DLMACD

- Indikatoren

- Roman Sukhorukov

- Version: 1.1

- Aktualisiert: 23 November 2021

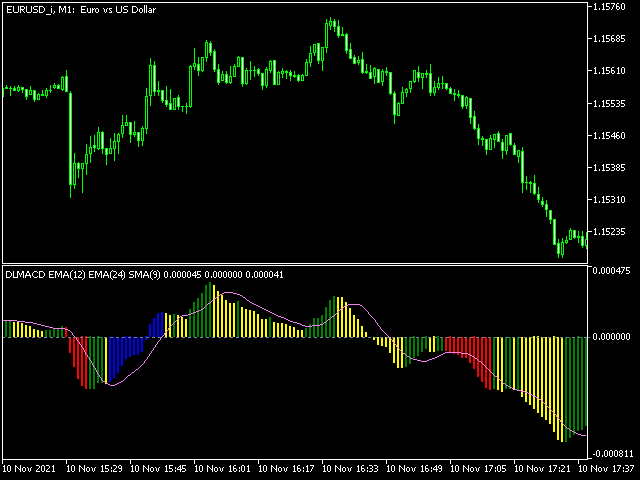

DLMACD - Divergence Local (Wave) MACD. The indicator displays divergences by changing the color of the MACD histogram. The indicator is easy to use and configure. It was created as an addition to the previously published DWMACD.

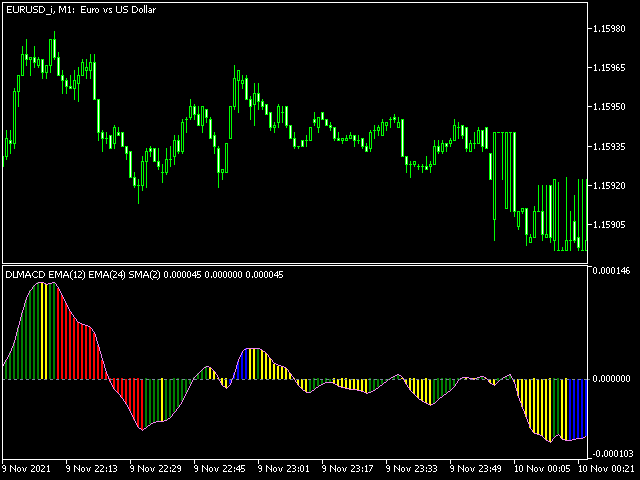

For the calculation, a signal line or the values of the standard MACD histogram can be used. You can change the calculation using the UsedLine parameter. It is advisable to use a signal line for calculation if the histogram often changes directions and has small values, forming a kind of flat. To smooth the histogram values set the signal line at UsedLine and a small period (2-5). As the period increases, the indicator lags behind the price (which applies to any indicator).

The indicator is calculated at the current price (close).

You can use your own moving average values in the settings. It is possible to use 4 standard types of moving averages (SMA, EMA, LWMA, SMMA). The CONST type has also been introduced - this is a straight line (constant value) - it cannot be used in this indicator.

The local divergence displayed by this indicator reflects the price movement after the divergence. Significant local divergence occurs with simultaneous divergence on DWMACD. If DWMACD does not show divergence, then movement along local divergence may not last long, although it will be strong. In this case, the market becomes more volatile.

The divergence colors correspond to the intuitive: blue - looking for purchases, red - sales.

Note: the next divergence cancels the previous one!

Have a successful trading!

Der Benutzer hat keinen Kommentar hinterlassen