Fibonacci Pyramid

- Indikatoren

- Andy Ismail

- Version: 1.2

- Aktivierungen: 5

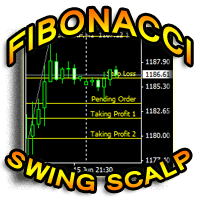

This indicator draws Fibonacci level automatically from higher high to lower low or from lower low to higher high combinate with Pyramid Trading Strategy for better risk reward ratio. With adjustable Fibonacci range and has an alert function.

What is Pyramid Trading Strategy?

The basic concept of pyramiding into a position is that you add to the position as the market moves in your favor. Your stop loss moves up or down (depending on trade direction of course) to lock in positions. This is how you keep your overall risk while increasing your position size on the trade.

Advantages of Pyramid Trading Strategy:

- The only risk on the multiple trades you take is the risk on the current trade because all the rest of the trades must have their trailing stops moved to lock in positions.

Disadvantages of The Pyramid Trading Strategy:

- you cannot apply pyramid strategy to every trade as sometimes, your trading system may give only one signal or the trend direction may change.

- Some forex traders would tend to move their stop losses (increase stop loss distance…thus increasing their risk) when they see price heading the other way to nearly knocking off their stop losses. Don’t do that. The only loss you should suffer is the loss of the most recent trade….all the other trades, when the trailing stop loss gets hit.

How to use Fibonacci Pyramid trading strategy

Forex traders use Fibonacci-Pyramid to pinpoint where to place orders for market entry, for taking profits and for stop-loss orders. Fibonacci levels are commonly used in forex trading to identify and trade off of support and resistance levels.

Fibonacci retracements identify key levels of support and resistance. Fibonacci levels are commonly calculated after a market has made a large move either up or down and seems to have flattened out at a certain price level. Traders plot the key Fibonacci retracement levels of 38.2%, 50% and 61.8% by drawing horizontal lines across a chart at those price levels to identify areas where the market may retrace to before resuming the overall trend formed by the initial large price move. The Fibonacci levels are considered especially important when a market has approached or reached a major price support or resistance level.

The 50% level is not actually part of the Fibonacci number sequence, but is included due to the widespread experience in trading of a market retracing about half a major move before resuming and continuing its trend.

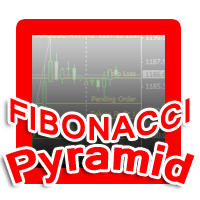

How to trade using Fibonacci-Pyramid levels

- Entry order (Buy/Sell) at Entry 1 retracement level with a stop-loss order placed at SL (can be adjusted by your spread pips manually).

- Second entry for pyramiding at Entry 2 with the same lot as entry 1 or double your lot, put all your stop-loss order at Break Even, and move entry 1 stop-loss (trailing) to Break Even level (Now all Stop-loss at Break Even level).

- Taking profit Entry 1 and Entry 2 at TP level.

- Mind your risk between 2%-4% in every trade.

Parameters

- Depth - shift = counted bars - depth (default 12).

- Deviation - the higher/lower price deviation (default 5).

- Backstep - show entry points in history on the chart for visual analysis.

- Alert - enable/disable push alerts when price touches the Fibo area.