Fair Value Gaps

- Indikatoren

- Cao Minh Quang

- Version: 3.0

- Aktualisiert: 15 April 2025

Fair Value Gap (FVG) Indicator

Overview

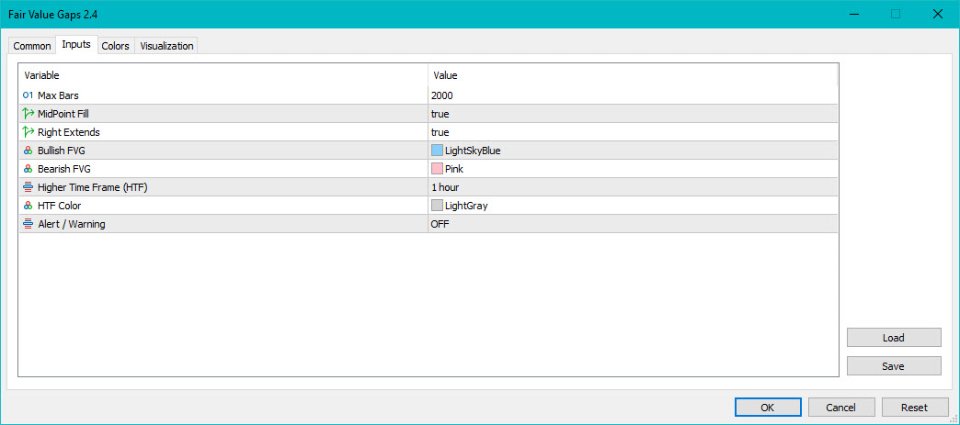

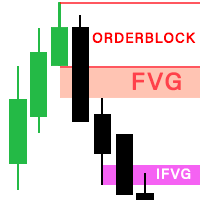

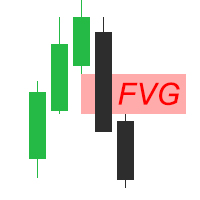

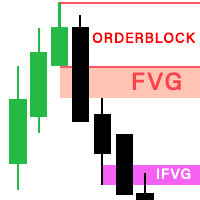

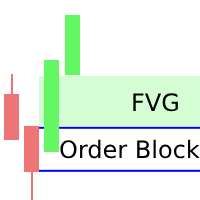

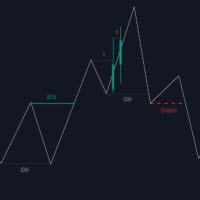

The Fair Value Gap (FVG) Indicator identifies inefficiencies in price action where an imbalance occurs due to aggressive buying or selling. These gaps are often created by institutional traders and smart money, leaving areas where price may later return to "fill" the imbalance before continuing its trend.

Key Features:

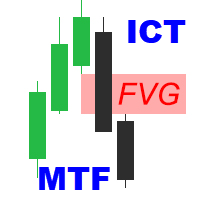

- Automatic Detection of FVGs – The indicator highlights fair value gaps across different timeframes.

- Multi-Timeframe Support – View FVGs from higher timeframes on lower timeframe charts.

How It Works:

-

The indicator scans price movements and detects gaps where a candle’s high does not overlap with the low of two candles ahead (bullish FVG) or vice versa (bearish FVG).

-

These areas are marked as potential liquidity zones where price may revisit before continuing in the dominant trend.

-

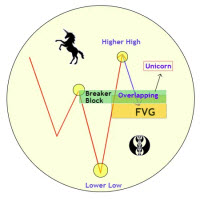

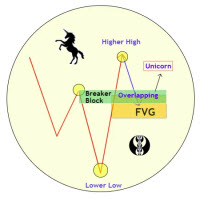

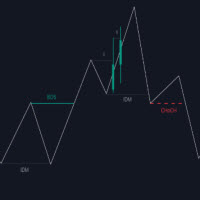

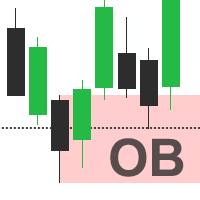

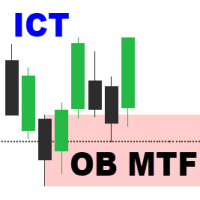

The indicator assists traders in recognizing smart money footprints, combining FVG with BOS, CHoCH, and Order Blocks.

How to Trade Using FVGs:

- Entry Strategy: Wait for price to return and react to the FVG zone (rejection, support, or resistance).

- Confluence Trading: Combine with BOS, Order Blocks, and Liquidity Sweeps for higher accuracy.

- Take Profit Targets: Consider the next liquidity pool or major structure level.

Who Should Use This Indicator?

- Smart Money & ICT Traders

- Price Action & Institutional Traders

- Scalpers & Swing Traders

Hello, Thanks for your dedication to this platform, your work is very good and you impacts so many lives of traders around the globe. Can you please add just minor issue. Allow alerts from two different TF, like from 15min and 1H simultaneously without applying to all TF