HighSpeed

- Experten

- Andriy Sydoruk

- Version: 3.0

- Aktivierungen: 5

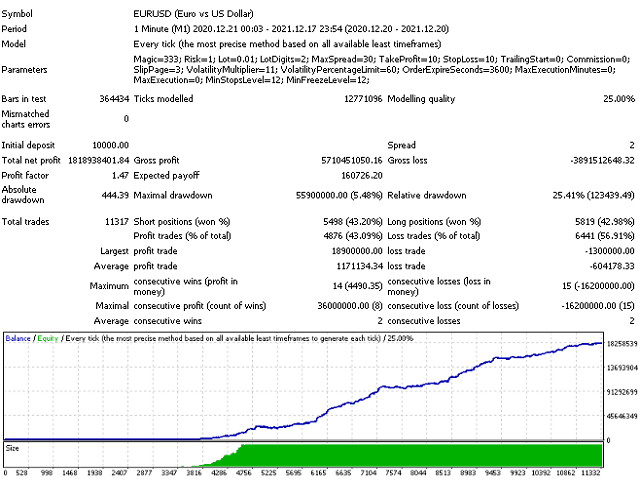

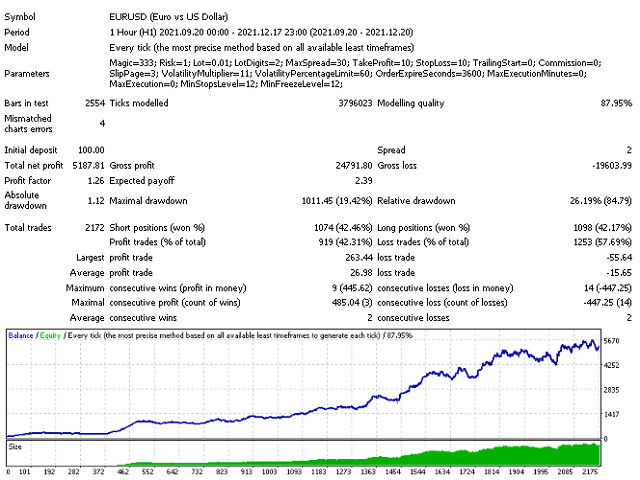

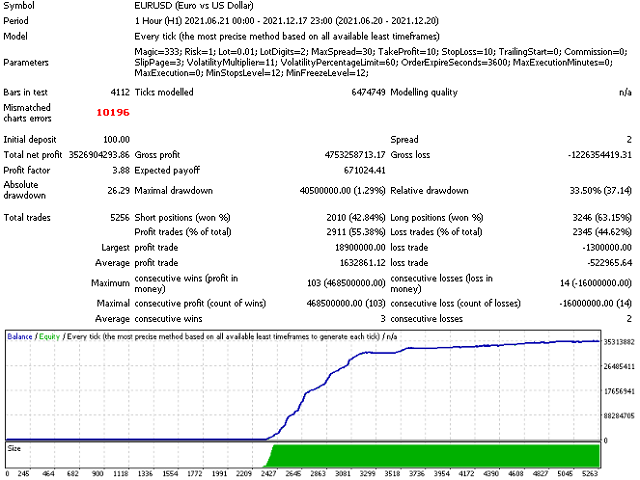

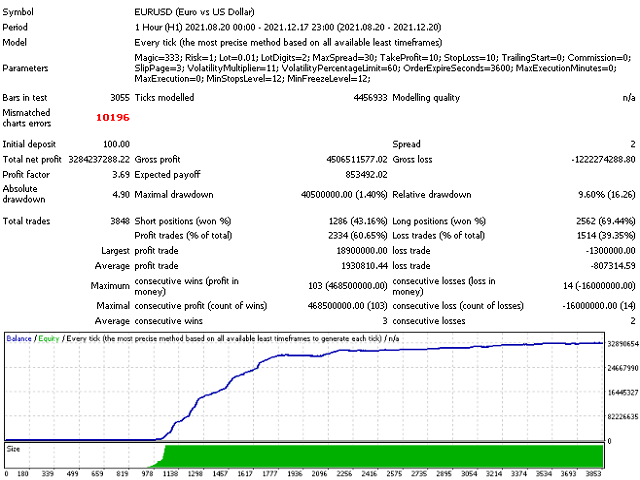

HighSpeed is a scalping expert system. It is enough to optimize the bot once, for example, a month. After that, it shows excellent results in the forward period (several times longer), which can be seen in the screenshots.

Be attentive to your broker's spread indicators! The higher the spread, the less frequent market entries. If the spread is above 20 pips, then the number of entries drops by two orders of magnitude. Pending orders will be inserted but will be deleted due to a bad spread. Only if there are suitable conditions, the order will become a market one.

It is ideal to use a broker with a floating spread of 6 pips or more. There are such brokers on the market. In those moments when the spread is lower than the one set during optimization (for example, you set 10-14 pips), then when a signal appears at that moment, you can expect an entry. That is, in reality, the inputs will be less frequent than with the ideal tester performance.

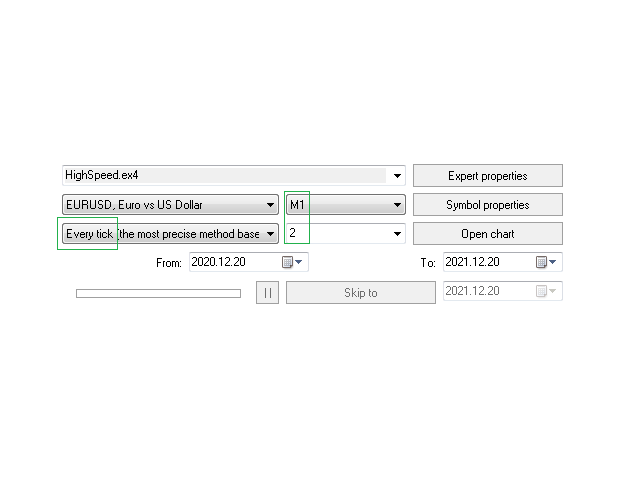

All parameters need to be optimized:

- Lot - position volume;

- Risk - risk (the volume is calculated from the balance);

- MoneyManagement - allows you to use the risk field;

- TakeProfit - take profit;

- StopLoss - stop loss;

- Trailing - trailing stop;

- SpeedV - tick speed (relative value);

- HighW - volatility (relative value);

- MaxSpread - spread limitation (if this field is less than the real spread, the EA will not enter the market).

- You need to trade on timeframes M1-M15. The Expert Advisor is designed for trading on any instrument. It is preferable to test the EA with a broker with five-digit quotes, or even better on the MetaQuotes-Demo server. It is recommended to work on liquid Forex pairs with low spreads and use VPS. You can start using it with $ 100 and 0.01 lot.

The lower the commission and the spread, the greater the profit. The more latency your broker has with the Internet channel, the more you need to set stop loss, take profit and trailing start so that the server can process them at the required price, since the tester executes requests without delays. During testing, the spread can be adjusted in the tester. The main task is to find a broker offering low spreads. When testing, use only all ticks.