Ann bb Trend Chinese

- Experten

- Pingtao Wang

- Version: 4.3

- Aktualisiert: 22 Februar 2022

- Aktivierungen: 5

Free use for 3 months without any restrictions

July 7, 2021 will be restore the original price of 199$

This is a fully automatic Quantitative Trading Advisor (QTA )

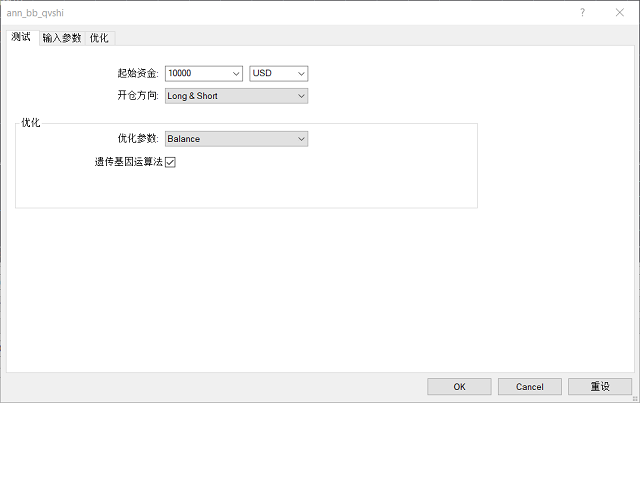

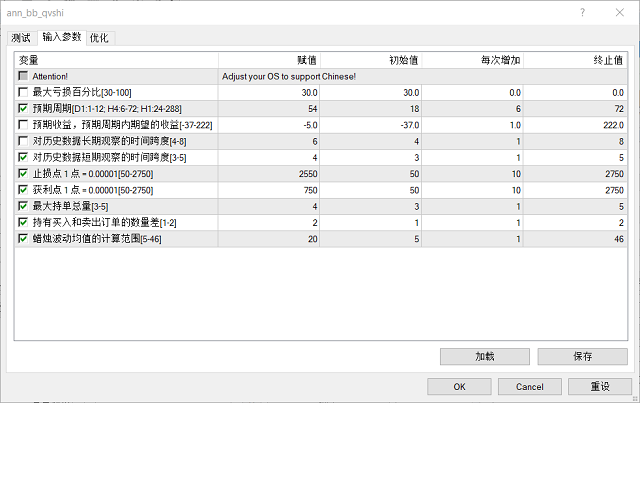

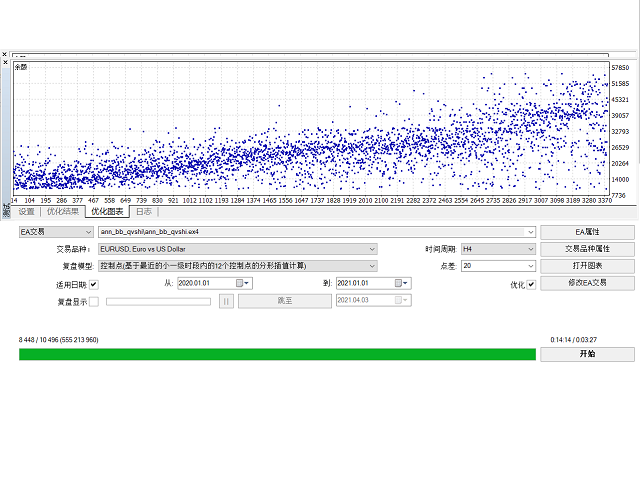

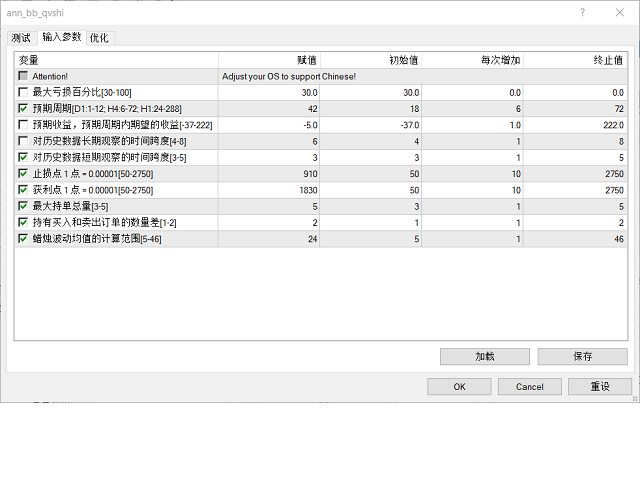

What you need to do is to optimize the parameters, then select the appropriate parameters and let it run.

No one strategy is a one-size-fits-all solution. Now we have given you the best and most advanced tools, but you need to learn how to use them.

This QTA can help you find out the characteristics of the parameters that get several times or dozens of times of income within a year for you to choose.

how many possibilities are used to find these results? The answer is more than one trillion, which is bigger than 1.0e+14.

Regarding the operating instructions of the parameters, we will issue a separate document, or you can send an e-mail consultation.

Even if you don't understand Chinese or how to use the parameters, we still give you the optional range for you to optimize the parameters, which is very friendly.

Important advice:

We suggest that you are prepared to run this QTA for at least one year.

For example, select 5 market quotations to test separately according to the daily chart (D1), and obtain the parameters from these five situations for use.

The 5 situations are:

1. Slowly falling market, daily candlestick chart , for example: 2018.10 ~ 2019.10

2. Slowly rising market, daily candlestick chart, for example: 2013.03 ~ 2014.03

3. Rapid decline market, daily candlestick chart, for example: 2014.04 ~ 2015.04

4. Rapidly rising market, daily candlestick chart, for example: 2017.02 ~ 2018.02

5. Horizontal fluctuation market, daily candlestick chart (D1), for example: 2015.07 ~ 2016.07

After obtaining the parameters, we decide which set of parameters to adopt after judging the general trend from the weekly candlestick chart (W1).

If do you think that the market trend will slowly rise in the next six months.

Then you use the parameters measured in the second case above.

The risks you face when using this QTA:

We write programs very carefully, and the programs have undergone a lot of data testing.

When feeding a large amount of data to the program in batches, the program tells us that there is no general rule.

If it is unlucky, the maximum loss will not exceed your setting, the default is 30% of the account funds.

We do not promise that you will be win, but our expected profit is still considerable.

Precautions for quantitative trading:

The time when EA enters the market may be random, but there may be two situations of profit and loss after entering the market, so some manual intervention is appropriate.

Investors have different risk tolerance, so we often see securities companies do risk tolerance tests on their investors.

Investors have different habits. The emergence of an EA, whether EA is suitable for you, and whether you are suitable for EA is a question.

Excessive expected returns will cause quantitative trading advisors to exit prematurely.

QTA do not hinder manual trading.

In order to protect the safety of the account funds:

- The trading volume of QTA will be reduced, if you place an order manually.

- It will cause QTA to exit, if your manual order has a large loss.

The following are the principles that our program development follows for your reference:

The purpose of quantitative trading:

Using computer technology to formulate strategies from huge historical data that can bring high probability events that can bring good returns.

Reduce the impact of investor sentiment fluctuations.

Avoid making irrational investment decisions when the market is extremely enthusiastic or pessimistic.

Basic principles of quantitative trading:

Risk control

You must use a demo account to pass the test.

The amount of margin that can be operated for quantitative trading must be clear.

Exit conditions must be clear.

Feasibility Control

The expected benefits must be clear.

Prevent abuse

Over-trading must be prevented.

The scope of application of quantitative trading must be clear.

The contract object to be adapted must be clear.

Prevent over-dependence

The EA program is not a once-and-for-all project.

Take appropriate risks and continuously optimize the parameters.

Good luck!

Der Benutzer hat keinen Kommentar hinterlassen