QRSICalc MT5

- Indikatoren

- Tatiana Savkevych

- Version: 1.0

- Aktivierungen: 5

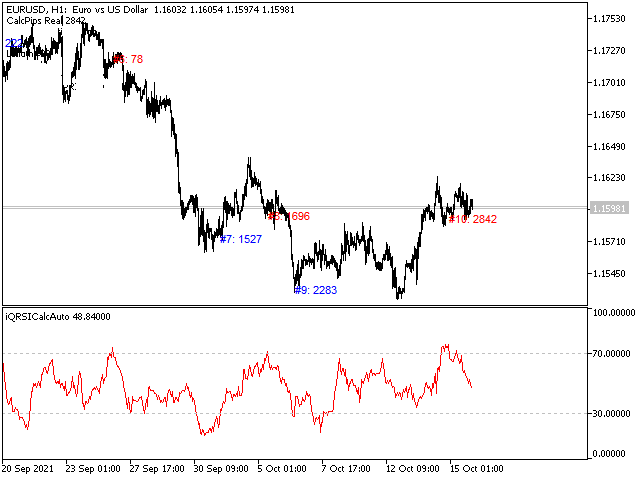

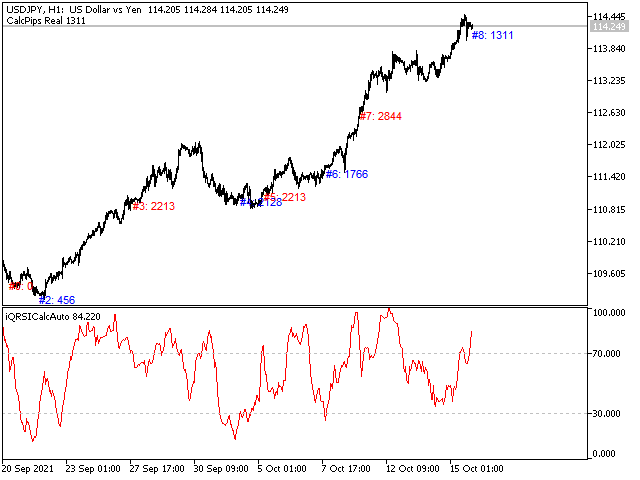

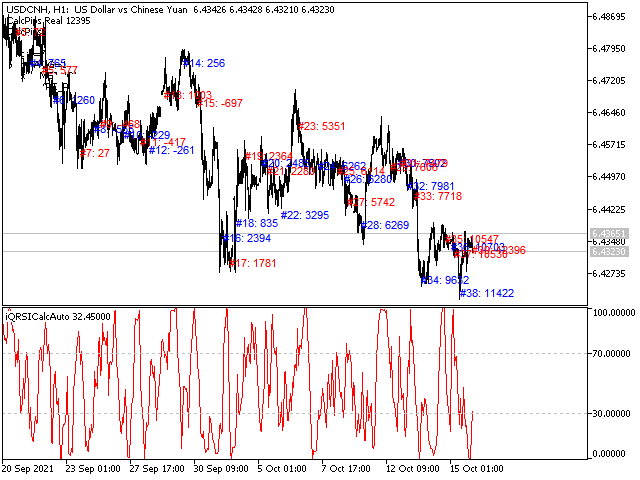

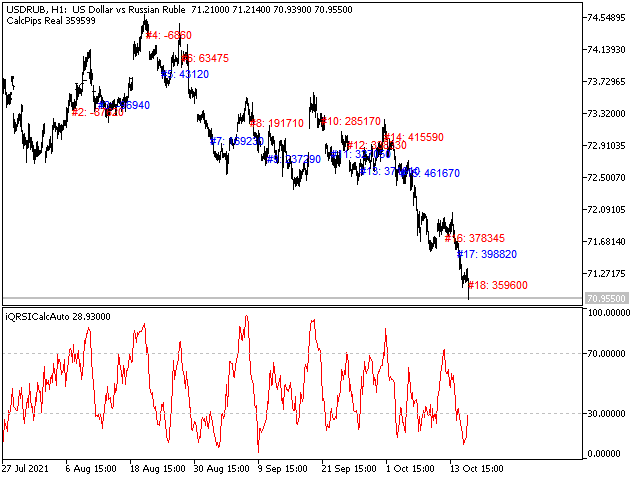

The QRSI indicator is one of the most important and well-known indicators used by traders around the world. All signals are generated at the opening of the bar. Any closing price or zero bar prices are replaced with the corresponding price of the previous bar in order to avoid false results. This indicator is suitable for those who are interested in the classic calculation method but with improved functionality. There is a version for both MT4 and MT5.

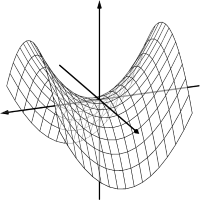

By its nature, the QRSI indicator is an oscillator, that is, it fluctuates in a certain zone, limited by the maximum (100) and minimum (0) values. Specifically, this indicator works according to an accelerated algorithm, but this is not its only difference. This indicator implements a more advanced calculation based on the Relative Strength Index algorithm. The peculiarity of the implementation is that improved functionality is used for the calculation. This indicator is suitable for those who are interested in the classic calculation method but with improved functionality.

This version of the indicator differs in that it has an extended functionality for calculating the averaging Metod (below is a list), as well as advanced possibilities for calculating the application to prices Price (below is a list). A significant drawback has also been removed, namely the inability to see the digital display of the inputs. And in this implementation, we can see not only the projection of the calculations on the chart in the form of a curve, but also a digital view - how well this curve will work successfully, provided that it is traded according to the specified rules. The Rules parameter (the list below is presented) sets the rules for trading by the indicator, of course, here it is necessary to take into account that trading by the indicator is, first of all, strict adherence to the rules.

Trading rules Rules (there are more of them in the list, but for this indicator there are 5).

- ANGLE BIN - Trading on the slope of the curve (as in the trend on the slope of the line).

- CROSSING CHANNEL_LEVEL - Trading at the intersection with the 30/70 levels of the previous bar in the direction of the channel (as a thread, without an entry point).

- CROSSING_TREND_LEVEL - Trading at the intersection with the 30/70 levels of the previous bar in the direction of the trend (as a trend, without an entry point).

- CROSSING_LEVEL_CHANNEL_POINT - Trading at the intersection with the 30/70 levels of the previous bar and the pre-previous bar, as an entry point towards the channel (as a thread, without an entry point).

- CROSSING_LEVEL_TREND_POINT - Trading at the intersection with the 30/70 levels of the previous bar and the pre-previous bar, as an entry point in the direction of the trend (as a trend, without an entry point).

Advanced functionality for calculating averaging Metod.

Moving averages are commonly used in time series data to smooth out short-term fluctuations and highlight major trends or cycles. Moving average is a type of convolution mathematically. This implementation differs in that it presents a whole set of different types of convolution, which is reflected in the settings by an extended set of methods.

- SMA

- EMA

- SMMA

- LWMA

- WILDER EMA

- SINE WMA

- TRI MA

- LSMA

- HMA

- ZL EMA

- ITREND MA M

- MOVING MEDIAN M

- GEO MEAN

- REMA M

- ILRS

- IE_2

- TRI MA GEN

- VWMA

Expanded possibilities of calculating the application to prices Price.

Also, this indicator implements the calculations of averages relative to an extended set of price calculations. What's in the settings is represented by the following list.

- CLOSE

- OPEN

- HIGH

- LOW

- MEDIAN

- TYPICAL

- WEIGHTED

- MEDIAN OC

- TYPICAL O

- WEIGHTED O

- WEIGHTED OC

- HO

- HC

- LO

- LC

- H MIN

- H MAX

- L MIN

- L MAX