VWAP Simple

- Indikatoren

- Deibson Carvalho

- Version: 2.40

- Aktualisiert: 2 Juli 2021

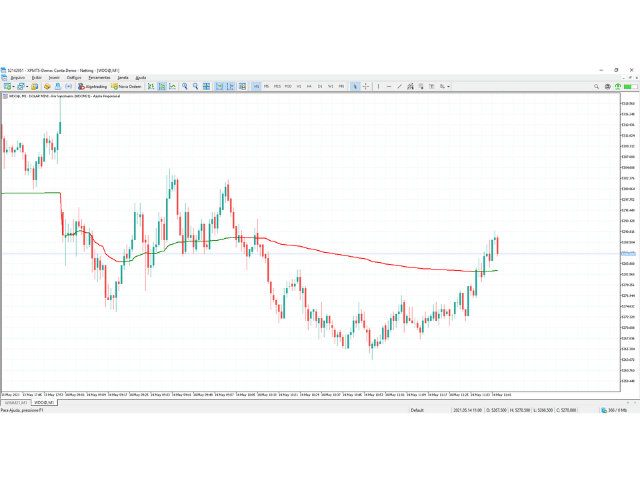

The Volume Weighted Average Price is similar to a moving average, except volume is included to weight the average price over a period.

Volume-Weighted Average Price [VWAP] is a dynamic, weighted average designed to more accurately reflect a security’s true average price over a given period. Mathematically, VWAP is the summation of money (i.e., Volume x Price) transacted divided by the total volume over any time horizon, typically from market open to market close.

VWAP reflects the capitalist democracy of the market — where it’s one vote per share, not one vote per trader — more honestly describing the concept all traders implicitly accept: that the market is driven by large participants.

Institutions use it to objectively evaluate the execution quality of large trades, whereas independent traders experience this as dynamic, otherwise hidden support and resistance occurring at the VWAP. Institutional buyers and algorithms will often use VWAP to plan entries and initiate larger positions without disturbing the stock price.

The VWAP can be used similar to moving averages, where prices above the VWAP reflect a bullish sentiment and prices below the VWAP reflect a bearish sentiment. Traders may initiate short positions as a stock price moves below VWAP for a given time period or initiate long position as the price moves above VWAP.

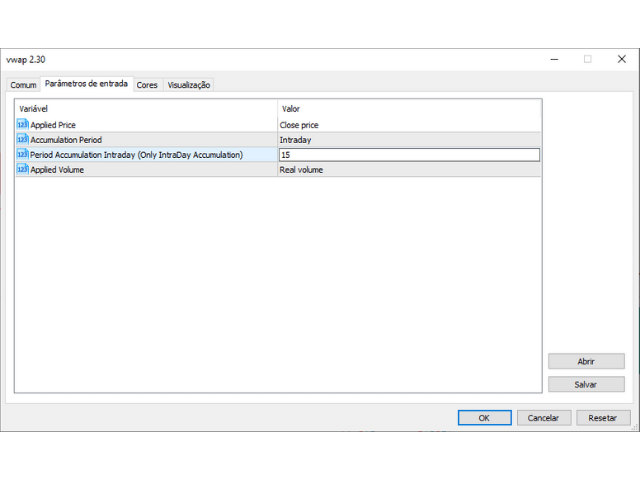

Parameters:

Applied Price: PRICE_CLOSE = Closing Price

PRICE_OPEN = Opening Price

PRICE_HIGH = The maximum price for the period

PRICE_LOW = The minimum price for the period

PRICE_MEDIAN = The median price, (maximum + minimum) / 2

PRICE_TYPICAL = Typical price, (maximum + minimum + closing) / 3

PRICE_WEIGHTED = Average price, (maximum + minimum + closing + closing) / 4

Accumulation Period: DAILY

WEEKLY

MONTHY

NONE

INTRADAY * New Feature in 2.25v

Applied Volume: VOLUME_TICK

VOLUME_REAL

Period Accumulation Intraday: Int value to required period in candles for accumulation. ( This only work with Accumulation period INTRADAY.)

For example, to VWAP for 60 minutes, use Trimeframe 1 minute and set 60 period.

Buffers:

This indicator has 2 buffers.

1) The first, VWAP value,

2) Second is Stag (Candle current. 0 is first candle)

Funcionando bem no Mini Indice B3