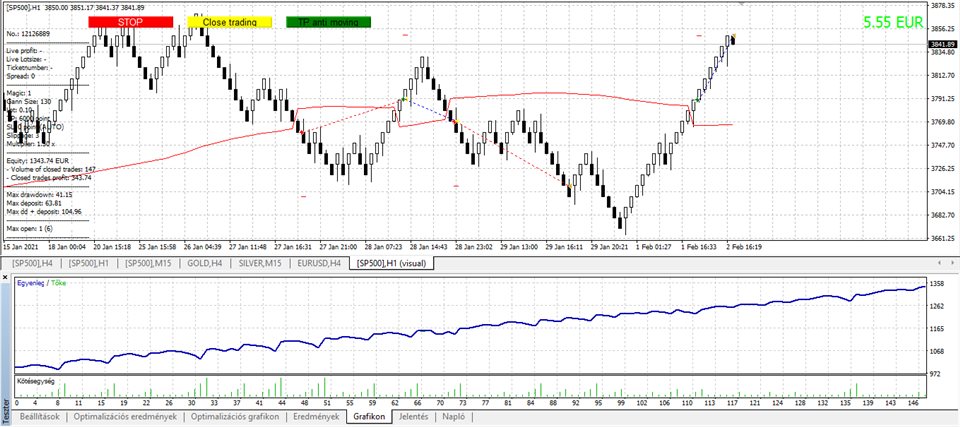

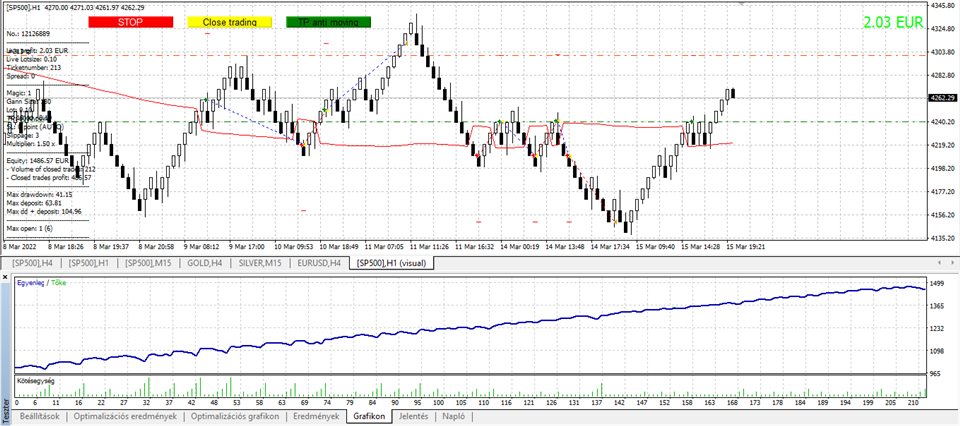

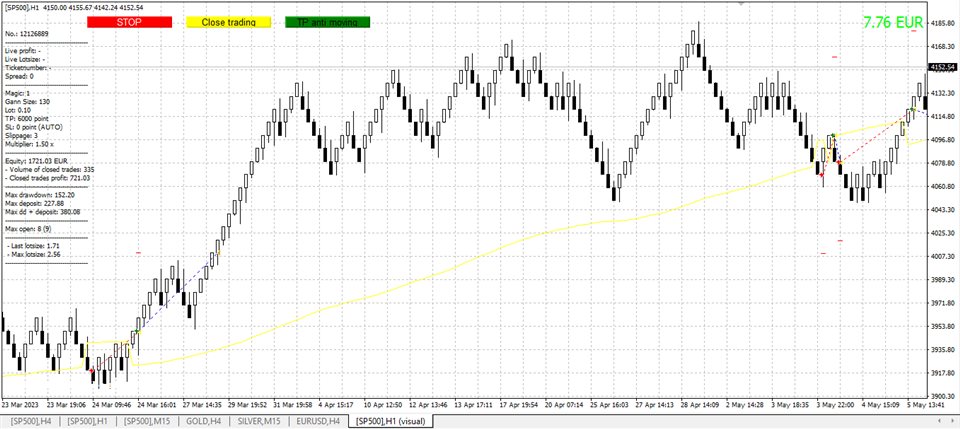

There's no holy grail! During a single trading period, one or more trades are executed until the period is closed with a profit. Within that, there can be both losing and winning trades! The essence is that the result of winning trades exceeds the result of losing trades. The difference is the profit.

The foreign exchange market is an unregulated market, therefore the depiction of candlesticks on the charts provided by forex brokers may differ to a greater or lesser extent even for the same instrument (EURUSD, SP500, etc.). This means that when trading or testing a particular robot on the same instrument, different users may obtain different results.