StopHunt Killer

- Experten

- Arunkumar Kamalakannan

- Version: 1.0

- Aktivierungen: 5

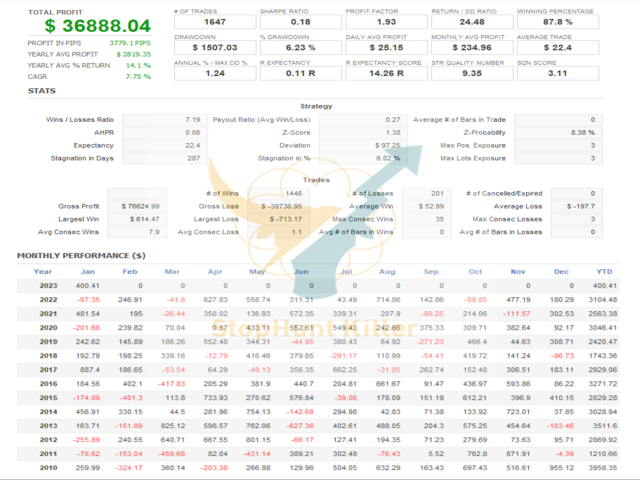

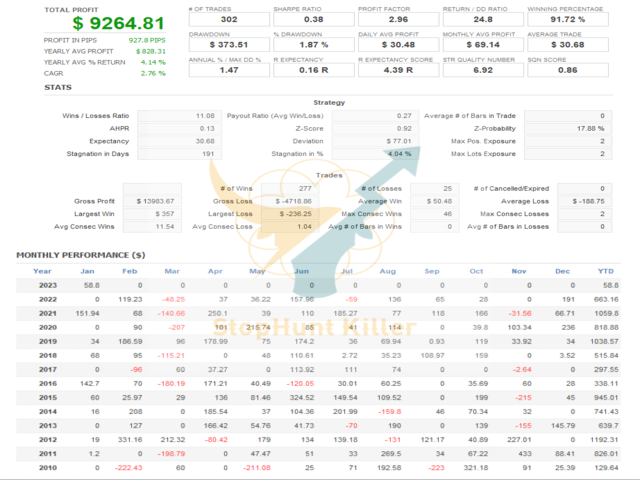

Markets : “EURUSD” and “USDJPY” 15M Chart.

Broker Selection : ECN Brokers with Low spreads.

Intro:

The stopHunt Killer EA is based on the Price Imbalance around the major liquidity points. Big banks use these points as liquidity mechanisms before taking the markets in their direction.

EA identifies points of major liquidity and set orders to capitalize on the Bank Stop Hunts. EA works on “EURUSD” and “USDJPY” as they are largely traded pairs and high liquidity pools work in our favor.

Trade settings are made simple to ensure that parameters are not over-optimized. It is suitable for new traders and also for increasing long-term wealth as per the different settings in the Expert advisor.

StopHunt Killer EA was stress tested with slippage and commission approximate to the real market conditions using real ticks with 100 % between 2010-2023.

Idea:

What is StopHunting? : Stop hunting is a strategy that large Banks attempt to force some market participants out of their positions by driving the price of an asset to a level where many individuals have chosen to set stop-loss orders.

Statistical Edge: The Ea’s edge lies in anticipating these manipulations and taking counter measures. I am trading this strategy for years myself and gives good returns with minimum drawdown.

How is this EA Different?:

Most EAs would lose the edge if it is used by multiple people. The strong fundamental reason (Large Bank’s Money) behind the strategy and statistical edge makes it robust and it is highly unlikely that the strategy would lose edge.

It is not a risky strategy like Grid/Martingale or Eas which trades in Low liquidity sessions (Ea work work in Backtesting. In reality, Trading costs through slippage zeros out the edge)

EA Settings:

Please Reach out for any queries or assistance on settings: https://www.mql5.com/en/users/fxdruid/messages

“Place the EA in EURUSD or USDJPY 15M Chart. It is disabled in other charts/Timeframes.”

Settings are already optimized and made simple to attain uniform results as Backtests.

- General Settings:

- Panel Enabled : True/False. Enables the Info panel in the Chart.

- Trade Mode : Can select which trades to take (Hedging compatible)

-

Risk/Money Management :

- Lot Type: The default Lot setting is Fixed Lot with 1.0 standard Lot. Change sizing according to your preferred risk. Options are Account balance based and based on Kelly's criteria lot size.

-

Risk:

1. Take Trades frequently ( Takes trades frequently with balanced Profit Factor)

2. Only Take High Probability Trades : (For Large accounts, slow and steady capital growth over years with less drawdowns)

- Trade Close :

- Close Trade : Option to close all the trades before the end of the day. Only there for Funding account requirements. Keep the trades open as the default setting.

- Trade duration in Mins : Time difference in minutes since the trade open Time.

-

Trade Hours:

-

Restricts trading outside of hours specified. Default is based on GMT+2. Adjust based on your broker time settings.