TheTradeExecutor

- Utilitys

- Felix Argast

- Version: 3.0

- Aktualisiert: 3 Februar 2020

- Aktivierungen: 5

The TradeExecutor

The „TradeExecutor“ EA is designed to make your trading and especially the trade execution as easy as possible. It has a lot of useful features to help you execute and manage your trading strategy. This tool is immensely useful for traders who use multiple stacked orders with their strategy, because you can enter multiple orders with a single button click.

Practical Buttons

The TradeExecutor has four different buttons. First the “BUY” and the “SELL” buttons are used to trigger either a buy or a sell entry if you click on them. This makes it super easy to enter into trades. The “BE” button is also a great tool while trading. You can use this button to move the stops of all your open orders to the overall breakeven level, which is also displayed by the blue line. Lastly the “CLOSE” button is, as the name suggests, used to close your orders. One click is enough, and all your market and limit orders of the current pair are closed.

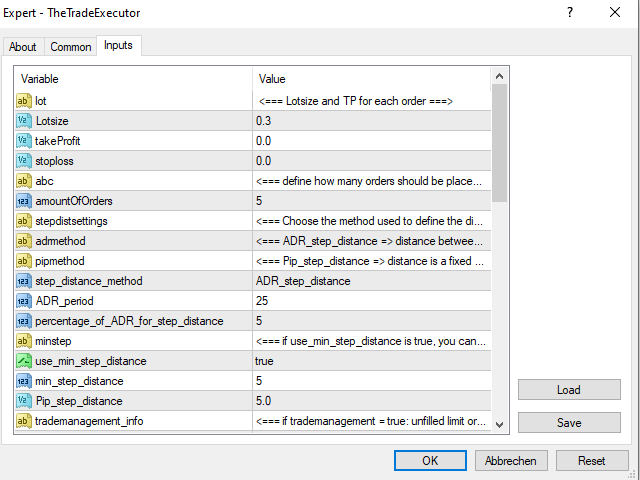

Easily setting Lotsize, Takeprofit and stoploss for all orders

With the first feature of the TradeExecutoryou can easily define your preferred lotsize as well as a takeprofit- and a stoploss-level. Next you can also choose the amount of orders that you want the EA to execute once you click on a button. If you want to enter the market you simply press the “Buy”- or the “Sell”- button that the EA is displaying on your chart. The TradeExecutor will then automatically place one market order and as many limit orders as you previously defined (in this case 5 total orders => 1 Market order + 4 Limit Orders).

Defining the step distance

These next settings allow you to determine the distance between your orders. You can choose between the “ADR_step_distance” or the “Pip_step_distance” method. Both have their advantages and it is for you to choose.

Let’s start with the easier one, the “Pip_step_distance”. If you choose this method the TradeExecutor will use the entered value in the “Pip_step_distance” field and place the orders that many pips apart from each other. In the screenshot above, the orders would be 5 pips apart.

The “ADR_step_distance” method is a more dynamic and adapts to the typical behavior of the pair you are trading. You must first define the period of the average daily range (ADR) that the EA uses in the background. Additionally, you must define a percentage of the ADR that you would like to base the order distance on. Once you now click the “Buy”- or “Sell”-button, the TradeExecutor will first calculate the ADR of the pair and then calculate the step distance as a percentage of this value.

To protect you from having orders that are too close together, which would happen if you use this method on slow moving pairs that have a low ADR, the EA offers the “use_min_step_distance” variable. If you set this to “true”, the EA will use the “min_step_distance” amount of pips as step distance if it would otherwise be below this value.

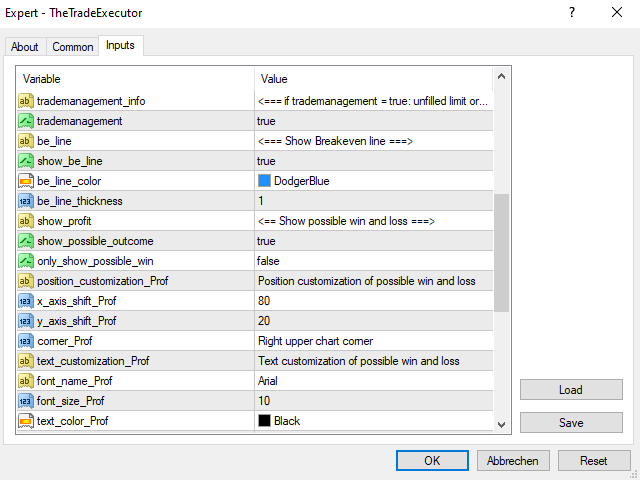

Trade management

The next great feature of the TradeExcecutor is its trade management feature. If this is switched on, the EA will automatically close your unfilled limit orders if their defined target was already reached. This way you don’t get stuck with unwanted orders in the market that got filled after your setup was already successfully closed. This feature is for example very useful if you leave your trades running over night or you have a job and can’t monitor them constantly.

The Breakeven Line

The TradeExecutor can also show you the breakeven level of your trades. This is a great feature if you are using multiple orders, because it is otherwise very hard to figure this level out. Now can easily see where the level is if you for example want to move your stop to breakeven. In addition to showing you this line, the EA also has a “BE”-button, which can be used to automatically move your stops to the overall breakeven level if you click it.

Showing the possible trade outcome

Another feature of the TradeExecutor is its ability to show you the possible outcomes of your trade. Meaning the amount of money, you would lose if all your orders hit the stoploss and also the potential profit if all orders were to reach the takeprofit. Figuring this out with multiple orders is again very complicated but is of great importance for your trading success.

Perfect for Gridtrading!