EUR 8 of 8 MT4

- Experten

- Tomas Michalek

- Version: 1.0

- Aktivierungen: 10

Plug & Play portfolio - series of high-quality EURUSD H1 strategies for maximized success.

The eighth strategy, the last one from the EUR-8 portfolio, uses BollingerBands mean reversal method for setting up the pending order.

To have a whole portfolio of strategies, which trades for you is incredibly efficient, don't miss that opportunity.

Check my other strategies today! and assemble your portfolio.

Benefits for you

Plug & Play system, designed to have simple initial setup. That's saved time for you.

Every position has predefined stoploss with configurable fixed amount (100 USD by default).

Strategy is selected to fit to the EUR-8 portfolio. One strategy is great, but whole portfolio is something else entirely.

Strategy is developed by genetic algorithms on long data period and it passed all 9 robustness tests against various market condition or over-fitting, so the quality of the strategy is verified.

One strategy is great, but whole portfolio is more diversified and balanced. Check also my other strategies for GBPUSD or EURUSD to complete your portfolio.

Technical parameters

· CustomComment - choose your comment to distinguish strategy, or keep default

· MagicNumber - choose your number to distinguish strategy, or keep default

· mmRiskedMoney - configurable fixed amount, so you can risk portion of your initial balance

Screenshots

· Portfolio equity: combined backtest of all strategies together, for years 2003 to 2020.

· Portfolio parts equity: particular equities of strategies from the portfolio EUR-8, for years 2003 to 2020.

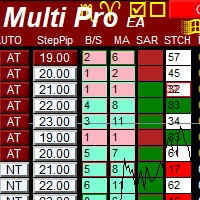

· Portfolio statistics: see the portfolio statistics from 2003 to 2020. You can see details like number of trades, return to drawdown ration and other parameters.

· Portfolio correlation: if two or more strategies have losses at the same month, it is not good for the portfolio. Portfolio correlation has to be taken seriously - see that no strategies correlate above 0.5, which means low correlation.

· Strategy equity: backtest of the strategy, tested on the data from Dukascopy, from 2003 to 2020.

· Strategy statistics: see the detailed statistics of the strategy backtest from 2003 to 2020.

· Monte Carlo analysis - randomized slippage, spread and historical data: simulation of real market conditions and test of strategy sensitivity to market volatility and liquidity. Lines similar to original backtest means good robustness of the strategy.

· Monte Carlo analysis - randomized trades order: test, which tells us whether the strategy is sensitive to specific market cycles. According to the picture, the strategy is not sensitive to the specific order of trades.

· Monte Carlo analysis - randomized strategy parameters: test against over-fitted strategy, which proves, that strategy is not over-fitted, as it has great backtest results even with changed parameters.

· Walk-forward matrix - complex series of simulations, where we optimize strategy parameters based on one period and then do the backtest on another period, comparing whether results are profitable. These steps are then repeated for the next time periods, which leads to the creation of a matrix of executed tests. The goal of this test is to find out, whether the strategy is over-fitted. If strategy won't work with slightly different parameters, it is most probably over-fitted and won't work in the future. You can see on the screenshot that the strategy was profitable for a lot of various optimization iteration on historical data.