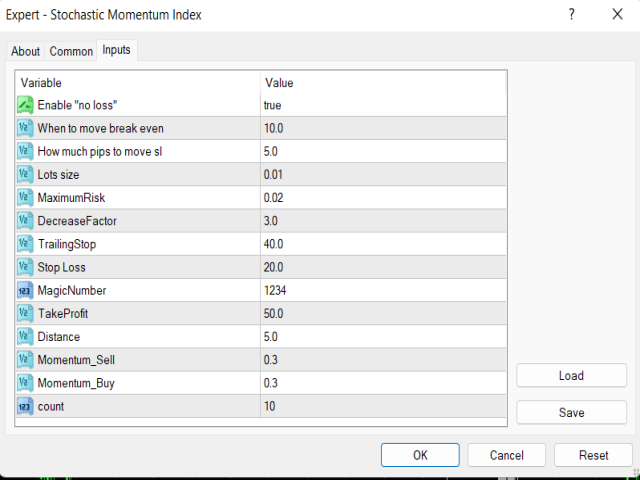

Stochastic Momentum Index EA

- Experten

- Jason Edward Todt

- Version: 1.0

- Aktivierungen: 5

Stochastic Momentum Index is an adaptation of the classic Stochastic Oscillator that smoothes out the stochastic oscillations.

This indicator is calculated by comparing the currency price relative to the average of an N number of periods.

Then instead of plotting these values directly, We smooth them out using a MACD, Multiple Moving Averages and RSI indicators and then the values plotted to form the Stochastic Momentum Index.

When the closing price is greater than the average of the range, the Stochastic Momentum Index will move up.

When the closing price is less than the average of the range, the Stochastic Momentum Index will move down.

This oscillator ranges between the values of +100 and -100. This EA is also less prone to whipsaws compared to the stochastic oscillator.

When the Stochastic Momentum Index gives a signal for price change?

when it changes a direction and starts to rise it provides us with a signal that we need to buy.

when it reverses, and it goes down it’s a signal that we need to sell. The extreme high or low points are signals that the trend will continue.

With this EA, we have the over-bought and over-sold areas.

This means that the indicator shows us when the price might reverse. While with the Momentum, we can expect a continuation of the current trend.