TSO Total Negative Management MT5

- Experten

- Dionisis Nikolopoulos

- Version: 2.86

- Aktualisiert: 21 März 2018

- Aktivierungen: 10

The TSO Total Negative Management EA contains an adaptive negative management system that can prevent losing trades and even account collapse in almost any market condition.

- Adapts to adverse market conditions and switches to the correct negative management strategy for any situation.

- TSO Signal Builder, TSO Order Recovery and TSO Loss Management are included and can be used in combination or individually.

- Apply negative management to any strategy (manual or automated).

- No pending orders placed.

- Any account size - $1,000+ is recommended.

- Works on any currency pair.

- Lots of customization (a default strategy is included for demonstration purposes).

- For detailed explanations for all the features check the Quick Start Guide.

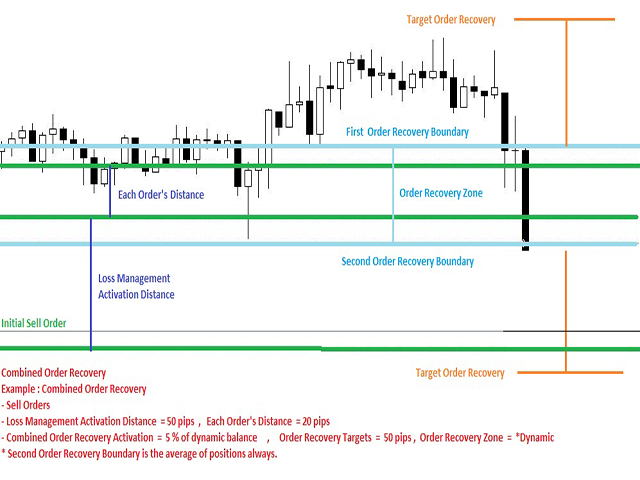

Combined Negative Management

Two methods of negative management are combined, each with a very different approach. This way, negative management can adapt to situations where it faces adverse conditions and avoid an account collapse.

- The Loss Management system can eliminate losses when the market is trending favorably or moving sideways.

- The Order Recovery system excels in situations where there is a clear strong trend, regardless of direction.

TSO Signal Builder

The TSO Signal Builder EA offers a library of 29 indicators as well as advanced position management, allowing to build an almost infinite amount of strategies.

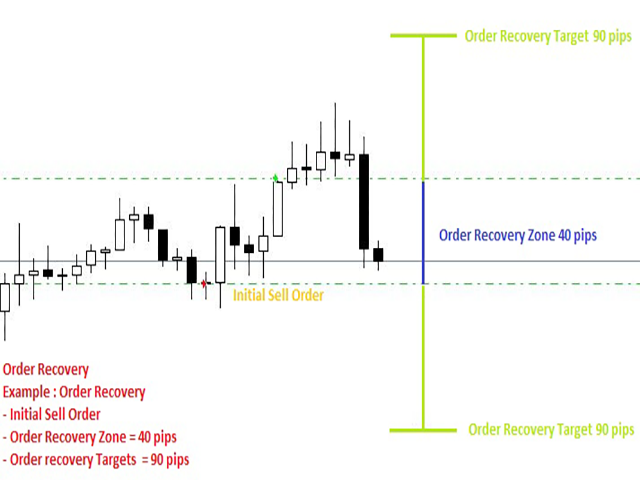

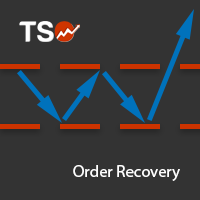

TSO Order Recovery

The TSO Order Recovery system relies on hedging to cover losses, targeting to exit the market once a significant trend appears in any direction.

It detects a losing trade and opens an opposite position of larger lot size at a fixed distance from the original trade creating a zone within which the loss is confined. This creates two scenarios:

- If the price reaches the target, the second position will cover the losses of the initial trade and even profit. All positions are then closed with a net profit.

- If the price reaches the level of the initial trade an additional position is opened so that the total lots will now be more in the original order’s direction, so that the new position together with the initial one will cover the losses of the second trade and even profit if the price reaches the opposite target. All positions are then closed with a net profit.

This process continues and new positions are opened each time the price reverses direction and passes from the edges of the zone, until one of the targets is reached.

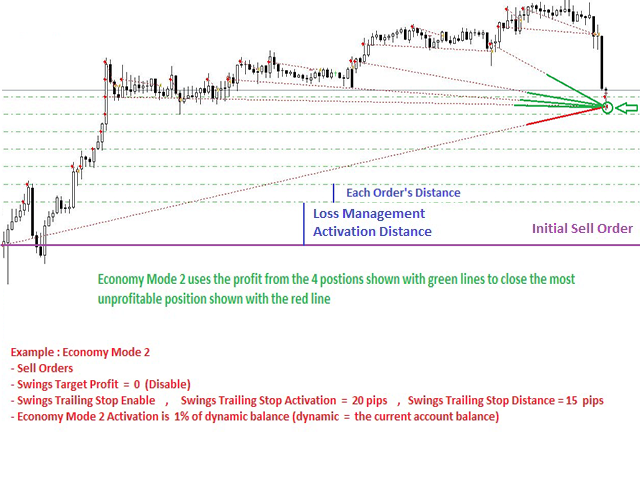

TSO Loss Management

On the other hand, the TSO Loss Management system focuses on reinforcing the losing order, targeting on a small favorable trend, or even a sideways market movement to exit the market without net losses.

Loss Management system strategy:

- A trade loses enough to activate the Loss Management system.

- The System starts opening multiple positions in the direction of the initial position on the levels of support and resistance.

- Meanwhile, the Swings mechanism uses small price movements to capture profit from sideways market.

- All positions are closed when their net loss, including the profits captured from swings, is zero (0) or a requested profit target has been reached.

Keep us updated to keep you updated

Give us your feedback in the comments section to improve this EA.

Key Inputs

Check the Quick Start Guide for a detailed list.

Basic inputs are the same as in TSO Signal Builder, TSO Order Recovery and TSO Loss Management. Additional inputs are displayed below:

- ENABLE Combined Order Recovery: If enabled, negative management is switched from the Loss Management to the Order Recovery system when the open loss reaches a percentage of balance.

- Dynamic: The open loss percentage is based on the current balance.

- Static: The open loss percentage is based on the initial balance.

- Disable.

- (Open Loss)%_of_Balance for Order Recovery Activation: The percentage value of the open loss to make the switch.