Deviation Index

- Indikatoren

- Francisco De A Vilar Enriquez

- Version: 7.2

- Aktualisiert: 22 April 2024

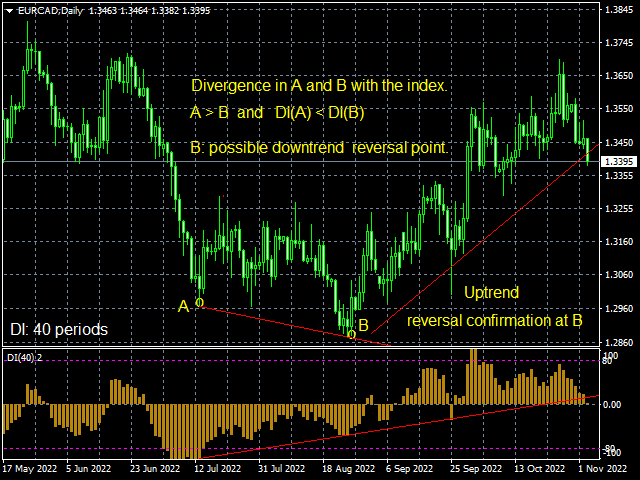

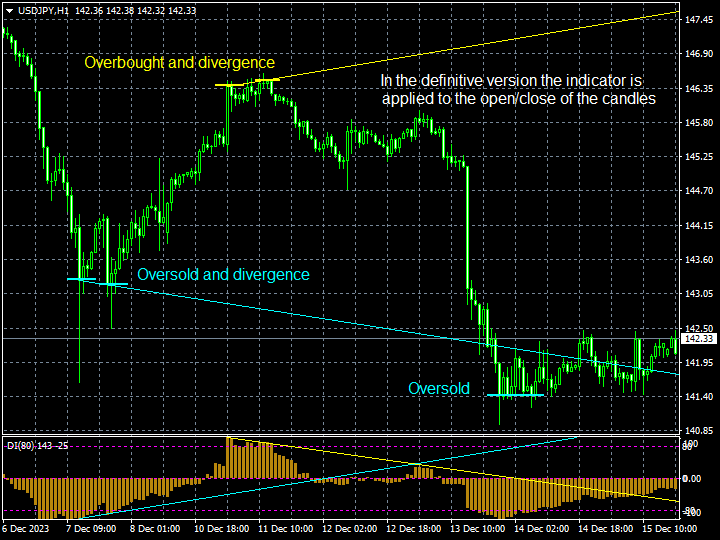

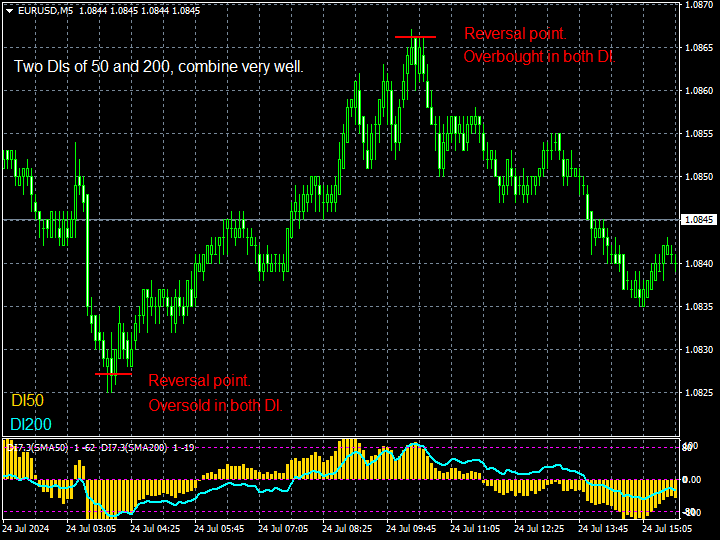

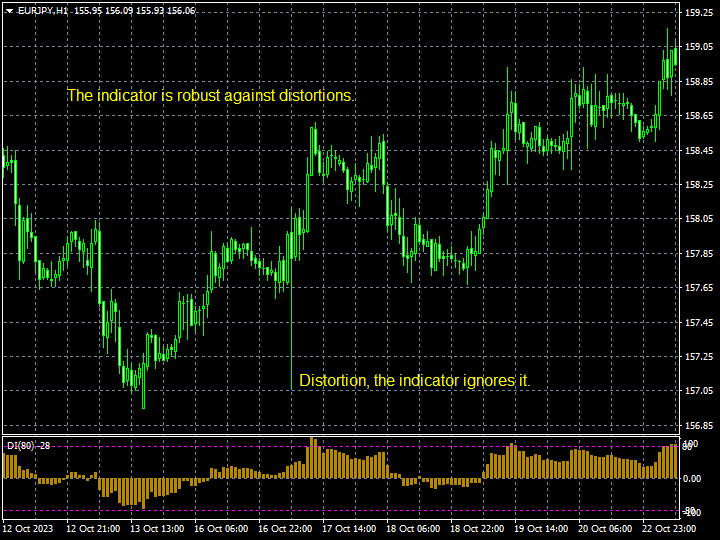

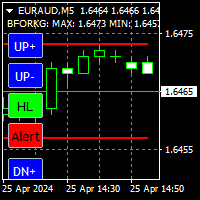

Normalized indicator. It measures the relative deviation of the price from its moving average. It is extremely reliable. Accurately determine overbought and oversold price areas and divergences.

Features.

The indicator is applied to the open/close of the candles.

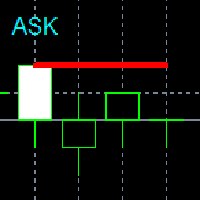

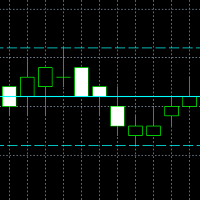

Has a range of -100 to 100. The overbought zone is above 80 and the oversold zone is below -80.

Mode: histogram/line.

MA method: simple, exponential, smoothed, linear weighted.

By default the indicator is calculated on an SMA of 200.

Reversal.

When there is overvalue with divergence it is a clear sign of reversal.

Index formula.

DI = 100 x deviation to the moving average of n periods / maximum deviation in the current n periods.

Recommended indicators: Basic Fork

Contact email: fve2022@hotmail.com