V Max

- Experten

- Szymon Palczynski

- Version: 1.20

- Aktualisiert: 30 November 2020

- Aktivierungen: 5

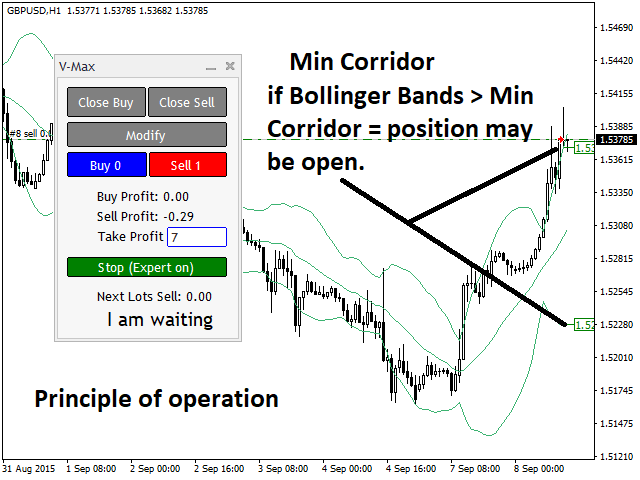

One of the most common Bollinger Band strategies is using them to gauge if a market is overbought or oversold.A lot of traders will use these bands and look for price to revert back the middle band or to the mean.When using a mean reversion strategy we are assuming that if price deviates or moves too far away from the mean it will eventually have to come back.This is often looked at as price moving back from an overbought or oversold market into more true value. Bollinger Bands react to price as it is being created in live time. They will constrict and expand as price moves depending on what the price action is doing.That's why I added a corridor-size filter. See how effective Bollinger becomes then.

Simple and effective with an amazing multiplier (nx).

Principle of operation:

lower=iBands(NULL,0,period,Deviations,0,PRICE_CLOSE,MODE_LOWER,1);

upper=iBands(NULL,0,period,Deviations,0,PRICE_CLOSE,MODE_UPPER,1);

corridor=upper-lower;

if(Close_1>upper && corridor>cooridor_chart*gpoint_320)return(sell);

if(Close_1<lower && corridor>cooridor_chart*gpoint_320)return(buy);

x < sell

--------------------MODE_UPPER

x

x

x

corridor

x

x

--------------------MODE_LOWER

x < buy

Close a position (default settings)

Open positions = 6

1---------------

2---------------

3--------------- 1,3,4,5,6 <---- close

4---------------

5---------------

6---------------

Open positions = 7

1,4,5,6,7<---- close

e.t.c.