"CrossMAn" ist leider nicht verfügbar.

Schauen Sie sich andere Produkte von Pavel Verveyko an:

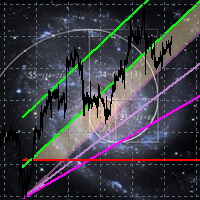

The indicator builds a graphical analysis based on the Fibonacci theory.

Fibo Fan is used for the analysis of the impulses and corrections of the movement.

Reversal lines (2 lines at the base of the Fibonacci fan) are used to analyze the direction of movements.

The indicator displays the of 4 the target line in each direction.

The indicator takes into account market volatility.

If the price is above the reversal lines, it makes sense to consider buying, if lower, then selling.

You can op

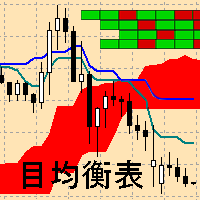

Ichimoku Map (instant look at the markets) - built on the basis of the legendary Ichimoku Kinko Hyo indicator.

The task of the Ichimoku Map is to provide information about the market strength on the selected time periods and instruments, from the point of view of the Ichimoku indicator. The indicator displays 7 degrees of buy signal strength and 7 degrees of sell signal strength.

The stronger the trend, the brighter the signal rectangle in the table. The table can be dragged with the mouse.

T

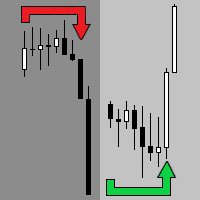

The indicator is a trading system for short-term trading.

Scalper Assistant helps to determine the direction of the transaction, and also shows the entry and exit points.

The indicator draws two lines (possible points for opening positions).

At the moment of the breakdown of the upper line up (and when all trading conditions are met), an up arrow appears (a buy signal), as well as 2 goals.

At the moment of the breakdown of the lower line down (and when all trading conditions are met), a do

The indicator draws support and resistance lines on an important part of the chart for making decisions. After the trend line appears, you can trade for a breakout or rebound from it, as well as place orders near it. Outdated trend lines are deleted automatically. Thus, we always deal with the most up-to-date lines. The indicator is not redrawn .

Settings:

Size_History - the size of the calculated history. Num_Candles_extremum - the number of candles on each side of the extremum. Type_Ar

The trading system is designed to work with gold on time periods: 30M, 1H. The indicator allows you to adjust to the market situation.

Parameters for 1H : PERIOD=9F , FILTER=300 .

Parameters for 30M : PERIOD=22B , FILTER=450 .

A small adjustment to a specific broker is allowed .

If you change the amount of history displayed, you may also need to adjust the parameters.

The indicator is not redrawn.

"Gold n XAU" uses different rules for entering a trade and different

The indicator shows the market turning points (entry points).

Reversals allow you to track rebound/breakout/testing from the reverse side of the lines of graphical analysis or indicators.

Reversals can be an independent signal. The indicator allows you to determine reversals taking into account the trend and without it. You can choose a different period for the movement preceding the reversal, as well as the volatility coefficient. When plotting reversals, the indicator takes into account vola

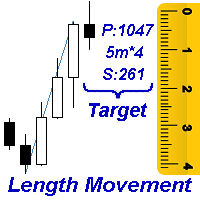

Measures the length of the selected movement in points, shows the duration of the movement, as well as the speed of movement. Outputs the average value of each dimension.

It is designed to calculate the expected target based on typical market movements.

The intended goal will provide information about the ratio of the stop size to the possible profit and will allow you not to open positions with a small expected profit.

It will also help you determine the point at which it is more logical t

The indicator allows you to quickly switch from one instrument to another, from one time period to another using the keyboard or buttons on the monitor. Each command can be assigned a hot key from 0-9, a-Z (case-insensitive) and VK_OEM_COMMA ("<" on the keyboard) and VK_OEM_PERIOD (">" on the keyboard). This can help you to operate the maximum number of instruments that are available at your broker, analyze more instruments/periods in less time. This product cannot be tested in the tester , beca

This indicator allows you to measure the profitability of each specific transaction (the ratio of Stop and Profit). The indicator allows you to adjust the ratio by step size and number of steps. You can build an unlimited number of ratios to compare the risks from different movements.

Note: in MT4, the number of horizontal lines in a single ratio cannot exceed 32.

Building a line : click the " Ratio " button and draw a line (mouse click - the first point of the line, where the mouse is relea

The script displays info about the share's corporate reports and dividends. The data is downloaded from investing.com : Report date Profit per share (EPS) Revenue Market capitalization Amount of dividends Date of payment of dividends Dividend income The product cannot be tested in the tester (since it is not possible to receive data from the Internet).

Before launching: Add 2 URL https://ru.investing.com/earnings-calendar/Service/getCalendarFilteredData and https://ru.investing.com/

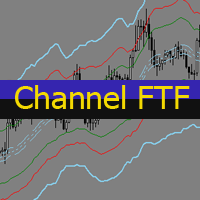

The Envelopes indicator determines the presence of a trend or flat. It has 3 types of signals, shows the probable retracement levels and levels of the possible targets. The Fibonacci coefficients are used in the indicator's calculations. Signals (generated when touching the lines or rebounding from lines): Trend - the middle line of the Envelopes has a distinct inclination; the lines below the channel's middle line are used for buy trades, the lines above the middle line and the middle line itse

The indicator shows and highlights the chart candles, which are formed as a result of large players entering the market in large volumes. Such candles can also be formed after achieving a certainty on the market, when most of the participants hold positions in the same direction. The movement is likely to continue in that direction after such candles. The indicator highlights the significant candles from the existing ones on the chart; The indicator allows identifying the trends based on candles

The indicator identifies the most suitable moment for entering the market in terms of market volatility, when the market has the strength to move (the signal is indicated by an arrow under the candle). For each of the signals, the presence of trends on the current and higher timeframes is determined, so that the signal is in the direction of the majority of positions opened on the market (denoted near the signal by abbreviations of timeframes with a trend present). The signal appears after the c

The indicator displays the key support and resistance levels on the chart. The significance of these levels lies in that the price may reverse or strengthen the movement when passing such levels, since they are formed as a consequence of the natural reaction of market participants to the price movement, depending on which positions they occupied or did not have time to occupy. The psychology of the level occurrence: there always those who bought, sold, hesitated to enter or exited early. If the

This indicator is a multitimeframe trading strategy. It has the levels for stop loss, take profit and entry point. The order level can also be set manually. The indicator uses the regularity of the market, which manifests itself on all instruments, and does not require adjustment of the parameters. The strategy uses a proprietary approach to determining: trend, volatility, hierarchy of timeframe significance, the size of the history period (the number of candles), which is important for making a

The indicator shows the trend of 3 timeframes: higher timeframe; medium timeframe; smaller (current) timeframe, where the indicator is running. The indicator should be launched on a chart with a timeframe smaller than the higher and medium ones. The idea is to use the trend strength when opening positions. Combination of 3 timeframes (smaller, medium, higher) allows the trend to be followed at all levels of the instrument. The higher timeframes are used for calculations. Therefore, sudden change

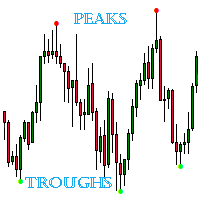

The indicator detects important peaks and troughs (extremes) on the chart. These points can be used to plot support/resistance levels and trend lines, as well as any other graphical analysis. These points can serve as reference points for setting trading orders. The indicator does not redraw .

Settings:

Size_History - the size of the calculated history. Num_Candles_Right - number of candles to the right of the peak or trough.

Num_Candles_Left - number of candles to the left of the pea

The indicator draws support and resistance lines on an important part of the chart for making decisions. After the trend line appears, you can trade for a breakout or rebound from it, as well as place orders near it. Outdated trend lines are deleted automatically. Thus, we always deal with the most up-to-date lines. The indicator is not redrawn .

Settings:

Size_History - the size of the calculated history. Num_Candles_extremum - the number of candles on each side of the extremum. Type_Ar

The indicator shows key volumes confirmed by the price movement.

The indicator allows you to analyze volumes in the direction, frequency of occurrence, and their value.

There are 2 modes of operation: taking into account the trend and not taking into account the trend (if the parameter Period_Trend = 0, then the trend is not taken into account; if the parameter Period_Trend is greater than zero, then the trend is taken into account in volumes).

The indicator does not redraw .

Settings Histo

This trading system is based on market impulses of varying complexity.

To generate a signal, the indicator uses the moments when the direction of the pulse and the necessary section of the trend coincide. The indicator also takes into account the current market volatility. Stop_loss tags can be set with the parameter "0" or "1", then Stop_Loss will take into account market volatility.

Take_Profit tags can be set with the parameter "0", then Take_Profit will take into account market volat

The stocks that make up the index are one of the drivers of the movement. Analyzing the financial performance of all elements of the index, we can assume further development of the situation. The program (script) displays corporate reports of shares that are part of the index selected in the settings.

"Indexes" cannot be tested in the tester (since there is no way to get information from the Internet).

Information is downloaded from the site investing.com: Report Date Earnings per share

The indicator builds a graphical analysis based on the Fibonacci theory.

Fibo Fan is used for the analysis of the impulses and corrections of the movement.

Reversal lines (2 lines at the base of the Fibonacci fan) are used to analyze the direction of movements.

The indicator displays the of 4 the target line in each direction.

The indicator takes into account market volatility.

If the price is above the reversal lines, it makes sense to consider buying, if lower, then selling.

You can op

The indicator determines the state of the market: trend or flat.

The state of the market is determined by taking into account volatility.

The flat (trading corridor)is displayed in yellow.

The green color shows the upward trend.

The red color shows the downward trend.

The height of the label corresponds to the volatility in the market.

The indicator does not redraw .

Settings History_Size - the amount of history for calculation.

Period_Candles - the number of candles to calculate the

The indicator plots flexible support and resistance levels (dots). A special phase of movement is used for construction. Levels are formed dynamically, that is, each new candle can continue the level or complete it.

The level can provide resistance or support to the price even where it is no longer there. Also, support and resistance levels can change roles. The importance of levels is affected by: the amount of time the level is formed and the number of touches.

The significance of these l

The indicator is a trading system for short-term trading.

Scalper Assistant helps to determine the direction of the transaction, and also shows the entry and exit points.

The indicator draws two lines (possible points for opening positions).

At the moment of the breakdown of the upper line up (and when all trading conditions are met), an up arrow appears (a buy signal), as well as 2 goals.

At the moment of the breakdown of the lower line down (and when all trading conditions are met), a do

The trading system is designed to work with gold on time periods: 30M, 1H. The indicator allows you to adjust to the market situation.

Parameters for 1H : PERIOD=9F , FILTER=300 .

Parameters for 30M : PERIOD=22B , FILTER=450 .

A small adjustment to a specific broker is allowed .

If you change the amount of history displayed, you may also need to adjust the parameters.

The indicator is not redrawn.

"Gold n XAU" uses different rules for entering a trade and different ru

The indicator builds "psychological levels": levels of round numbers and intermediate levels of round numbers.

Round numbers play an important role in forming support and resistance levels. There is a pattern in which the decline or growth of the price can stop at round numbers.

The level whose price ends at 0 is the level of a round number of the first order. Intermediate level, this is the level between two round levels, for example, between 10 and 20 this is level 15.

In the " Num_Zero

Ichimoku Map (instant look at the markets) - built on the basis of the legendary Ichimoku Kinko Hyo indicator.

The task of the Ichimoku Map is to provide information about the market strength on the selected time periods and instruments, from the point of view of the Ichimoku indicator. The indicator displays 7 degrees of buy signal strength and 7 degrees of sell signal strength.

The stronger the trend, the brighter the signal rectangle in the table. The table can be dragged with the mouse.

T

The indicator displays a stock chart of a non-standard type, in which the price and time have the same value.

The usual chart of Japanese candlesticks does not take into account all the information that the time analysis can give. Renko charts do not use all the information that price can give in relation to time. The "Chart Price and Time" indicator takes into account price and time equally and shows the predominance of price or time.

Taking into account price and time equally gives an i

The indicator tracks sharp volatility (moments when the market has shown increased activity and movement may occur), on the selected instruments and time periods.

The information is displayed as colored rectangles. Thus, it is possible to assess at a glance which tool should be given priority attention.

The indicator will be useful for scalpers when they need a quick reaction or for traders working with a large number of instruments. The indicator does not redraw. The indicator displays 8 degr